Ahead Today

G3: US initial jobless claims, Germany CPI

Asia: BoK policy rate decision

Market Highlights

The June FOMC meeting minutes indicate a divide among Fed officials over the future path of fed funds rate, largely due to differences on the inflationary impact of tariffs. A few officials believed that tariffs would lead to a one-off inflation shock, but most saw the potential for more lasting tariff-induced inflation. Only a couple of officials are open to a July rate cut, while most only anticipate some rate cuts later this year. The Fed’s patient stance is underpinned by broadly resilient economic data, which have provided room for the Fed to wait and see the impact of tariffs on inflation dynamics. Fed Chair Powell has previously said that inflation could pick up in June, July, and August.

Meanwhile, President Trump has issued another batch of tariff letters to several countries. Notably, the tariff rate on the Philippines has been raised to 20%, up from the 17% announced during US liberation day in April. In a more aggressive move, tariffs on Brazil have been raised to 50% for non-trade reasons, hurting the Brazilian real. Brazil has a trade deficit with the US.

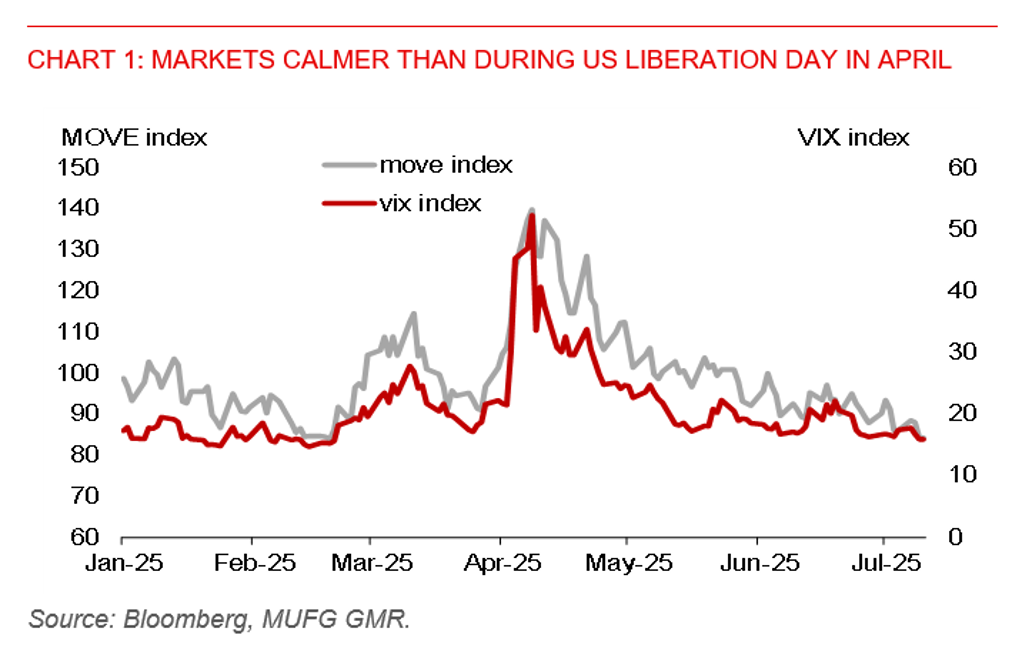

The US dollar index (DXY) has edged up by just 0.4% so far this week, reflecting a relatively modest response to latest tariff developments. The yen is a notable exception, though, weakening by 1.3% so far this week against the US dollar. Markets are relatively calmer compared to the volatility seen during US liberation day.

Regional FX

Asia ex-Japan currencies have weakened against the US dollar, with the Thai baht underperforming in yesterday’s session, falling 0.5%. Notably, the Thai baht has also fallen by 1.1% against the US dollar so far this week, following President Trump’s announcement of a 36% tariff on Thailand and amid ongoing domestic political uncertainty. USD could still get some reprieve against Asian FX, with short USD trade looking somewhat crowded from a positioning perspective. But ultimately, markets may place more weight on the future path of fed funds rate, which could shape the outlook for the USD. A key highlight today is the BoK policy rate decision, where we expect a hold.

Yesterday, Bank Negara Malaysia lowered its Overnight Policy Rate (OPR) by 25bps to 2.75%, likely in response to rising tariff risks following President Trump’s announcement of a 25% reciprocal tariff rate on US imports from Malaysia, effective on 1 August. BNM stated that the rate cut is a pre-emptive move to support Malaysia’s growth trajectory, as the balance of risks to growth are tilted to the downside amid persistent global trade uncertainties. We expect Malaysia’s GDP growth to slow to 4.1% in 2025, with some negative effects likely to spill over into 2026. For now, we are not looking for further rate cuts, unless growth slows materially below 4% this year, which is not our baseline scenario. The ringgit will likely face near-term pressure from tariff developments. However, domestic macro resilience and our anticipated resumption of Fed rate cut in September support our outlook for USD/MYR to fall to 4.11 by end-2025.