Ahead Today

G3: US initial jobless claims, PMI, new home sales; ECB meeting

Asia: Thailand trade, India PMI

Market Highlights

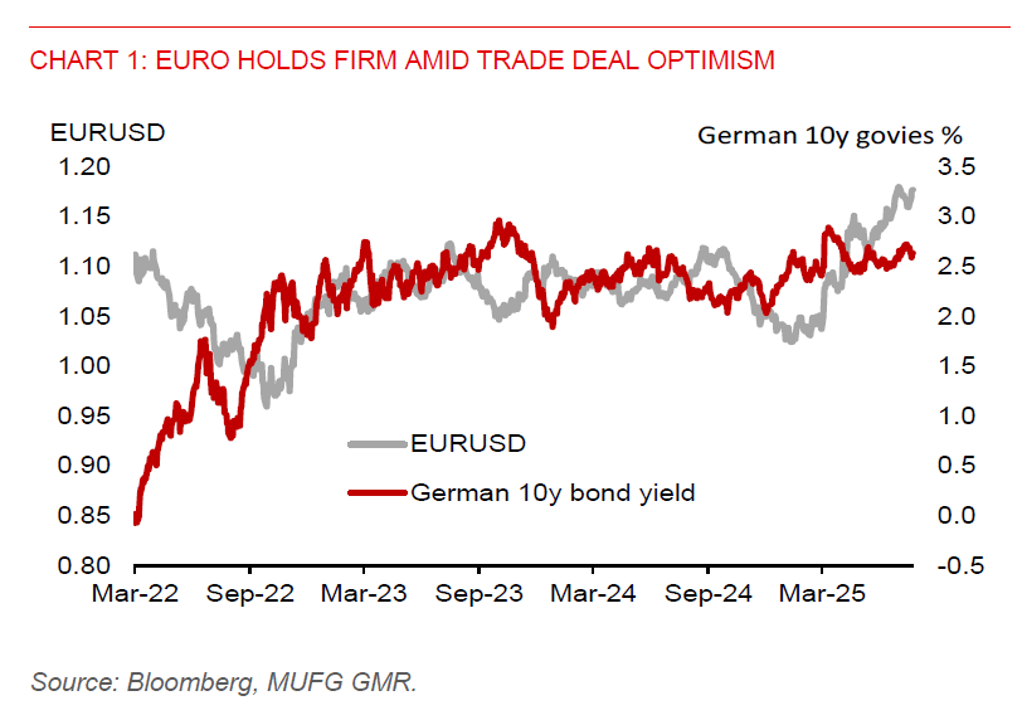

The ECB could hold interest rates steady at the meeting today, as it awaits greater clarity from ongoing EU-US trade talks and assess the impact of past policy easing measures. The European Union is reportedly advancing toward a trade agreement with the United States, under which a 15% tariff rate could be applied to most EU imports. Key sectors, including spirits, medical devices, and aircrafts, are expected to be exempt from these tariffs. If finalized, the 15% rate would align with the tariff rate seen in the recently concluded US-Japan trade deal. Nonetheless, a 15% tariff could still impact price competitiveness and profit margins for EU exporters in the US market.

Recent US trade agreements with major partners have also similarly established tariff rates within the 10%–20% range: 10% for the UK, 20% for Vietnam, and 19% for the Philippines and Indonesia. This suggests that a 10%–20% tariff band is emerging as the new norm for countries that successfully negotiate trade deals with the US. This also reflects a shift in US trade policy toward a relatively more moderate form of protectionism compared to those reciprocal tariff rates announced on US Liberation Day in April.

However, EU-US trade negotiations remain fluid. In the event of a breakdown in negotiations, the EU is reportedly prepared to impose retaliatory tariffs of 30% on some EUR 100 billion worth of US goods, should President Trump proceed with his threat to levy 30% tariffs on EU imports after 1 August.

Regional FX

Asian currencies will likely continue to find support from a cyclical downturn in the US dollar, which continues to face headwinds from persistent policy uncertainty in the US and growing tensions between President Trump and Fed Chair Powell. The divergence in views is stark - Trump thinks the fed funds rate should be 3 percentage points lower, which would stimulate housing demand and significantly reduce the government debt burden. Should the Fed begin to signal a policy shift towards a more accommodative stance, the US dollar could face further downside. This could incentivize capital flows into economies with relatively stable domestic macro fundamentals, less exposure to trade headwinds, and offer comparatively higher yields.

Meanwhile, Singapore’s core inflation remained steady at 0.6% year-on-year in June, unchanged from the previous month and slightly below Bloomberg’s consensus forecast of 0.7%. Following the release, the Monetary Authority of Singapore (MAS) maintained its core inflation outlook of 0.5%–1.5% for 2025. MAS also expects growth to slow to 0%-2% this year amid significant uncertainty in the external environment. In an annual publication this month, MAS assessed that a slower rate of appreciation in the S$NEER policy band is appropriate for medium-term price stability.

In Malaysia, the government has adjusted the price of RON95 fuel downward to RM1.99/litre from RM2.05/litre. The move is expected to have limited impact on inflation, while fiscal consolidation continues at a gradual pace.