Ahead Today

G3: US Durable Goods orders, Germany IFO

Asia: Singapore industrial production

Market Highlights

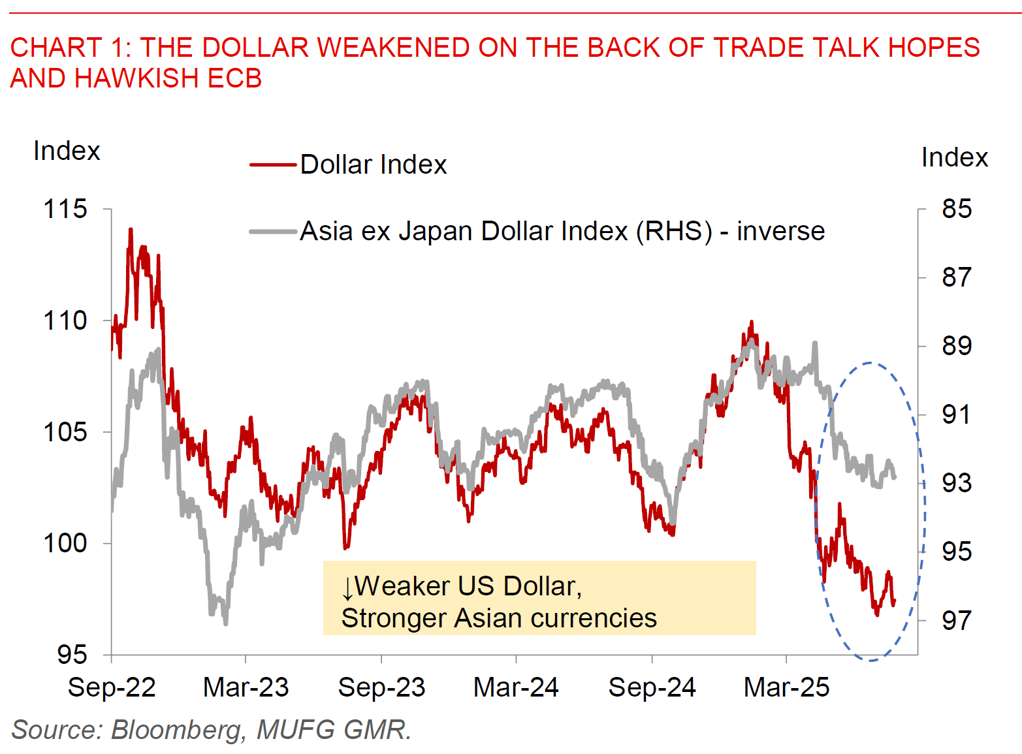

The Dollar weakened as we headed into the Asia session, with a somewhat hawkish ECB, continued hopes around further trade deals beyond Japan’s, and a stronger PBOC CNY fix helping to lift sentiment on Asian currencies to some extent. ECB kept rates on hold at 2%, while ECB President Christine Lagarde said the central bank is in a “wait-and-see” mode and that they are in a good place now to hold and watch how risks develop over the course of the next few months. Meanwhile, higher actual and expected tariffs were factors cited as key risks, but overall the assessment is that the ECB can afford to wait for now.

Japan’s latest trade deal including its sectoral auto tariff cuts from 25% to 15% is also likely driving further impetus in striking a deal, most notably the countries which compete directly with Japan’s auto exports such as EU and South Korea. One key element to the US-Japan deal has been this reported investment fund between the US and Japan, where Japan will reportedly invest US$550bn in the US in sectors and projects at the choosing of the current administration according to Trump, and also where the US will receive 90% of the profits and Japan will receive 10%. As we have seen with these announcements the devil is certainly in the details and it is not clear for now who will finance this investment, the viability of projects, who exactly takes the risks between the US and Japan, among many others.

Crucially for the likes of South Korea, latest news reports suggest that both US and South Korea have discussed creating a similar fund to invest in American projects as part of a trade deal, although the smaller size of the South Korean economy relative to Japan will make hitting a larger headline investment number that much more difficult. Yonhap News reported that South Korea is preparing to propose at least US$100bn in US investment pledges, secured through consultations with the nation’s conglomerates and could grow if government support is added. The financing mechanism may however be different from Japan’s due to the lack of development banks in South Korea at least at the scale that is being touted.

Beyond tariffs and the rush to close the art of the deal, one continuing theme that we see in Asia and many countries outside the US is the acceleration in moves to diversify away from or at least hedge with the US. The UK and India officially signed a free trade deal that would slash tariffs from 905 of tariff lines for UK exports to India, including 85% that will be fully tariff-free within a decade. India meanwhile will see duty reductions on about 99% of tariff lines for goods shipped to UK, with levies on whisky and gin halved to 75% before reducing to 40% by the 10th year of the deal, while automotive industry tariffs will reduce to 10% - under a quota – from 110% over that period.