Ahead Today

G3: UK CPI

Asia: Bank Indonesia, Malaysia CPI

Market Highlights

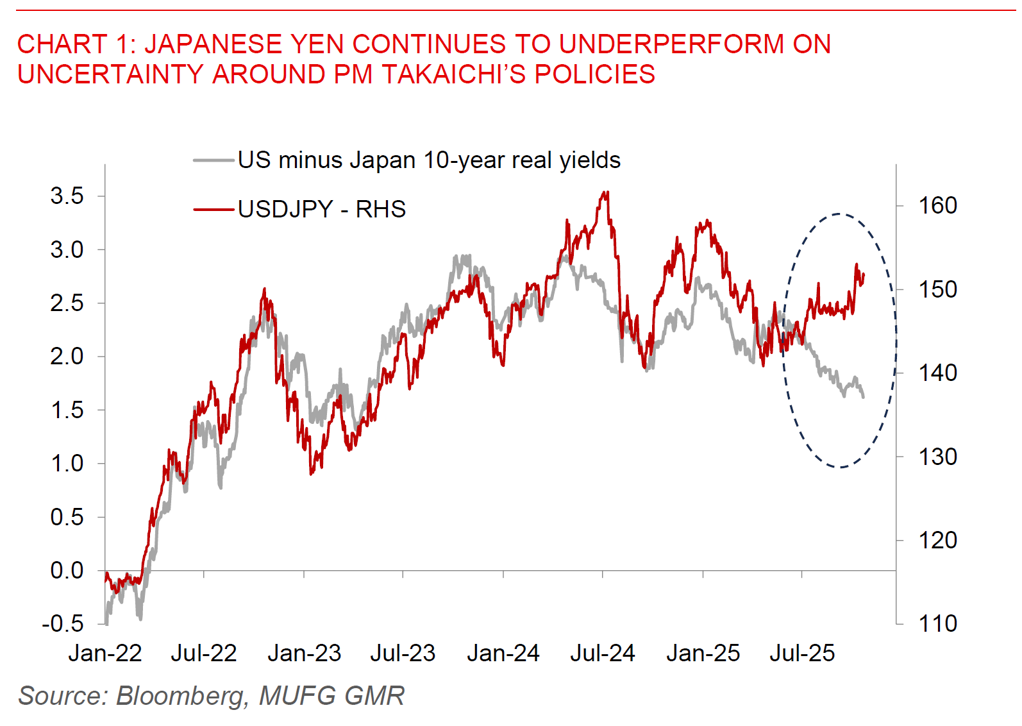

The Dollar strengthened and with that Asian currencies softened, gold prices dropped sharply towards the US$4000/tonne handle, while risk sentiment was slightly mixed. There were several themes happening at the same time, including the shape of Japan Prime Minister Takaichi’s cabinet, the timing of Bank of Japan rate moves, and uncertainty around whether the upcoming Trump-Xi meeting will happen. President Trump said overnight that he expected to make a “good deal” with President Xi, but also mentioned that there’s a chance the meeting will not happen and any deal has got to be a fair one. Meanwhile, USD/JPY moved above the 151.50 levels, with Takaichi becoming Prime Minister by receiving 237 votes in the House of Representatives election for the PM. There was some market uncertainty around the impact of PM Takaichi’s cabinet appointments, and in particular the new Minister of Finance Satsuki Katayama, and to some extent the Minister of Economic and Fiscal Policy Minoru Kiuchi. Markets are uncertain about the views of Finance Minister Katayama on fiscal policy, and in particular whether her perceived history in supporting and active fiscal policy will result in more meaningful fiscal expansion and as such affect the Japanese Yen. This is even as she has been known to push back against JPY depreciation as an inflationary driver but also has questioned the efficacy of currency intervention on curbing JPY weakness.

All these changes in Japan are also happening in the context of Bank of Japan’s upcoming monetary policy meeting later this month. Bloomberg reported yesterday that Bank of Japan officials are of the view that there is no urgency to hike rates in the October meeting, even as the economy is making progress towards achieving the price target and as such the path for another rate hike is likely to become clearer over time. The news reported that Japanese authorities will only make a final decision next week only after looking at data until the last minute. Overall, our base case is for USD/JPY to gradually move lower over time towards 150 by the end of this calendar year, as Fed rate cuts and a weaker Dollar dominate.

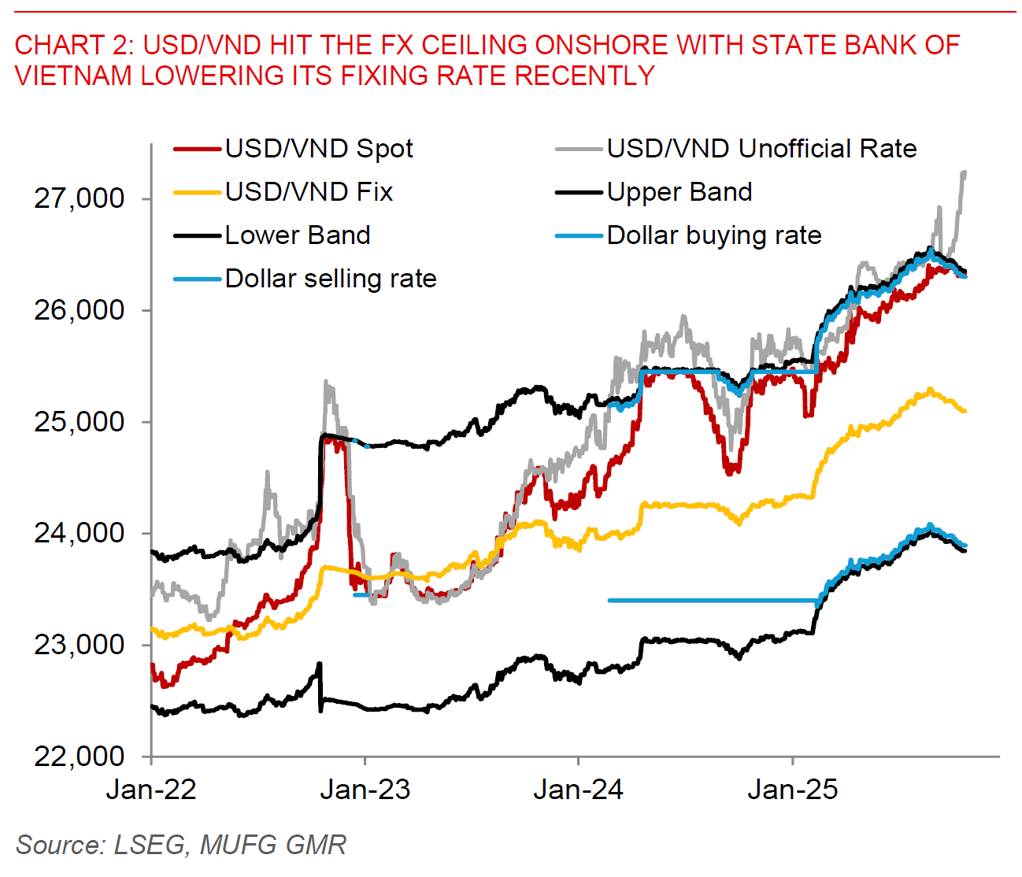

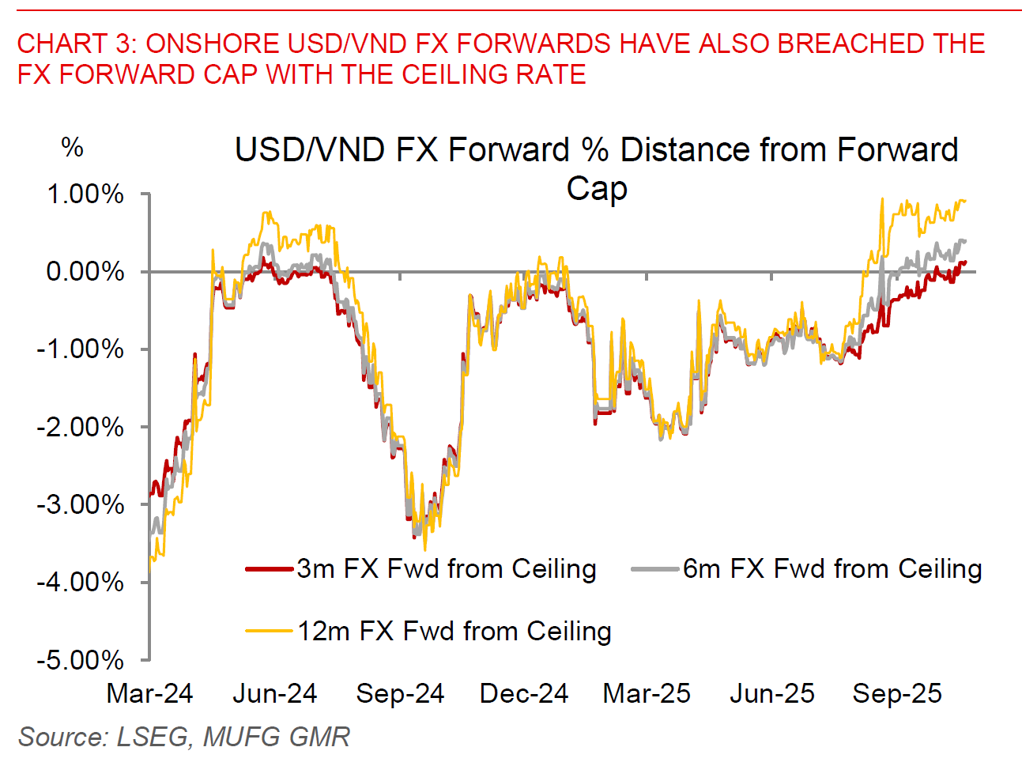

Meanwhile in Asia, the Vietnamese dong hit the upper end of the onshore FX ceiling rate, and with that FX forward tenors have also hit the onshore FX forward caps. We last saw some of these on an extended basis during 2Q last year when there were significant outflows. This time around, the State Bank of Vietnam seems to be pushing back against VND weakness in recent weeks, over time gradually lowering the onshore FX fix, but with that onshore domestic interest rates have also been quite volatile and elevated as a result.

A key local development which has caused some market concern was the recent inspection by the Vietnam Government, finding that 67 bond issuers including five banks had “various violations”, including misuse of proceeds, inadequate disclosures, poor capital management, delayed principal and interest payments and premature project sales. In particular, what has caught the market’s attention has the investigation of Novaland over allegations that the company misused proceeds from bond sales between 2015 and 2023 including potential round-tripping of funds.

Our view at this point is that the situation today is unlike what we saw back in 2022 during the corporate bond market crackdown and investigations in Vietnam, in part given the reforms that have already been done to clean up the corporate bond market and banking sector. Nonetheless, we do continue to see VND being under modest depreciation pressure moving forward, and continue to forecast USD/VND moving towards 26,500 by year-end.