Ahead Today

G3: US ISM Manufacturing, ISM Prices paid, Powell in fireside chat

Asia: Asia PMIs, Indonesia inflation

Market Highlights

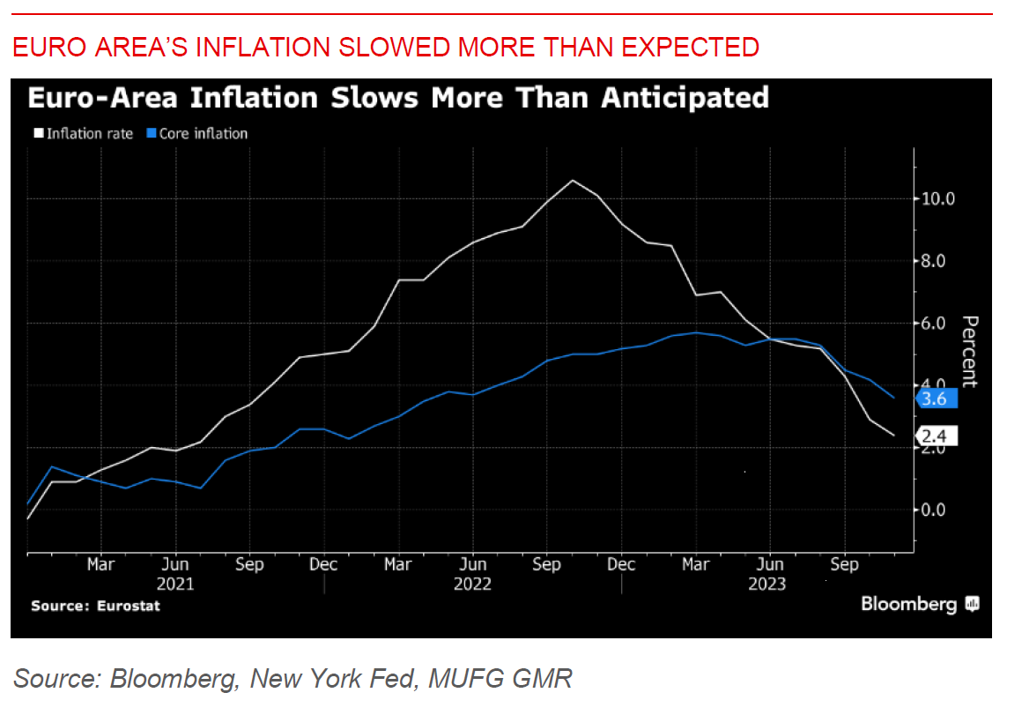

The US Dollar regained some ground yesterday, as Eurozone’s inflation came in lower than expected, while China’s PMIs disappointed. In particular, Eurozone’s headline CPI moderated to 2.4%yoy in November, down from 2.9%yoy, with the core measure printing at 3.6%yoy. While there may be some pickup in Europe’s inflation in coming months due to the removal of government energy subsidies, markets have now priced in 100bps of rate cuts by the ECB next year to start in April. Meanwhile, China’s manufacturing activity contracted while services PMI was also weaker in November, underscoring the structural challenges still facing China’s economy.

Oil prices fell as the OPEC+ meeting promised further output cuts but was light on details of enforcement. The grouping announced roughly 900,000 barrels a day of additional oil output cuts from January, but this was largely “voluntary” with Angola already rejecting them, and did not come with a press conference. Saudi Arabia announced it will prolong its 1 million bbl/day cuts through 1Q2024.

Looking ahead, markets will focus on Chair Powell’s fireside chat, together with US ISM Manufacturing.

Regional FX

Asian FX pairs were generally weaker against the Dollar on back of the USD recovery and higher US yields. India’s 3Q GDP came in stronger than expected at 7.6%yoy (vs consensus expectations for a 6.8%yoy rise). The details were somewhat mixed, with strength in fixed investment (+11%yoy) and government consumption (+12%yoy) helping to offset a slowdown in private consumption (3%yoy). From an FX perspective, the strength in investment implies some pressure for a wider current account deficit, and coming at a time when capital inflows have also slowed down meaningfully. We are cautious near-term on INR, and forecast USDINR at 83.7 in 3m, but see FX volatility well-contained by aggressive FX intervention by RBI on both sides. Meanwhile, Korea’s exports for November picked up to 7.8%yoy from 5.1%yoy previously, providing some further signs of export recovery across the region. This comes as the Bank of Korea kept rates on hold yesterday at 3.5%, but with fewer board members now seeing need to raise rates further.