Ahead Today

G3: Eurozone PMIs, US ISM Services, US JOLTS Jobs Opening, RBA Cash Rate

Asia: China Caixin Services PMI, Philippines CPI

Market Highlights

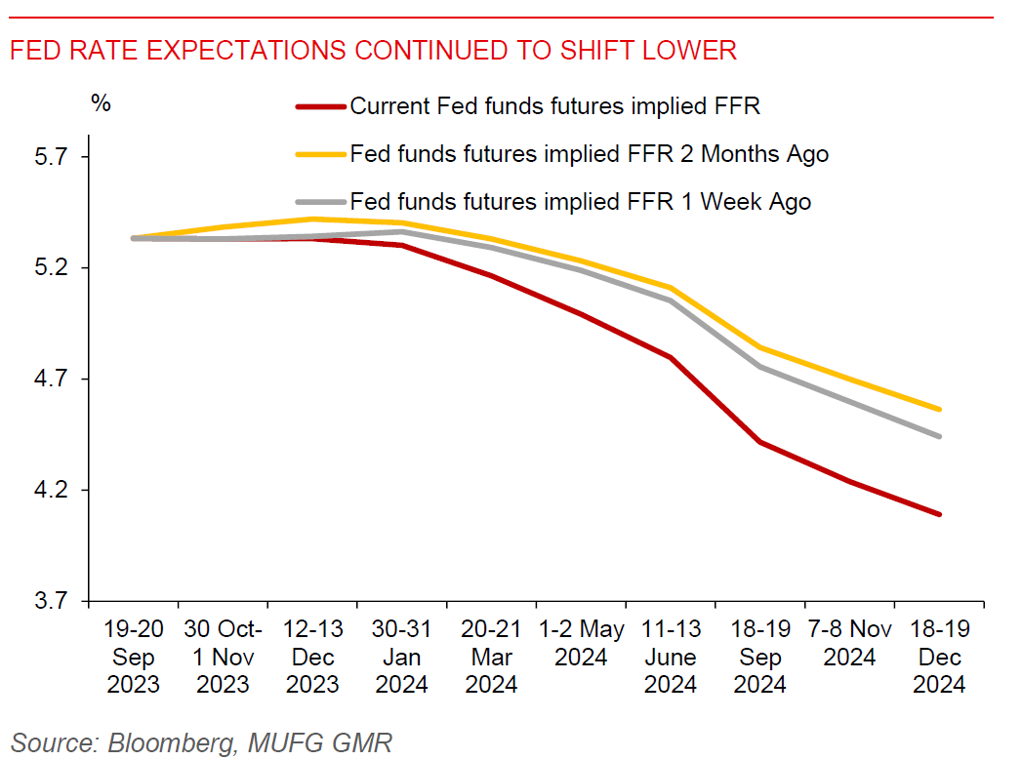

The Dollar strengthened by 0.4% ahead of key non-farm payrolls data this Friday. The exact catalyst was not entirely clear during thin liquidity through the December period. It’s worth noting that market expectations for rate cuts at the Fed and the ECB have continued to shift meaningfully, with markets now pricing in for around 120bps of cuts for both central banks by end-2024. On the macro data front, US durable goods orders was in line with expectations, declining 5.4% on a headline basis, with the underlying ex transportation measure unchanged on the month.

Meanwhile, Japan’s Tokyo inflation moderated more than expected both on a headline basis to 2.6%yoy, but nonetheless CPI excluding fresh food and energy was still elevated at 3.6%yoy. We continue to see the Bank of Japan shifting policy in 1Q2024 by removing its negative interest rate policy, together with removing YCC.

It’s a busy day looking ahead. The Reserve Bank of Australia releases its decision, where markets are expecting no change in the cash rate at 4.35%. With recent CPI print coming in lower than expected, markets will look for any change in RBA’s hawkish tone. We will also have US ISM Services and Jobs Openings data.

Regional FX

Asian FX pairs were generally weaker against the Dollar on back of USD strength, with USDCNH rising to 7.15 while THB and KRW declining 0.4%. South Korea’s 3Q GDP was in line with expectations at 1.4%yoy, with inflation slowing more than expected in November. Bank of Korea has made clear that fighting inflation remains the top priority, but has turned somewhat less hawkish in its latest policy meeting. Looking ahead, we will have China’s Caixin Services PMI, together with the Philippines CPI print. Markets are looking for inflation in the Philippines to moderate to 4.3%yoy from 4.9%yoy previously, partly on the back of base effects. We think that the BSP remains on hold for now and see the 1st rate cut coming in 4Q2024 as inflation is likely to remain sticky into 2024.