Ahead Today

G3: US U of Michigan Expectations, US Import price

Asia: China Trade

Market Highlights

The European Central Bank sent a clear signal that cooling inflation will soon allow it to comment rate cuts as soon as June. The ECB removed its reference to the time needed to keep rates at the current level (“sufficiently long duration”), while also clearly laying out the scenarios for cutting rates including the dynamics of underlying inflation. ECB President Lagarde in the press conference stressed data dependency and that the centra bank is not pre-committing to any rate path, while emphasizing it is also not Fed dependent (see MUFG FX Focus: ECB gives strong signal of June rate cut).

With ECB more clearly signaling a cut, EURUSD fell closer to the 1.070 level before rebounding to 1.072 overnight. Following the strong March CPI print, the good news for the Fed was that the PPI numbers released yesterday were softer than expected at +0.2%mom. This is important as the PPI feeds into PCE inflation, which is ultimately the inflation figure that the Fed targets. With that, core PCE inflation could come in around 0.25-0.3%, while not a disastrous print, is still not in line with what the Fed is hoping to see. We had some Fed speakers yesterday including John Williams, Susan Colins and Thomas Barkin reiterating the “going slow” and patient approach and certainly markets have priced as such.

Regional FX

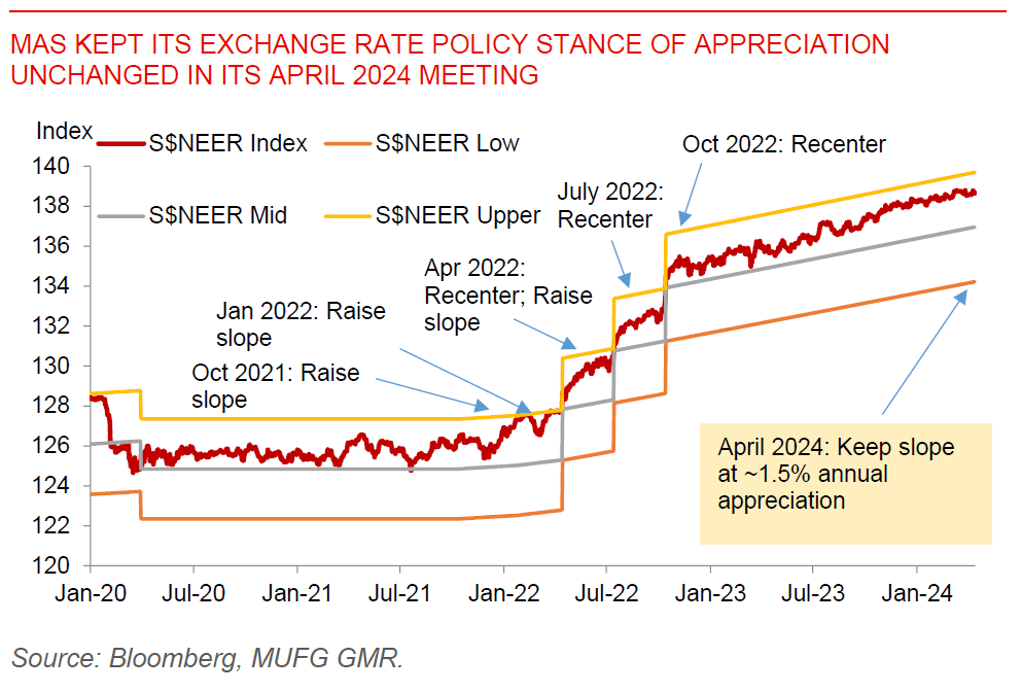

Asian FX markets traded mixed on the back of stronger US Dollar with USDSGD at 1.3532, USDCNH at 7.255, and USDKRW at 1367. China’s inflation numbers continued to remain soft with CPI at +0.1%yoy, indicating that domestic demand is still weak. Nonetheless, we have seen some improvement in manufacturing activity so far, and today’s export numbers out of China will be important to validate the pickup in export activity we are also seeing across Asia. The MAS kept its exchange rate policy stance unchanged as expected by the market. The statement was quite similar to the Jan meeting, continuing to highlight that Singapore's inflation should continue to moderate but only more noticeably so in 4Q. If anything, the statement was ever so slightly more hawkish, highlighting that the prevailing rate of appreciation "is needed to keep a restraining effect on imported inflation". The MAS continues to highlight that growth should improve through 2024 as the tech cycle turns and global central bank cuts rates. Today's 1Q advance GDP numbers were softer than expected driven by weaker manufacturing and construction, but the high frequency numbers have generally been decent. Ultimately, USDSGD should trade in line with the Dollar trend with MAS still unchanged in both its policy and statement.