Market Highlights

The US labour market and industrial production softened, while housing sentiment weakened, providing further signs that the US economy has lost momentum in the fourth quarter of the year. Initial jobless claims rose to 231k, while continuing claims rose to the highest in two years. The NAHB Housing Index fell further during the month. Some, but not all of the decline in industrial production can be attributed to auto strikes. In signs of further progress on disinflation, US import prices excluding petroleum fell to -0.2% mom (from -0.3% mom previously), while Walmart’s CEO sees potential for “deflation” in the months to come even as US consumers turn more cautious.

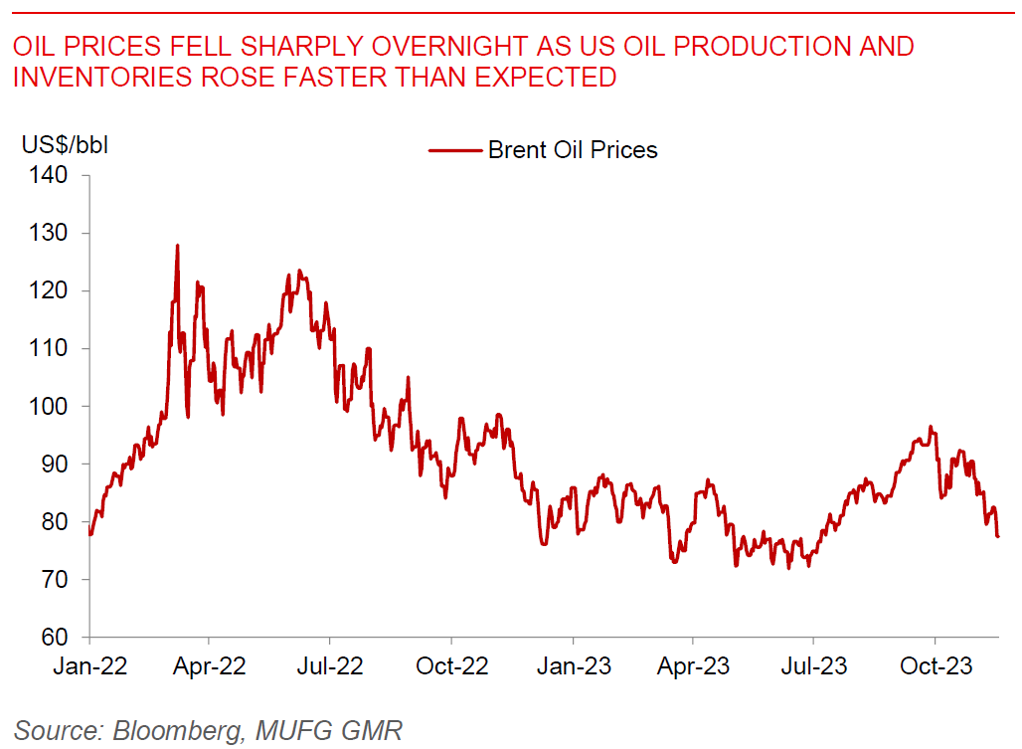

The big market mover was a sharp 4.6% decline in Brent Oil prices overnight to US$77/bbl, reinforcing global disinflation trends. Latest data showed US crude oil production and inventories rising much faster than expected, offsetting OPEC+ production cuts, coupled with uncertainties around oil demand. The Dollar was mixed, US 10-year Treasury yields fell below 4.5%, while US equity markets rose marginally.

Regional FX

Asian currencies were generally volatile but ended stronger against the US Dollar, with KRW, TWD and IDR outperforming. The Philippines central bank kept rates on hold at 6.5%, following an off-cycle hike previously (see BSP off-cycle hike), to allow previous increases to filter through the economy amid moderating price risks and a recovering Peso. The central bank highlighted that it remains data dependent, modestly lowered its inflation forecast for 2024, while still highlighted that monetary policy needs to remain sufficiently tight to keep inflation on a downtrend. We continue to see PHP underperforming Asian FX due to its large current account deficit and sticky inflation, but also highlight that recent trends such as lower oil prices, a weaker US Dollar and stronger than expected growth have been positive factors for PHP. We think BSP has an incentive to rebuild its FX reserves at some point, and as such, do not see too much room for PHP appreciation from here. Meanwhile, Indonesia’s trade surplus was stronger than expected at US$3.5bn, helped by a recovery in commodity exports, together with improvements in domestic demand.