Ahead Today

G3: US non-farm payrolls

Asia: Singapore PMI, Thailand Foreign Reserves

Market Highlights

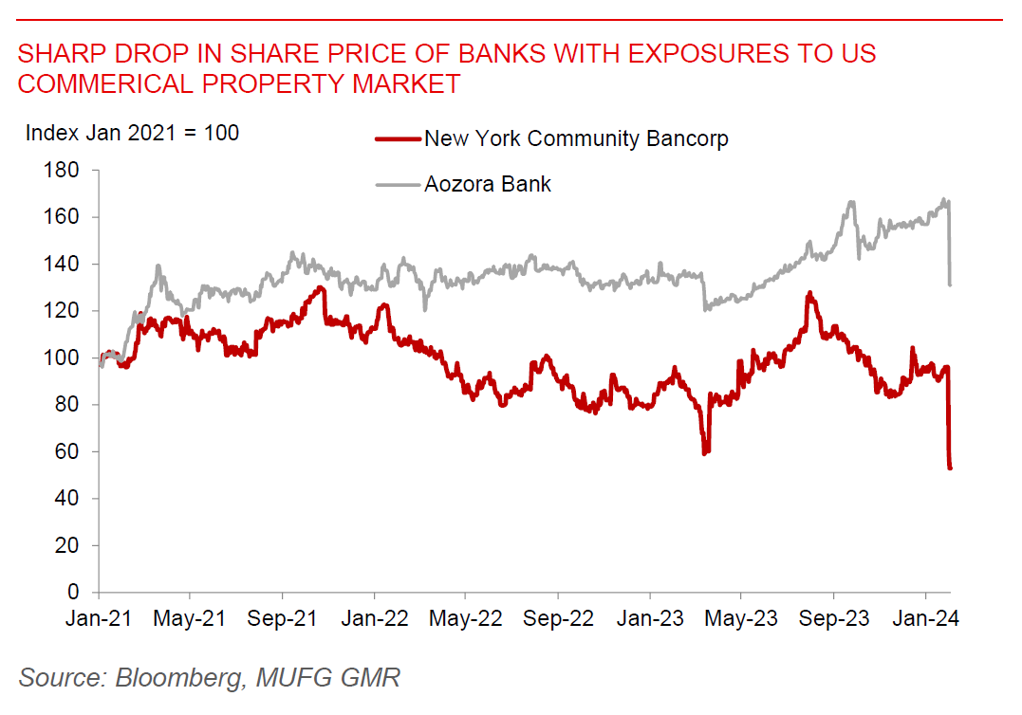

The US regional banking turmoil is starting to rear its head again, but this time centered around the US commercial real estate market. New York Community Bancorp, which had previously acquired part of Signature Bank, in a strange twist of fate fell by more than 38% as it increased credit losses and slashed its dividend on stresses in commercial property. This also spread to Japanese lender Aozora Bank, with the stock dropping 21% on losses also tied to US commercial property.

These negative developments however came on the back of pretty decent US data, with some green shoots showing US ISM Manufacturing emerging from the doldrums to 49.1 from 47.4 previously, coupled with a surge in labour productivity as such lowering unit labour costs, but juxtaposed against a slight uptick in initial jobless claims.

All in, the US Dollar weakened, US 10-year yields fell to 3.88%, while equity risk sentiment improved with the S&P500 up 1.25%. It was almost as if markets all but ignored Chair Powell’s remarks and the US commercial property stress, at least so far. The key market event today will be US non-farm payrolls.

Regional FX

Asian FX was generally stronger on the back of the weaker Dollar, with KRW (+0.4%) and PHP (+0.5%) outperforming. China pledged to keep spending this year to support economic activity, according to the Ministry of Finance, with sovereign bond issue likely to be front-loaded this year. Meanwhile, China’s Caixin Manufacturing PMI was in line with consensus at 50.8. India released its Interim Budget for FY2024/25, with the government targeting a smaller than expected fiscal deficit target of 5.1%, together with a smaller gross market borrowing programme of INR14.1 trillion. The mix of spending was also quite good, with continued focus on infrastructure spending, and the bulk of the fiscal adjustment coming from operational and subsidy spending. Post the announcement, Indian government bonds rallied sharply, while USDINR fell marginally below the 83.0 handle. Overall, the prudent Budget increases our confidence that INR can strengthen below the 82 handle over the next 12 months (see IndiaPulse – The Tide Has Shifted).