Ahead Today

G3: Germany IFO Expectations, US Consumer Confidence

Asia: Malaysia CPI, Taiwan Industrial Production

Market Highlights

In a whirlwind of events overnight, Brent oil prices fell more than 7% to US$68/bbl, and close to retracing the moves seen post the start of the Israel-Iran conflict. Iran fired missiles towards US military bases in Qatar in a retaliatory move, but the key was that this action was quite constrained and also potentially coordinated with key officials including in the US and Qatar, and as such minimizing collateral damage and providing an off-ramp. US President Trump ultimately took this off-ramp, while also claiming that Israel and Iran had agreed to a “complete and total ceasefire” starting early on 24 June, which will lead to “an official end” to their ongoing conflict. Details of the ceasefire agreement are still sparse at the time of writing and as such the détente and de-escalation is not a done deal. Nonetheless, latest news reports suggest Iran has agreed to the ceasefire and if this is right, the left tail risk of more extreme scenarios resulting in significant oil supply disruptions have meaningfully diminished.

Beyond the Israel-Iran conflict, the other crucial market driver was Fed Governor Michelle Bowman’s speech overnight calling for an interest rate cut as soon as July. She said that the inflationary effect of the trade war “may take longer, be more delayed, and have a smaller effect than initially expected”, with ongoing progress in tariff negotiations providing a less risky economic environment to adjust policy. With all those confluence of events, we saw US 10-year yields decline to 4.34%, the Dollar weaken, while risk assets strengthen.

Regional FX

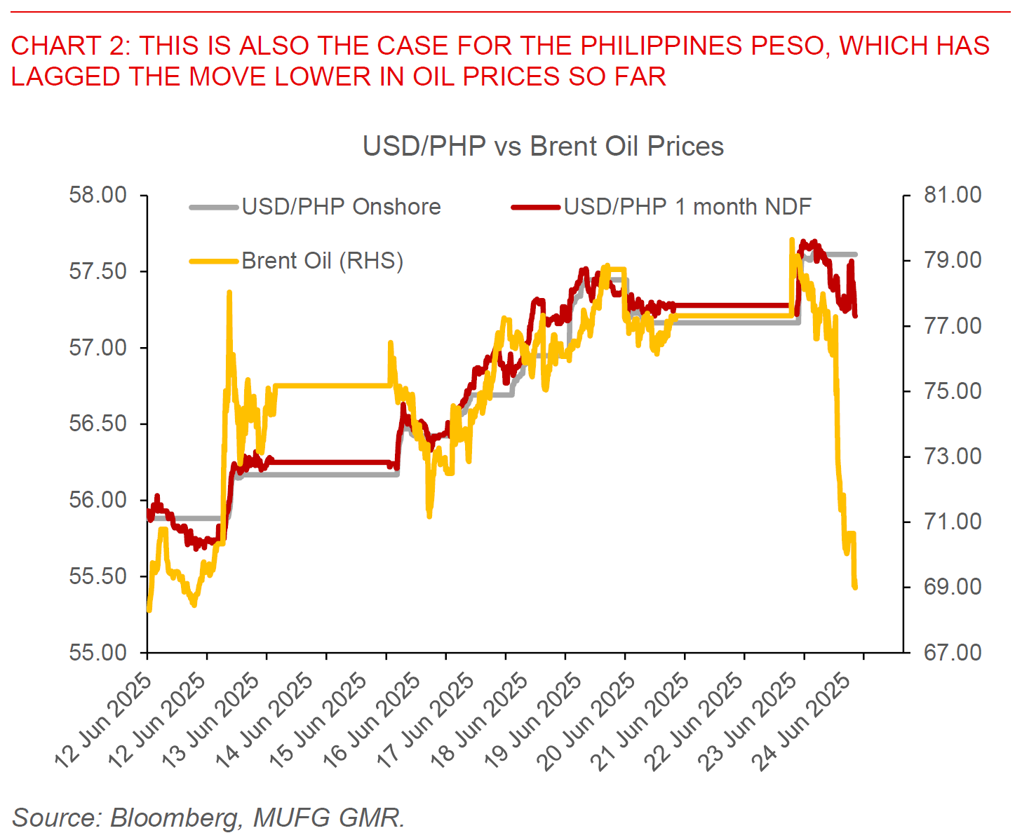

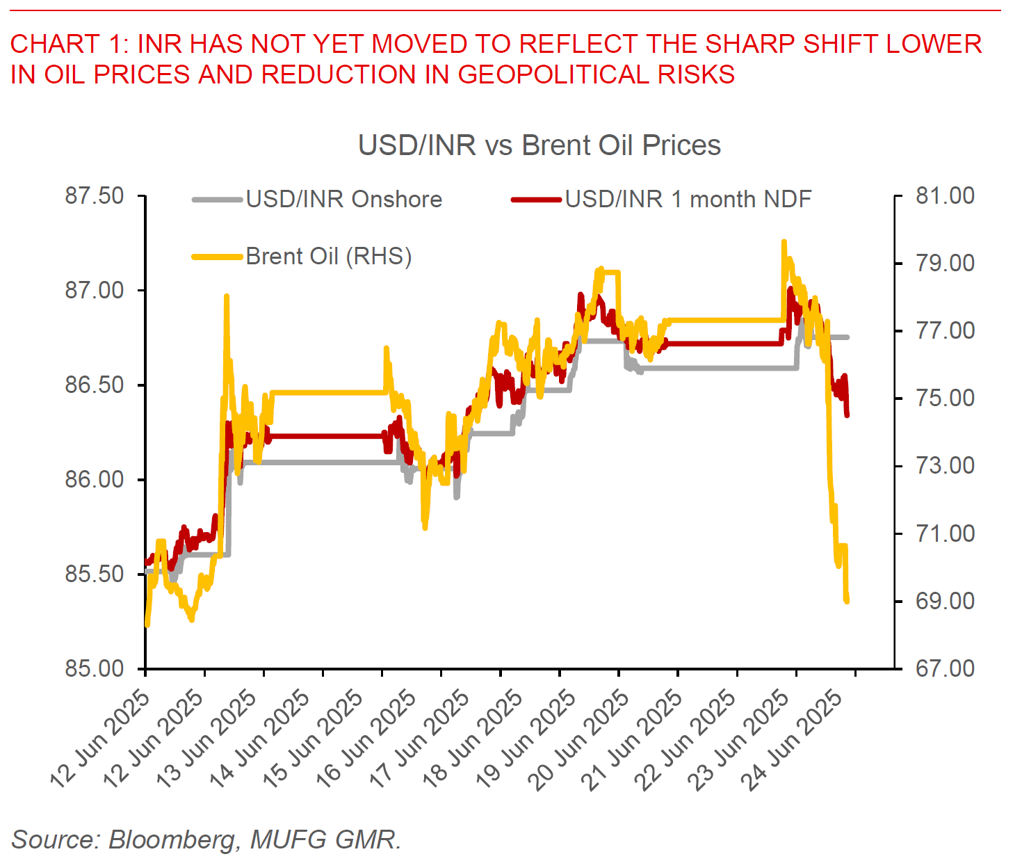

For Asia FX markets, what’s interesting is that not all Asian currencies have thus far reflected the sharp retracing lower in oil prices. Our research published suggest that PHP, KRW, THB and INR are more sensitive and vulnerable to sharp spikes in oil prices and the logic should be symmetric and works both ways (see Asia: The impact of oil price shock on Asia FX – a scenario analysis).

In particular, across our region, USD/INR and USD/PHP at least as proxied in the 1 month NDF markets have so far not moved as much as oil prices have fallen, with USD/KRW probably the pair that has moved more to reflect recent developments in geopolitics and the Israel-Iran conflict. From our perspective, shorting USD/INR and USD/PHP looks quite attractive given the existing and meaningful divergence with oil prices, and also how a fed rate cut in July looks somewhat more probably with Governor Bowman’s speech yesterday. This is in line with our view that risks for both PHP and INR are now more two-sided given how much they had depreciated, and more importantly, local positives such as improving growth and a possible trade deal in India’s case, and rising FDI approvals and low domestic rice prices in the Philippines’ case.