Ahead Today

G3: Bank of Japan policy meeting, US Housing starts, Germany ZEW expectations, Japan IP

Asia: Philippines BOP

Market Highlights

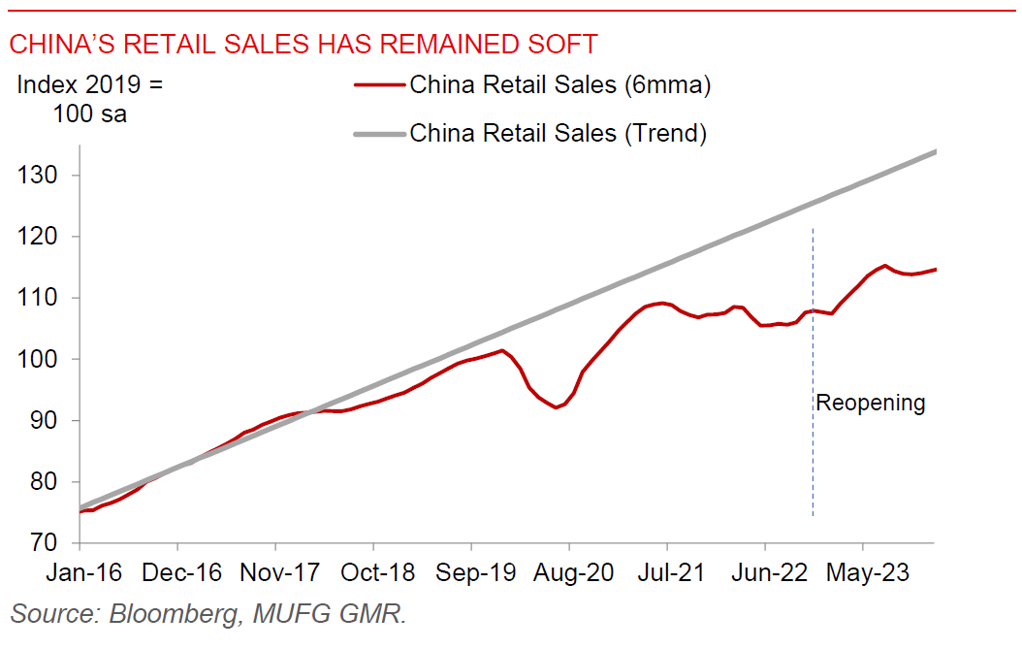

China’s monthly economic data was a mixed bag, with industrial production surprising on the upside at 7%yoy (vs consensus of 5.2%), and fixed investment better than expected at 4.2%yoy. However, retail sales was a touch softer than expected at 5.5%yoy, while property investment remained in the doldrums, highlighting the policy challenge of stimulating consumption in the midst of negative wealth effects from lower property prices. The modus operandi of Chinese authorities seem to be to focus on supply-side measures to generate “new productive forces”, and much less so on big bang stimulus.

Certainly, markets are awaiting the Bank of Japan policy meeting with bated breath to see if the central bank indeed crosses the Rubicon by removing its negative interest rate policy. Beyond the policy rate, it’ll be key to watch for statements on the path forward (eg. whether it’s communicated as a one and done decision), the existing commitment on overshooting, together with decisions on ETF purchases on equities and corporate bonds. Any joint statement with government officials will also be key to watch for during the meeting.

Overall, markets continued to price out Fed rate cuts to some extent ahead of the Fed meeting. The Dollar was somewhat stronger by 0.14%, US 10-year yields touched 4.33%, equity markets rebounded, while oil prices rose to US$86/bbl with news about Russian oil refining capacity removed from drone strikes.

Regional FX

Asian FX markets traded weaker against the Dollar, with KRW (-1.2%) IDR (-0.69%) and THB (-0.99%) underperforming. Apart from China’s data, we had export numbers out of Singapore and Malaysia, both of which disappointed consensus at -0.1%yoy and -0.8%yoy respective, highlighting the tentative nature of export recovery we see across the region. We do see scope for the tech cycle to improve further gradually through 2024 across Asia with the AI chip boom together with restocking activity.