Ahead Today

G3: US ISM Services Index

Asia: Indonesia GDP, Singapore Retail sales

Market Highlights

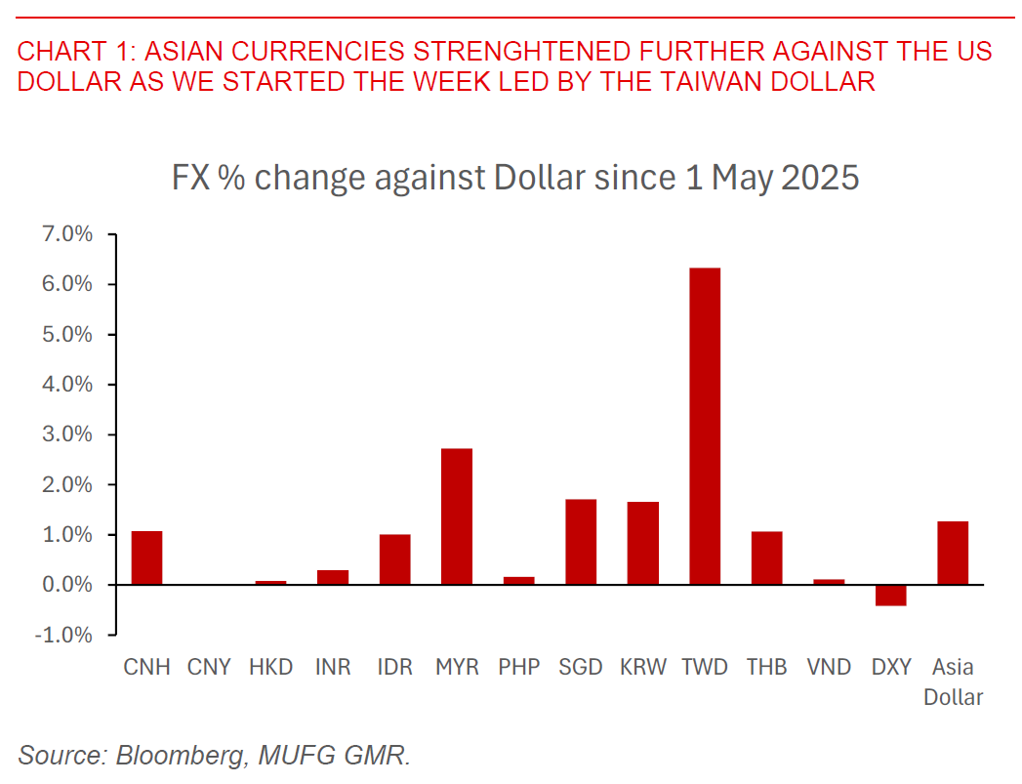

Asian currencies continued to move meaningfully at the start of this week, continuing the monumental moves last week led by sharp appreciation of the Taiwan Dollar (see Sharp moves in Asian FX led by TWD). Since 1 May, TWD has gained more than 6%, with the likes of MYR (+2.7%), KRW (+1.7%), SGD (+1.7%) and THB (+1.1%). Taiwan’s central bank held a press conference yesterday to try to assuage market concerns amid sharp TWD appreciation. Among other things, the CBC governor said that currency concerns did not feature in trade talks with the US, and he urged market commentators to stop speculating about the FX market, saying that there has been “excessive’ inflows from exporters and foreign investors to the Taiwan Dollar. The central bank also said that it has stepped in to intervene to smooth the FX market and will step in further if stability is threatened. Meanwhile, Taiwan’s Financial Supervisory Commission is meeting with life insurance firms to discuss the impact of the rapidly strengthening Taiwan dollar on their operations, with all three major life insurance companies telling the financial regulator that their risk-based capital remains within regulatory standards according to local news reports.

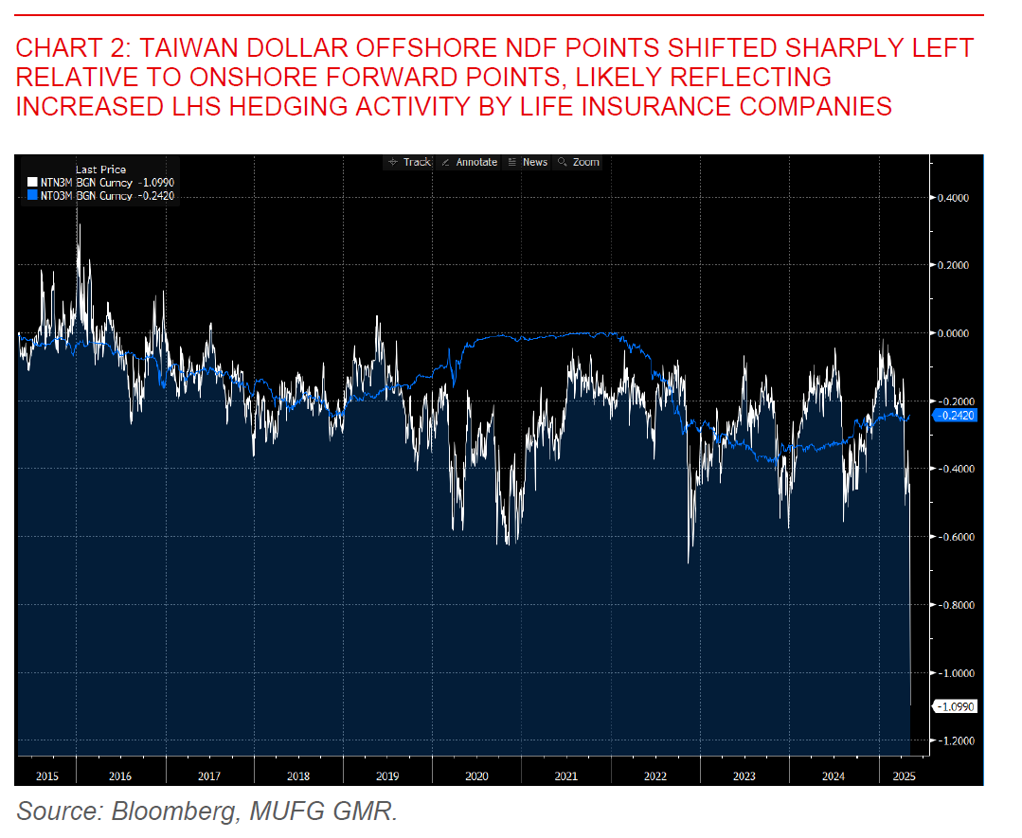

While it may take some time to understand the full picture and dislocations, one key driver might be increased LHS hedging activity by Taiwan’s life insurance companies. One key imprint that we see in markets is the sharp leftward shift in offshore NDF forward points relative to onshore. Beyond that, other factors which we have preivoulsy highlighted such as increased exporter conversion with build-up and hoarding of US Dollar deposits, combined with low liquidity probably all exacerbated the moves.

The bigger question as well is also what all these imply for the rest of Asia beyond the idiosyncratic factors driving the moves in Taiwan Dollar.

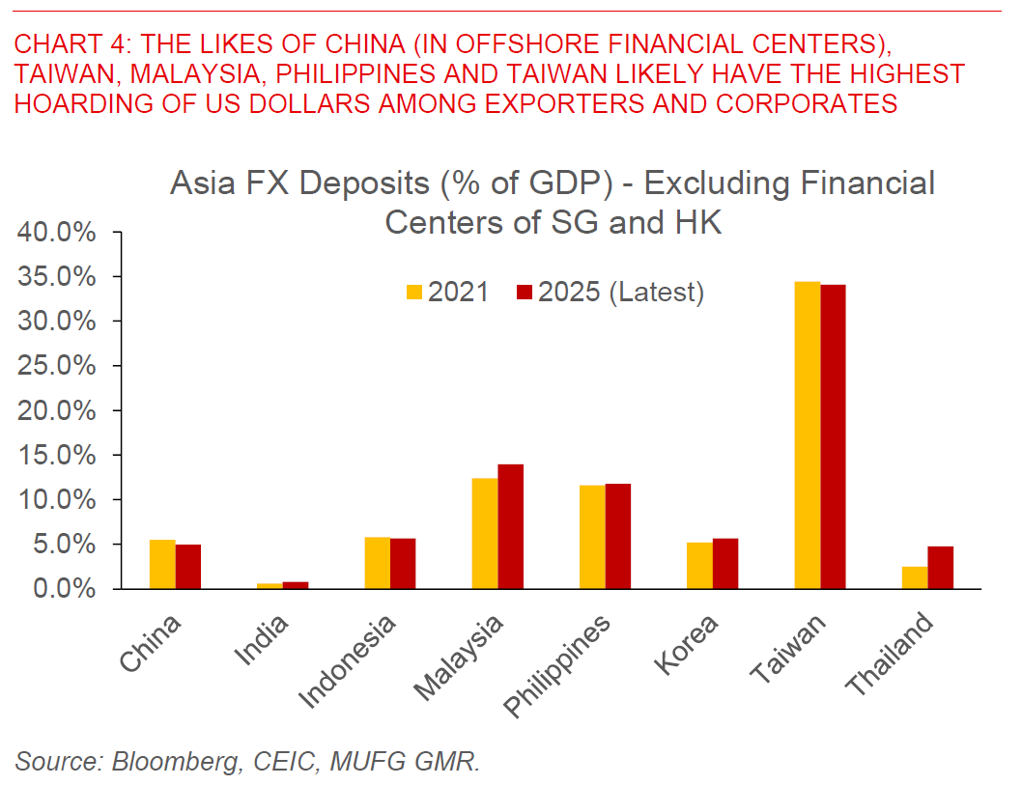

To some extent, it’s fair to say that Asian exporters have been among other things hoarding more US Dollar as US interest rates rose together with higher LHS hedging costs. This is probably most prominent in the likes of Taiwan, China, Malaysia, and to a smaller extent the Philippines and Thailand.

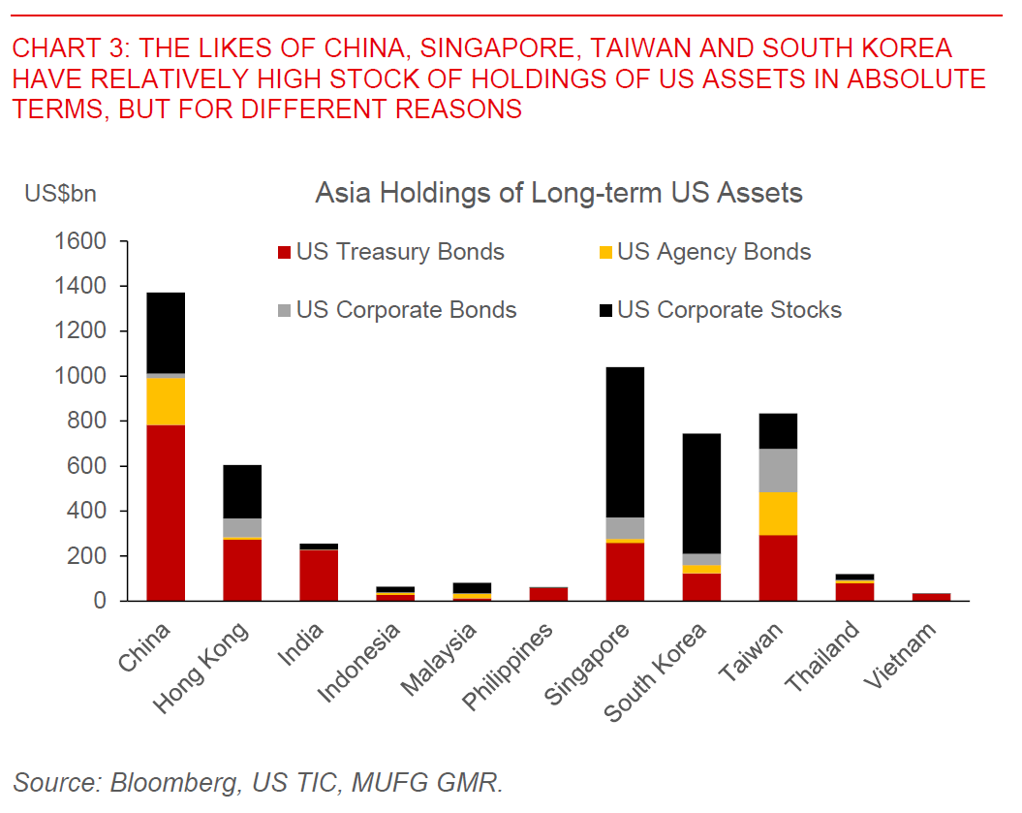

Meanwhile, Asian markets also have been over time increasing their exposure towards US assets, including US agency bonds and corporate stocks. To the extent that trade positions with the US changes more fundamentally, there could also be a more fundamental rebalancing, even if not repatriating back home, certainly some rebalancing towards other global assets might be reasonable