Ahead Today

G3: US PPI

Asia: India CPI

Market Highlights

President Trump confirmed a deal is done with China following two days of bilateral talks in London. However, details were sparse and lack clarity, particularly on the tariff rate. Nonetheless, the US tariff rate on Chinese goods will likely stay higher than before Trump’s second term in office. This, combined with a softer-than-expected US CPI print in May, has weighed on the US dollar.

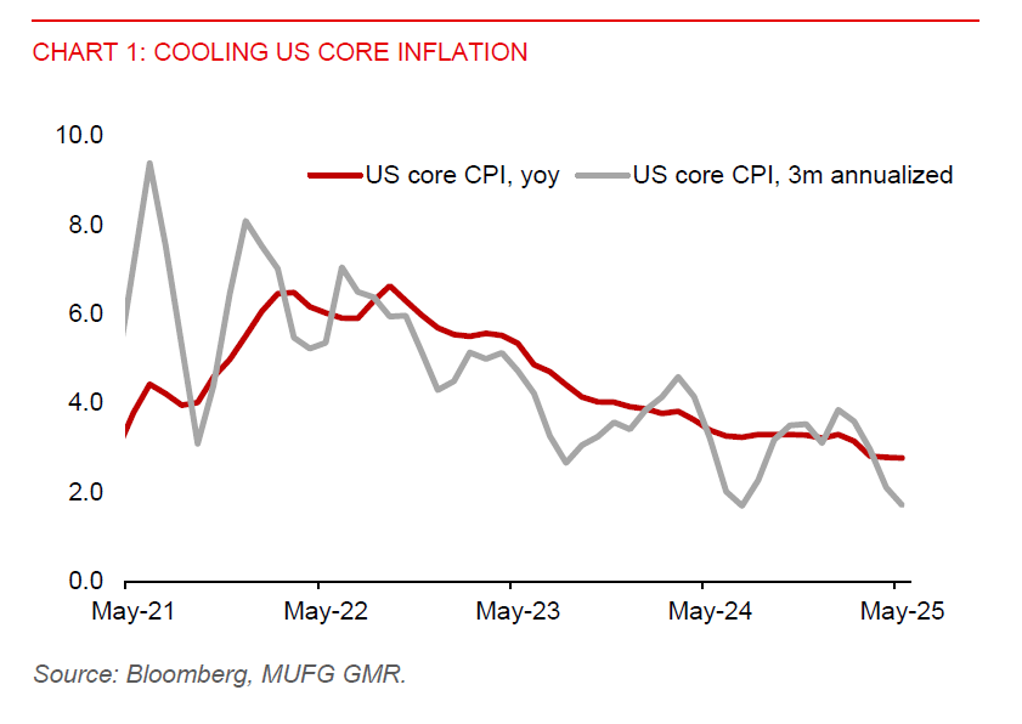

US headline CPI inflation edged up to 2.4%yoy in May, from 2.3%yoy in April, aligning with market expectations. Core CPI (ex-food and energy) held steady at 2.8% YoY, slightly below the Bloomberg consensus forecast of 2.9%. On a seasonally adjusted basis, core CPI rose just 0.1%mom, down from 0.2%mom in April and below market expectation of a 0.3%mom increase. This brings the 3-month annualized pace of core CPI to a modest 1.7%, signalling continued disinflationary momentum.

Notably, core services inflation (excluding energy) rose by less than 0.2%mom in May. Aside from a muted reading in March, this marks the slowest pace since February 2021, possibly reflecting a broader softening in the US economy. Core goods inflation also continued to ease. Most significantly, new vehicle prices declined by 0.3%mom in May. While core goods prices could face upward pressure in the coming months due to higher import tariffs, it remains uncertain whether this will be enough to offset the disinflation in services.

Markets will now turn their attention to producer price data due later today, with surveys suggesting that output prices may rise at a faster pace than consumer prices.

Regional FX

Asian currencies have largely consolidated against the US dollar, as the outcome of the recent two-day US-China trade talks failed to deliver a decisive catalyst for regional FX markets. The lack of concrete breakthroughs has kept market sentiment cautious. Meanwhile, the softer-than-expected US CPI data has led to a broad decline in US Treasury yields across the curve, narrowing the yield differential between the US and many Asian economies. This dynamic could offer near-term support for Asian currencies, although lingering trade uncertainties and rising geopolitical tensions in the Middle East may limit the pace of appreciation. Trump has said he will be setting unilateral tariff rates within 2 weeks, while Treasury Secretary Bessent indicated that the Trump administration may extend the 90-day pause on reciprocal tariffs for countries negotiating in good faith.

Meanwhile, an improving outlook for Asian local government bonds is providing a tailwind for regional FX. Notably, Indonesia’s 10-year government bond yield fell to 6.748%, its lowest level in seven months, amid sustained foreign interest. Net foreign bond inflows extended to a sixth straight month in May, with inflows totalling $1.8 billion last month. Similarly, Malaysia saw $2.9 billion in net foreign bond inflows last month, marking the third straight month of net inflows. These inflows reflect growing investor confidence in several Asian government debt, supported by disinflation trends and expectations of monetary easing across the Asia region.