Ahead Today

G3: US Pending home sales, EU Consumer Confidence

Asia: India industrial production

Market Highlights

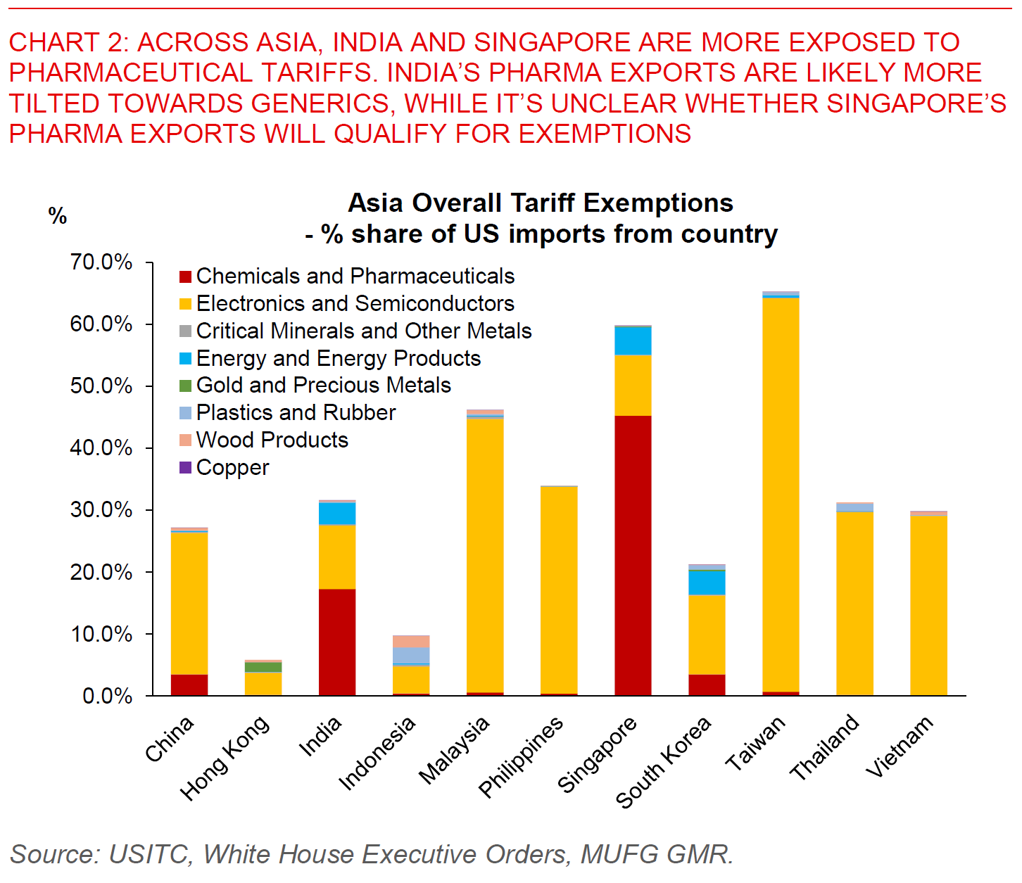

China’s industrial profits rebounded in August, rising by 0.9%yoy on a year-to-date basis, and more than 20% on a year-on-year perspective. This compares with a more modest profile for overall sales revenue with a 2.3% YTD rise. The spokesperson for China’s National Bureau of Statistics said that the increase in industrial profits was driven by multiple factors including the “effective implementation of macroeconomic policies”, advancement of unified national market, coupled with low base effects. Whether this improvement in profits has legs to go perhaps showing signs of the positive effect of the government’s anti-involution campaign, or is perhaps driven by temporary one-off factors will certainly be important for Chinese risk assets and the trajectory of CNY. On our end, we think gradual CNY appreciation against the Dollar makes sense helped both by a weaker dollar and continued better sentiment towards Chinese assets.

Beyond China’s macro data, recent developments continue to suggest that many trade deals with the US are built on shaky ground, with agreeing a deal perhaps much easier than actual implementation. For South Korea in particular, the Wall Street Journal reported that US Commerce Secretary Howard Lutnick has in recent conversations discussed slightly increasing the US$350bn South Korean previously guaranteed to the US, and has told Korean officials the US is looking for more of the funding to be provided in cash rather than loans. South Korean officials have in discussions also been emphasizing the potential FX impact of these investments, together with the different nature of South Korea vis-à-vis Japan’s including lower FX reserves and a much smaller economy among others. This also comes amidst the recent row over visas between the US and South Korea.

Even Japan’s implementation of a trade deal is unlikely to be smooth, with the US$550bn investment fund a key source of contention and discussion within Japan. Sanae Takaichi – one of the leading candidates for the upcoming LDP Presidential Election – said that Japan must stand their ground if anything unfair that is not in Japan’s interest comes to light in the process of implementing the deal.

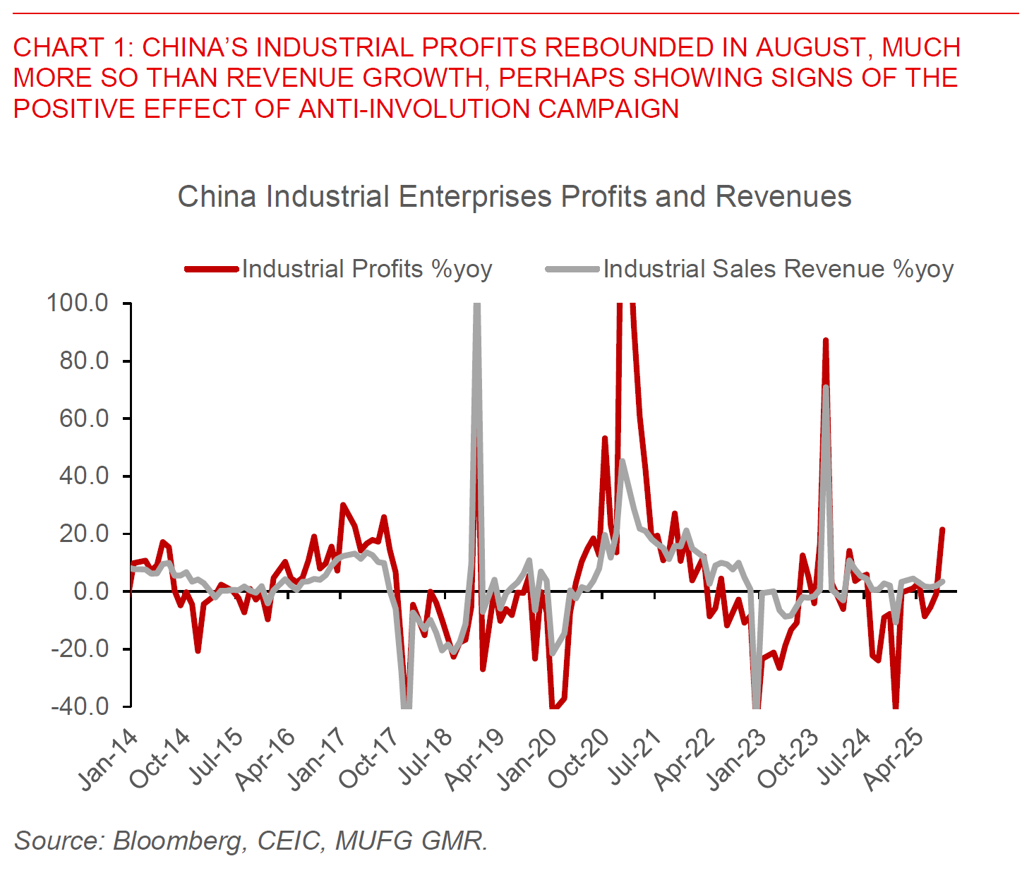

Last but not least, markets will watch closely for upcoming details of pharmaceutical and semiconductor tariffs, and other sectoral tariffs including upholstered furniture and kitchen cabinets. On this front, the details surrounding how branded or patented pharmaceutical products will be defined, coupled with how exemptions for pharma companies which are investing in the US will be implemented will be key to watch for. In Asia, Singapore stands out as potentially much more negatively impacted by the imposition of 100% pharma tariffs, followed by the likes of India and to a smaller extent South Korea. Singapore's Deputy Prime Minister Gan Kim Yong said over the weekend that new levies on pharmaceutical tariffs may not have an immediate impact on Singapore’s drugmakers given that most pharma companies in Singapore have built capacity in the us or have plans to do so, with companies seeking clarity at the moment if they would qualify for an exclusion. Meanwhile, Singapore is also in discussions with the US administration over semiconductors and whether the country can benefit from a tariff ceiling. For India’s pharma sector, our working assumption is that generics will not be impacted and so for the announced 100% tariffs, India should be largely exempted