Ahead Today

G3: US NFIB small business optimism, Germany CPI and ZEW survey expectations

Asia: India wholesale prices

Market Highlights

President Trump has appeared to moderate his stance on China following last Friday’s threat to impose 100% tariffs on all Chinese goods starting 1 November. Treasury Secretary Scott Bessent has indicated that the planned meeting between Trump and Chinese President Xi Jinping later this month is still expected to proceed. The tariff threat was largely seen as a response to Beijing’s decision to significantly tighten export controls on rare earth elements, which are critical inputs for manufacturing a wide array of products, including smartphones and computer chips. Under the new regulations, foreign entities producing goods that contain minute amounts of rare earths must also obtain licenses from Chinese authorities.

The US dollar and risk assets have rebounded, with markets seemingly interpreting latest Trump’s threat as a tactical manoeuvre aimed at strengthening his negotiating position. While further US actions, whether through dialogue or additional trade and non-trade measures, remain possible, the implementation of a sweeping 100% tariff appears unlikely due to the huge burden it would place on US companies. Nevertheless, the escalation in trade rhetoric introduces a fresh layer of uncertainty into the global trade landscape. China has pledged to retaliate if those steep US tariffs are enacted, and as we have seen in the first half of the year, Beijing could respond by raising similar tariffs on US goods or further tightening other trade-related measures.

Regional FX

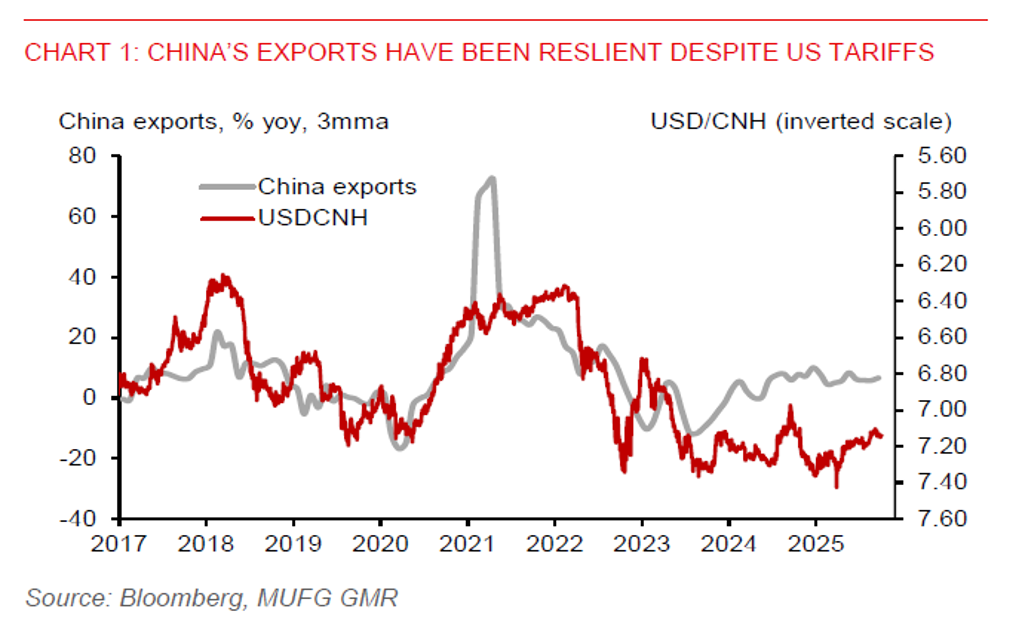

China has leverage in global trade, given its dominance in the supply of rare earth. In addition, China has been diversifying its exports away from the US and towards other economies in Africa and ASEAN. This strategic pivot reduces China’s reliance on US markets. China’s exports rose 8.3%yoy in September. Exports to the US fell 27%yoy amid higher US tariffs, but this was offset by strong exports to EU (+14%) and ASEAN economies (+16%).

In Singapore, advance Q3 GDP grew 2.9%yoy, beating market expectations of 2%yoy. While this marks a slowdown from 4.5%yoy in Q2, partly due to high base effects from a year ago, it nonetheless reflects a resilient pace of growth amid global trade headwinds. At its October meeting today, MAS maintain its monetary policy stance unchanged, keeping all parameters of the S$NEER policy band unchanged. This is in line with our and market expectations. MAS noted that some policy accommodation has been delivered in January and April, growth has surprised to the upside, while the output gap will stay positive this year before coming in around 0% in 2026. Policymakers have adopted a reactive posture rather than a pre-emptive one, signalling willingness to respond effectively to any risk to medium-term price stability.