Ahead Today

G3: France Manufacturing Confidence

Asia: China Fourth Plenum and Draft Five Year Plan Proposals, Bank of Korea Policy Meeting

Market Highlights

News reports overnight suggest the Trump administration is weighing export restrictions against China that would bar the purchase of a wide swath of critical software. What proved impactful was initial reporting by Reuters indicating a far more draconian proposal, with possible restrictions on all exports to China globally made with US software, which to our minds would be a massive escalation given that US software is incorporated in almost everything in our modern lives (perhaps outside of agriculture). The subsequent quotes including by the US Treasury Secretary indicate that the software curbs may be more similar to what has been done on Russia in the past, such as export controls on enterprise resource planning, customer relationship management and computer-aided design software. Meanwhile, oil prices jumped as the US announced sanctions on Russia’s biggest producers Rosneft and Lukoil.

With these developments, risk assets sold off quite sharply overnight and the Dollar strengthened, before reversing these moves somewhat with emerging details of discussions around critical software controls on China by the US. While specific details are not known at this point, what seems clear is that there are countermeasures prepared, and it also tells us that even as negotiations are ongoing it is uncertain whether both the US and China can eventually come to a landing point.

Closer to home in Asia, the focus will be on China’s Fourth Plenum and discussions around the draft Five Year Plan proposals, coupled with central bank policy meetings including the Bank of Korea out later today.

China's Fourth Plenum and the Discussions on the draft Proposals for Five Year Plan ends today (23 Oct). There will likely be a high level "Communique" published based on past experience, together with in subsequent days and weeks further details and papers including a likely press conference. Overall, the expectations is for a continuation from the themes from the 13th and 14th Five Year Plans, with a focus on technological self-sufficiency. Markets will also look for any meaningful signs of shift towards domestic demand and rebalancing, including through increasing welfare spending and/or targeting consumption to GDP ratios.

Meanwhile, Bank Indonesia surprised markets by keeping rates on hold yesterday at 4.75%. Nonetheless, the tone remains a dovish one, indicating that BI wants to see further transmission of lower rates to actual lending rates and end-users, with BI also pushing out additional policies in this regard to incentivise lenders to lower lending rates. The post policy statement suggests that BI remains focused on supporting growth with indications of further room for rate cuts moving forward. We continue to think that IDR can underperform with a dovish central bank and see USD/IDR moving towards the 17,000 levels over time.

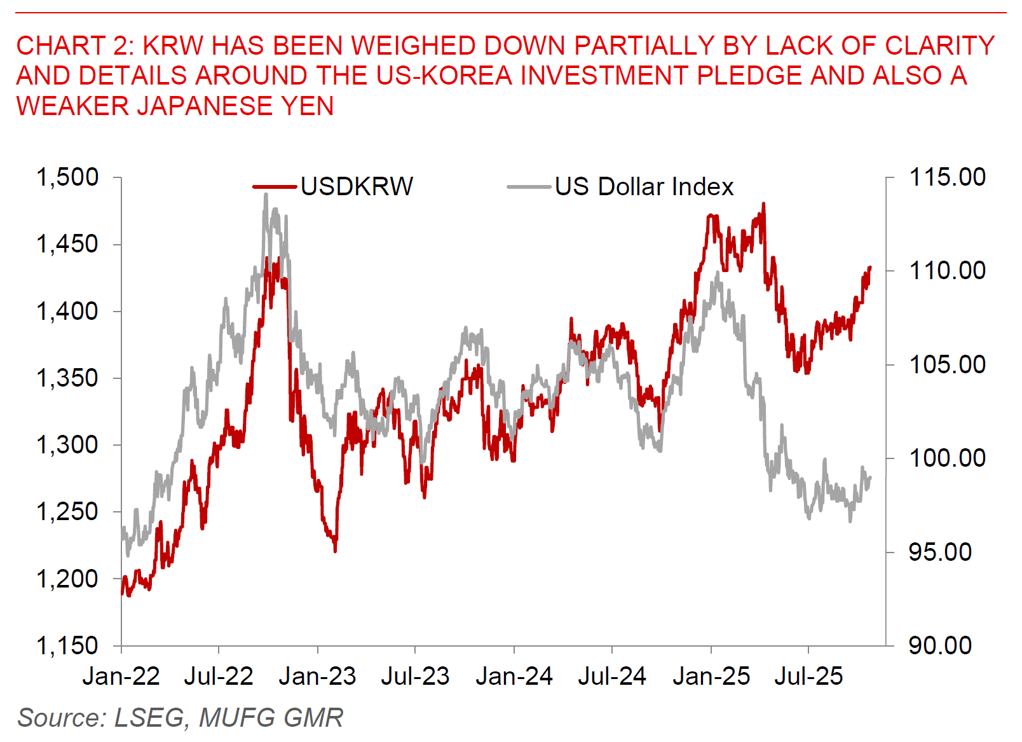

The Bank of Korea meets later today, and expectations are for a hold in the BOK policy meeting at 2.50%. Key for the markets would include the vote by the BOK Board members, with 5 out of 6 members in the August meeting thinking that a rate cut may be needed. In addition, the BOK will likely also closely consider the resurgence in housing prices and with that the government’s recent actions to cool the property market such as lowering loan-to-value ratios on the Greater Seoul area while implementing debt-to-service ratios. The potential FX impact to the South Korean won of current negotiations between the US and Korea on the investment deal package could also be important for the BOK. Latest news by Chosun suggests that discussions center around the structure of the US$350bn investment pledge, and the investment could be in phased payments of US$200bn over 8 years (~US$25bn annually), with US$150bn through credit guarantees. It is currently unclear whether the US$200bn over 8 years will be entirely in cash or if part of this could include loans.