Ahead Today

G3: US leading index

Asia: China’s 1-yr and 5-yr loan prime rates, Malaysia trade

Market Highlights

The US has a light data calendar, with the treasury market mainly awaiting the January 30-31 FOMC meeting minutes this week. The US dollar index was relatively flat while US yields continued to march higher.

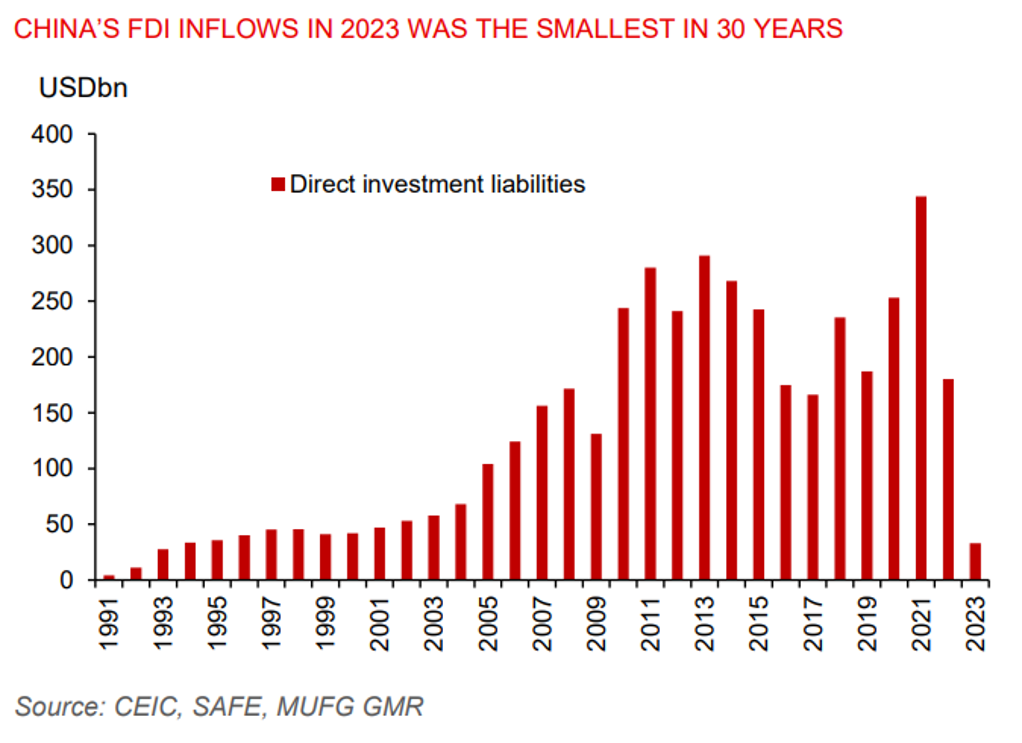

China has resumed trading following a week-long Lunar New Year holiday and on the back of a festive related boost to domestic tourism and consumer spending. The CSI300 index rose 1.2% yesterday. Meanwhile, China’s BOP direct investment liabilities were US$33bn in 2023, 82% lower than in 2022 and the smallest increase since the early 1990s. This reflects challenges by the Chinese government to attract foreign investment amid US-China tensions and a weak economic outlook. The PBOC left the 1-year MLF rate unchanged at 2.50% over the weekend, but markets are looking for a 10bps cut to the 5-year loan prime rate later today to provide more support for housing sales.

Japan’s Nikkei Index is approaching its 1989 peak, buoyed by the weak yen and strong corporate earnings, as markets look past data showing Japan’s economy slipping into a technical recession in 4Q.

Regional FX

Asian FX was little changed against the US dollar. USDCNY continued to trade above 7.20 level, while USDMYR neared the 4.80 level. Thailand’s 4Q GDP rose 1.7%yoy, from 1.5%yoy in 3Q, missing analyst estimates of 2.6%. Growth was weighed down by weaker consumption and investment. This brings full-year 2023 growth to just 1.9%, missing analyst estimates of 2.2%. On a seasonally adjusted basis, GDP fell 0.6%qoq versus market consensus for a 0.1% decline. The weaker than expected GDP bolsters the case for a lower policy rate to support growth.