Ahead Today

G3: US ISM manufacturing, eurozone manufacturing PMI

Asia: Manufacturing PMI for several Asian economies, Indonesia CPI and trade data, Hong Kong retail sales

Market Highlights

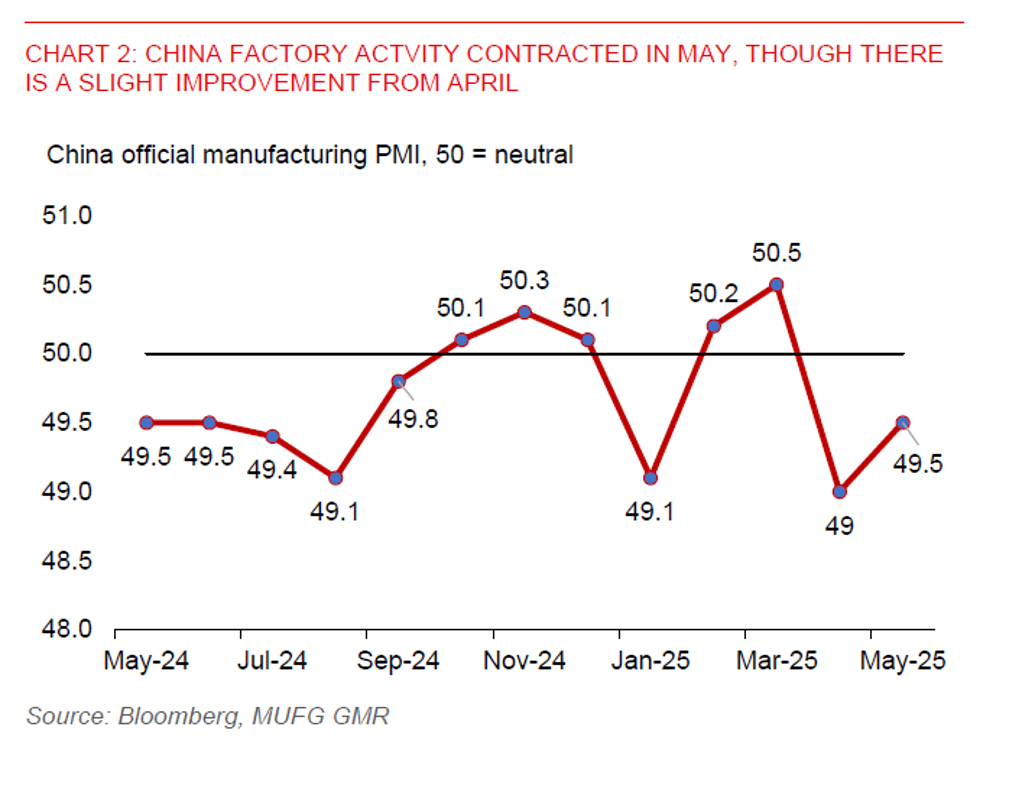

Heightened economic policy uncertainty in the US has weighed on consumer confidence. The University of Michigan consumer sentiment index stayed at 52.2 in May, unchanged from April and marking the lowest level since August 2022. Meanwhile, personal income rose 0.8%mom in April from 0.7%mom in March, beating the 0.3% estimate. However, personal spending slowed to 0.2%mom from 0.7%mom in March. The inflation-adjusted personal spending also slowed to 0.1%mom from 0.7%mom in March. While strong growth in personal income bodes well for the US consumers, they have become more cautious about spending.

In addition, US inflation remained relatively contained in April. US core PCE rose just 0.1%mom in April, unchanged from March and in line with market expectations. From a year ago, US core PCE inflation eased to 2.5%yoy, from 2.7%yoy in March. However, inflation could start to rise over the coming months due to higher US tariffs. Soft monthly PCE reading from mid-2024 could also mathematically raise the year-on-year inflation comparison.

Regarding US-China relations, Trump said China had “totally violated” the agreement. His tone suggests a tougher stance on trade enforcement going forward. This could be in relation to claims about China holding back some minerals it agreed to release during trade talks with the US.

Regional FX

Asian currencies have found support in a weaker US dollar in May. US-China tariff de-escalation has helped to shore up sentiment in the Asia region, while heightened risks from US trade and fiscal policies have remained a drag on the US dollar. The Bloomberg Asia Dollar index was up by 1.6% in May. Notable gains were seen in the TWD (+6.5%) and KRW (+2.9%) last month.

There seems to be no new macro developments supporting the US dollar for now, with markets still attaching a policy risk premium on the US dollar. The risk is that prolonged policy uncertainty in the US will hurt the US economy more leading to a weaker US dollar, despite the broad US dollar index (DXY) already down by about 8.4% so far this year.

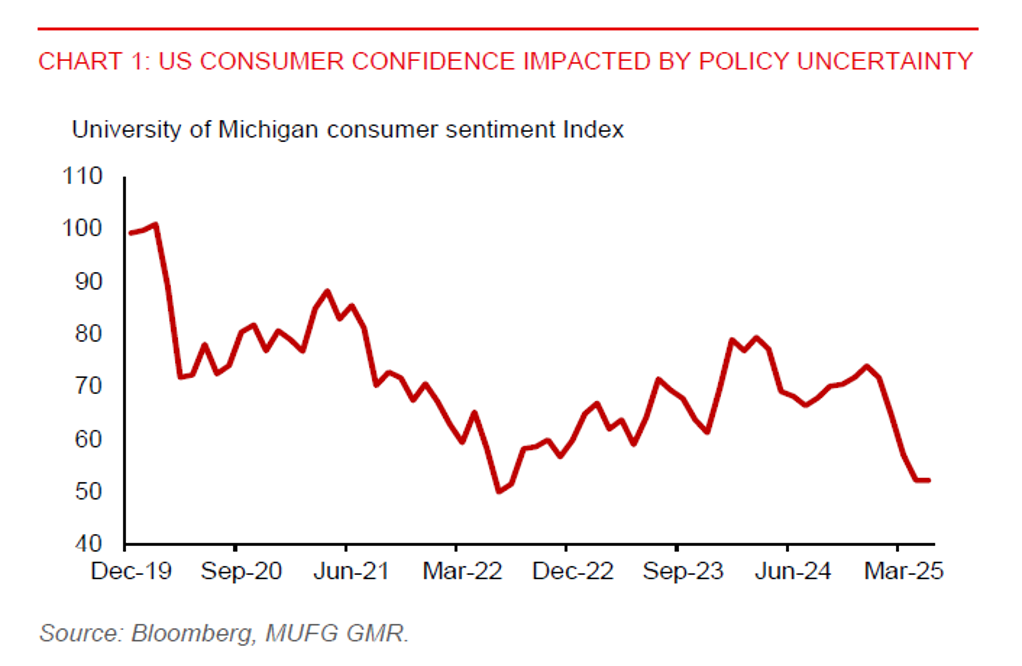

Meanwhile, China’s NBS manufacturing PMI rose to 49.5 in May, from 49.0 in April and in line with market estimates. But it remained below the 50-level, indicating contraction for a second straight month. The PMI sub-indices for new orders, raw material inventories, and employment have all remained in contraction territory, though there are signs of slight improvement.

India’s GDP rose 7.4%yoy in January-March, up from 6.4%yoy in October-December and beating the 6.8% estimates. However, RBI could still cut rates by another 25bps on 6 June amid below-target inflation, bringing the repo rate to 5.75%.

Thailand’s merchandise import rose 17.4%yoy in April, outpacing export growth of 9.9%yoy (slowing from 17.7%yoy in March). This led to the monthly trade balance slipping into deficit of $1.4bn in April, reversing the $3.4bn surplus in March. The frontloading of exports to the US in Q1 could fade in the coming months as the US had imposed 10% baseline tariffs on Thailand in April.