Ahead Today

G3: US CPI

Asia: China Press Conference on 15th Five Year Plan

Market Highlights

China released a high-level communique of the draft 15th Five-Year Plan after the end of the Fourth Plenum yesterday. The broad messages were quite similar to the past Five-Year Plan, with an emphasis on building a modern industrial system while supporting the real economy, accelerating technology self-reliance and achieving major progress on this front, building a strong domestic market by supporting consumption and creating a unified national market among others, and enhance high-quality development. Overall, the key messages seem to be one of doubling down on the continued importance of manufacturing, innovation and technological self-reliance, while at the same time shifting to higher quality growth and domestic demand and consumption. Key for markets will also be the specific plans through which China will achieve these broad objectives, including the parts on consumption and demand shifts. The full plan will only be approved in March 2026, but we could get more clues on the specifics in the press conference later today and also in subsequent weeks.

While these plans from China seemed supportive for CNY, Asia FX was also weighed down by other factors such as the Trump Administration’s moves to sanction Russia’s key oil companies Rosneft and Lukoil, and with Brent oil prices jumping up above US$65/bbl. There was some uncertainty and lack of clarity around how exactly these sanctions could be enforced for non-US persons, and the language included in the US Treasury release was quite vague on that front. Nonetheless, this uncertainty in itself could result in at least some near-term impact. News reports including by BBG and Reuters suggest the likes of Indian refiners and also China’s state-owned oil companies are likely to pull back from purchasing oil directly from these Russian oil companies, although in the case of China the smaller “tea-pot” refiners are likely to be less fazed by this.

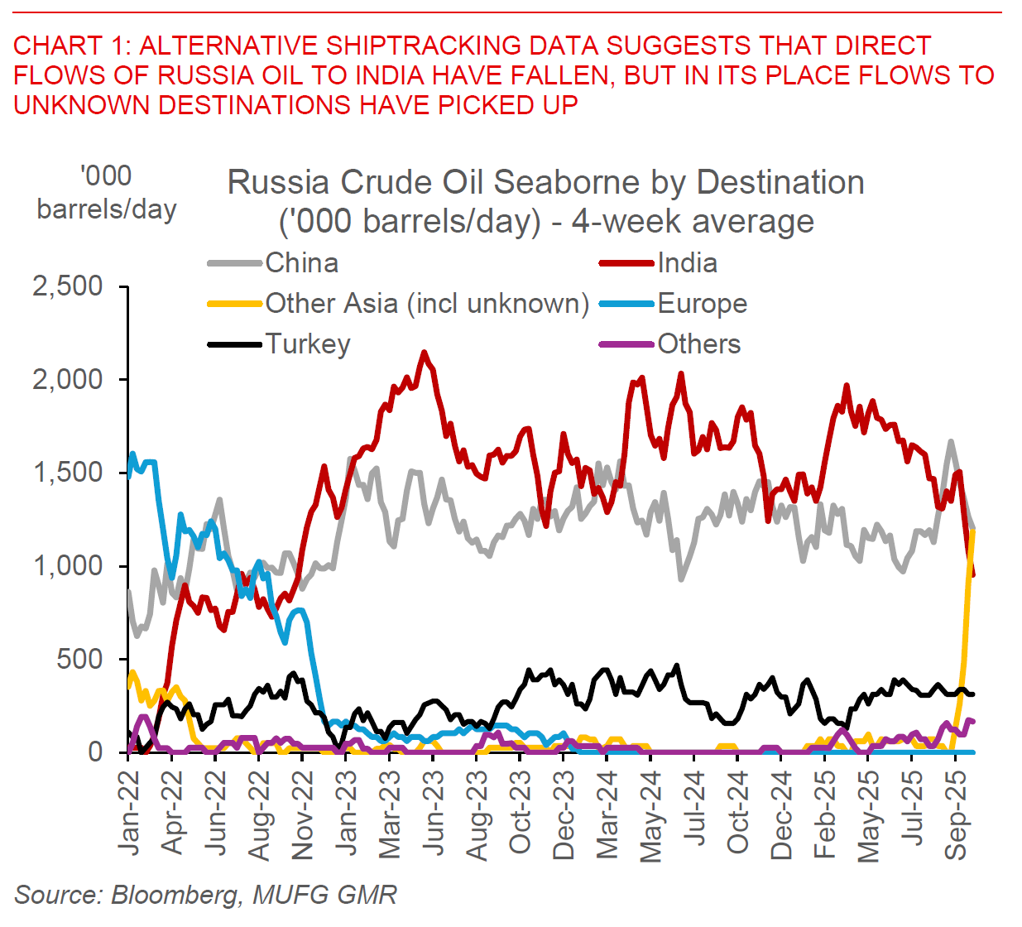

From a macro perspective, our best sense is that the oil market is still very much oversupplied to begin with, with global inventories still high and rising with meaningful spare capacity in Saudi Arabia. In addition, while direct flows of Russia oil may come down, historically the markets have also shown that indirect and clandestine flows could pickup as well. As an example, alternative shiptracking data shows that India could have been reducing purchases of oil directly from Russia, but the flows to “unknown destinations” and “other Asia” have also surged correspondingly. As such the net impact to the oil market could be far less what news headlines suggest, although it is no doubt a key risk to monitor moving forward.

Our previous sensitivity analysis on the impact of higher oil prices on Asia FX are still relevant, even if written for a different event (see Asia – impact of oil price shock). The likes of PHP, KRW, THB, and to some extent INR are more vulnerable to oil price spikes. Conversely MYR, TWD and CNY should be more resilient, all things equal.

Meanwhile, the Bank of Korea kept rates on hold at 2.50%, with the tone less dovish than before while keeping the easing bias still intact directionally. There were 4 out of 6 members open to a rate cut over the next 3 months, compared with 5 in the last policy meeting in August. Key considerations for the BOK include the acceleration in housing prices and with that the impact to financial stability and household debt, together with FX volatility in USD/KRW in part driven by questions around details of the US$350bn investment pledge between South Korea and the Trump administration. BOK Governor Rhee mentioned it is too early to say if a cut is possible in the November meeting, but continued to highlight weakness in domestic demand is also a key consideration. Overall, we continue to see the BOK cutting rates through 2026, but the effectiveness of the government’s recent housing cooling measures will also be key on the timing and pace of rate cuts.