Ahead Today

G3: BOJ policy meeting, Euro area consumer confidence, US Richmond Fed manufacturing index

Asia: Singapore CPI inflation, Taiwan industrial production

Market Highlights

Markets will focus on the Bank of Japan (BOJ)’s interest rate decision that will be out today, including the BOJ’s outlook for growth and inflation. Market consensus and our expectation are for no major changes to BOJ’s negative policy rate and yield curve control policy, particularly following the recent earthquake. The yen has weakened nearly 5% versus the US dollar since the start of the year to trade near its year-to-date low of 148.80. Other central banks that are meeting this week include the Bank of Canada (Wednesday), Bank Negara Malaysia (Wednesday), and the ECB (Thursday).

Meanwhile, markets have dialed back their expectations of an early Fed rate cut after several Fed officials signaled last week that there is no rush to ease monetary policy. The odds of a Fed rate cut in March has fallen to 40%, from about 66% a week ago. Markets will be watching the US Q4 advance GDP estimates this Thursday as they reassess their outlook for the path of US monetary policy.

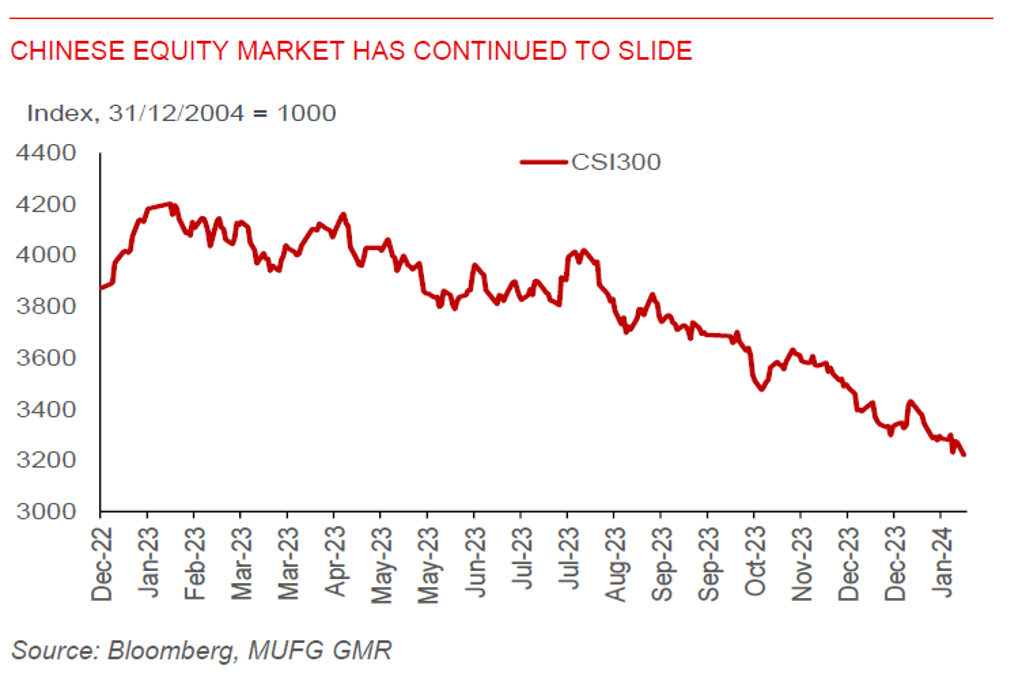

Meanwhile, market sentiment towards the Chinese equity market has continued to deteriorate amid a lack of major policy stimulus from Chinese authorities. The 1-year loan prime rate (LPR) and the 5-year LPR were left unchanged at 3.45% and 4.2% respectively. This followed the PBOC’s decision last week to keep the 1-year medium term lending facility (MLF) rate at 2.5%. The Shanghai stock exchange index has slumped about 7% year-to-date, nearing the low seen in March 2020. China’s premier has called for more measures to stop the stock market slide.

Regional FX

Southeast Asian currencies have been generally weaker versus the US dollar. But CNH and KRW were relatively flat, while the TWD gained 0.8%. Taiwan’s export orders fell 16% y/y, much worse than market consensus, suggesting the road to recovery for the semiconductor industry may be a bumpy one. Markets will focus on industry production data in Taiwan today to further gauge the extent of the chip recovery. Meanwhile, market consensus is for the BNM to hold rates at 3% tomorrow. Malaysia’s December inflation of 1.5% y/y is less of a worry, while GDP growth in Q4 is likely weaker than market expectation.