Ahead Today

G3: US mortgage applications

Asia: Bank Indonesia policy rate decision

Market Highlights

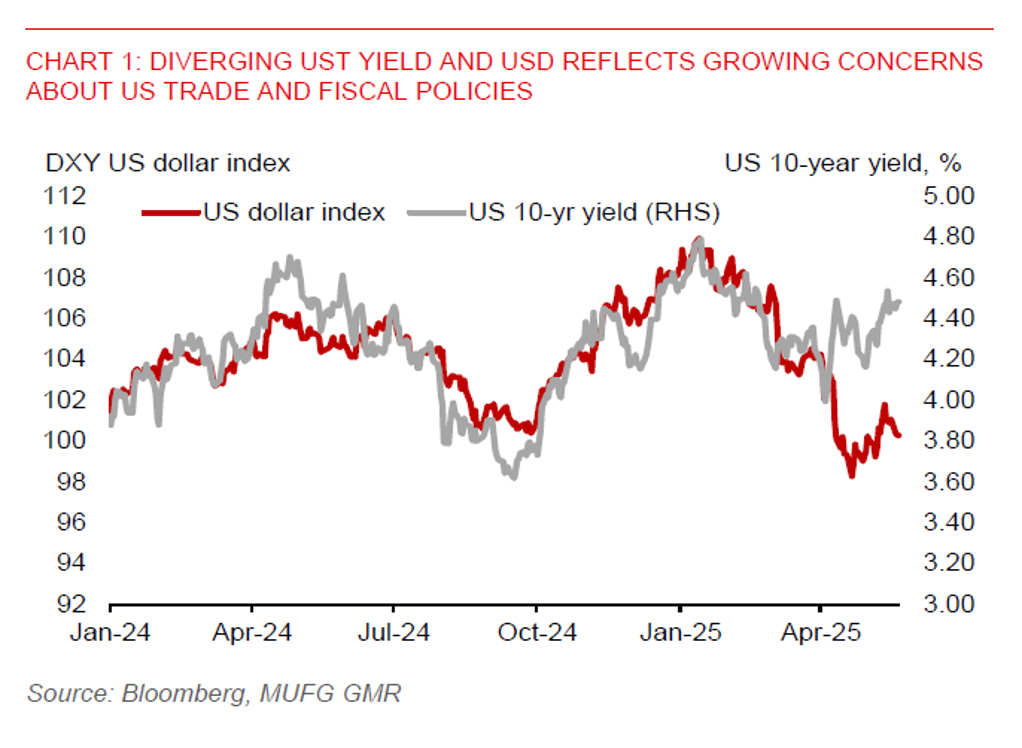

The US dollar has continued to weaken, while long-term US Treasuries have sold off, with the 10-yr yield rising about 4bps, 20-year up 6bps, and the 30-yr higher by 7bps yesterday. This has led to a further bear-steepening of the yield curve, possibly reflecting concerns about the fiscal outlook and higher inflation. There is possibly fading market confidence towards US trade and fiscal policies. Moody’s downgrade of US credit rating by 1 notch to Aa1 last week has also remained an overhang.

Meanwhile, Japan’s 10-year yield rose to 1.50%, reaching the highest level since 28 March. This follows from lackluster demand for the 20-year bond auction, where demand fell to the lowest since August 2012. Notably, Japan's 30-year bond yield jumped to 3.1%, reaching the highest level since 1999. Nonetheless, the yen appears to be stronger versus the US dollar than suggested by its yield differentials with the US.

In terms of Fed speak, Fed’s Musalem has said tariffs will weigh on growth and employment, even after the de-escalation of US-China tariffs on 12 May. He thinks the Fed should prioritize containing inflation, helping to anchor inflation expectations.

Regional FX

CNH was flat versus the US dollar yesterday. There is no surprise in markets about the 10bps cut to the 1-year and 5-year loan prime rates yesterday, which followed from the 10bps cut to the official 7-day reverse repo rate on 8 May. Other regional currencies were range-bound, except for the TWD (-0.3) and KRW (-0.3), which gave up some of their recent gains.

The key highlight today is Bank Indonesia’s policy rate decision. We look for BI to cut the policy rate by 25bps to 5.50%, as recent rupiah strength versus the US dollar should provide the room to resume policy easing today. BI could also cite the need to support growth. Indeed, Indonesia’s economy slowed in Q1, with real GDP growth slowing to 4.87%yoy from 5.02%yoy in Q4 2024. A key drag on growth was from fixed investment, which slowed to 2.1%yoy in Q1 from 5.0% in Q4 2024. Meanwhile, inflation has been well contained, with core inflation steadying at 2.5%yoy in April, staying at the mid-point of Bank Indonesia’s 1.5%-3.5% inflation target range.