Ahead Today

G3: Fed Chair Powell Jackson Hole Speech

Asia: Malaysia CPI, Taiwan Unemployment Rate

Market Highlights

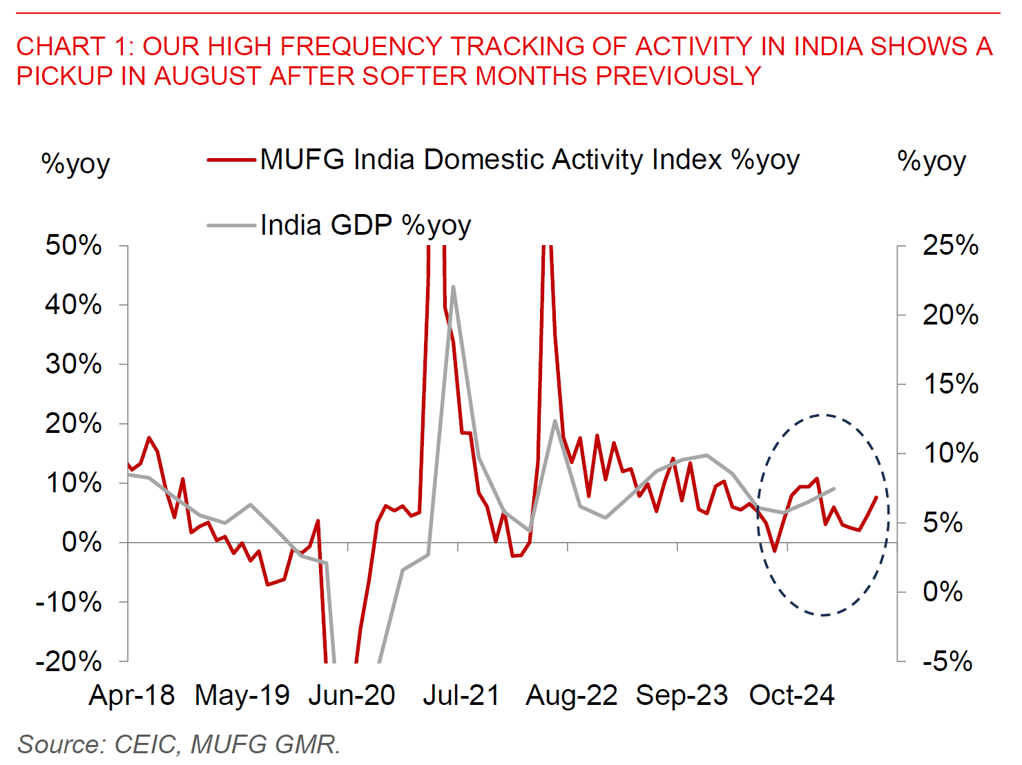

The macro data out overnight generally pointed to somewhat better demand conditions, although this was also combined by some softening in the US labour market and also rising price pressures. The S&P US Manufacturing PMI rose to 53.3 from 49.8 previously, with the prices paid sub-component rising at the highest rate since January 2023, with companies reporting that tariffs were the key driver. Meanwhile, Eurozone manufacturing PMIs were also firmer, perhaps overall reflecting some near-term reduction in tariff and trade uncertainty due to the announcement of trade deals, even as the absolute level of uncertainty remains high. The data out of Asia yesterday showed an impressive pickup in India’s PMI with the services subcomponent rising for instance to 65.6 from 60.5. Our high frequency tracking of domestic activity in India shows some improvement in August activity, helped by better rural consumption and investment activity, even if we stress that the increase has come from softer levels in previous months and there is of course still the uncertainty of tariffs for India.

Overall, markets will look closely at Chair Powell’s Jackson Hole speech out later tonight. We expect some modest dovish tilt but certainly not a 180 degrees about-face turn in terms of tone, given the continued uncertainty around tariff impact on inflation.

Across Asia, a variety of governments face the difficulty of placating the Trump administration and fulfilling deals in order to maintain lower tariff rates. For one, Taiwan has proposed stepping up defence spending next year, for a military budget of US$31bn, a nearly 23% increase from outlays the previous year. This would raise defence spending to 3.3% of GDP, up from the 3% of GDP target earlier in February. Meanwhile, South Korea President Lee Jae Myung will meet US President Trump next week in a meaningful first test of the South Korean leader’s presidency. The announced pledges of US$350bn in terms of investment will likely also involve the large South Korean conglomerates, with details and implementation still unclear, although the prize is to secure and cement lower auto tariffs for the country. Meanwhile, as Japan’s Prime Minister Ishiba has said, “agreeing is easier than implementing”, and certainly the details will matter for many Asian economies, including on how the so-called transshipment tariffs are eventually implemented.