Ahead Today

G3: US PPI, initial jobless claims; euro area Q2 GDP, France CPI

Asia: India exports

Market Highlights

US Treasury Secretary Scott Bessent has suggested that the fed funds rate should be 150–175 basis points lower than current levels. He also suggested the likelihood of a resumption of Fed rate cuts, starting with a potential 50bps reduction in September. Bessent’s latest remarks underscore the ongoing tension between President Trump’s push for more aggressive easing and the Fed’s cautious policy stance. In a notable development, Bessent also revealed that the Trump administration is considering about 10 candidates to replace Fed Chair Jerome Powell when Powell’s term ends in May 2026. This will include individuals from the private sector. The search process has reportedly begun, with Fed Governor Waller already interviewed for the role.

Markets have now fully priced in a rate cut for September, with growing speculation around a larger 50bps move. US Treasury yields declined across the curve, with both the 2-year and 10-year yields falling more than 6bps. The DXY US dollar index dropped 0.4%, extending its decline following the US CPI print.

Meanwhile, the Japanese yen remains supported amid narrowing yield differentials. The decline in US 10-year yield has helped supported the yen, as 10-year JGB yields remain around the 1.50% level. The latest 5-year JGB auction also saw a bid-to-cover ratio of just 2.96, which is below the previous auction’s 3.54 and the 12-month average of 3.7. This suggests moderating demand. The 5-year JGB yield remains above 1%, providing support for the yen in the near term.

Regional FX

Asian currencies have broadly appreciated against the US dollar, with high-yielding currencies such as the Indonesian rupiah (IDR) and Philippine peso (PHP) leading the gains in the region, both strengthening by 0.6%. The Malaysian ringgit (MYR) also posted a 0.6% gain against the dollar.

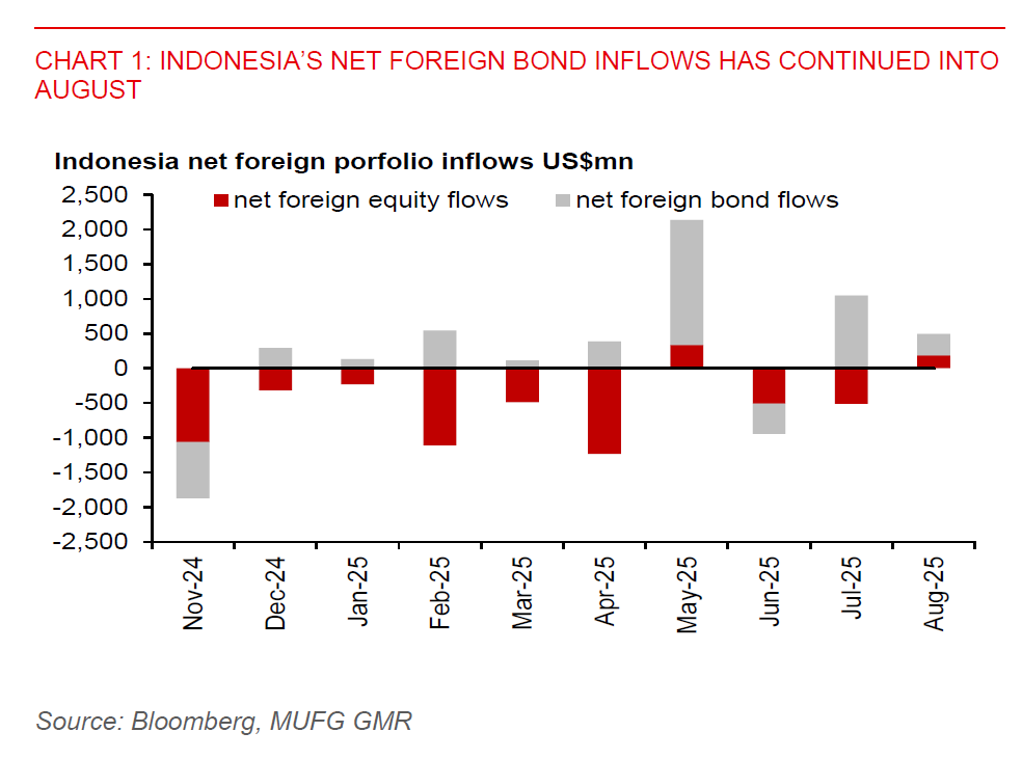

We remain constructive on the outlook for the rupiah, supported by a resumption of net foreign inflows into Indonesian government bonds. In July, net inflows reached about US$1 billion, reversing the net outflow of US$0.4 billion recorded in June. This positive momentum has continued into August, with month-to-date inflows totalling US$0.3 billion. Investor demand remains robust, as evidenced by the newly issued 5-year local government bond, which attracted a bid-to-target ratio exceeding 6 times, the highest level since October 2021.

Meanwhile, the Bank of Thailand (BoT) cut its benchmark policy rate by 25bps to 1.50% in August, in line with our and market expectations. We anticipate the terminal rate for this easing cycle to be 1.00%, implying further 25bps cuts in Q4 2025 and Q1 2026. Headline inflation remains in negative territory, credit growth has been subdued, and downside risks to economic growth persist, amid higher US tariffs. The Thai baht showed limited reaction to the widely expected rate cut. Looking ahead, the outlook for the baht remains mixed. While potential Fed rate cuts in September could support appreciation, further BoT easing is likely to offset these gains, keeping the currency stable in the near term.