Ahead Today

G3: ADP employment change, US Q1 GDP, US personal income and spending, EU Q1 GDP, Japan industrial production

Asia: Philippines trade, China PMI, Bank of Thailand policy rate decision, Taiwan Q1 GDP

Market Highlights

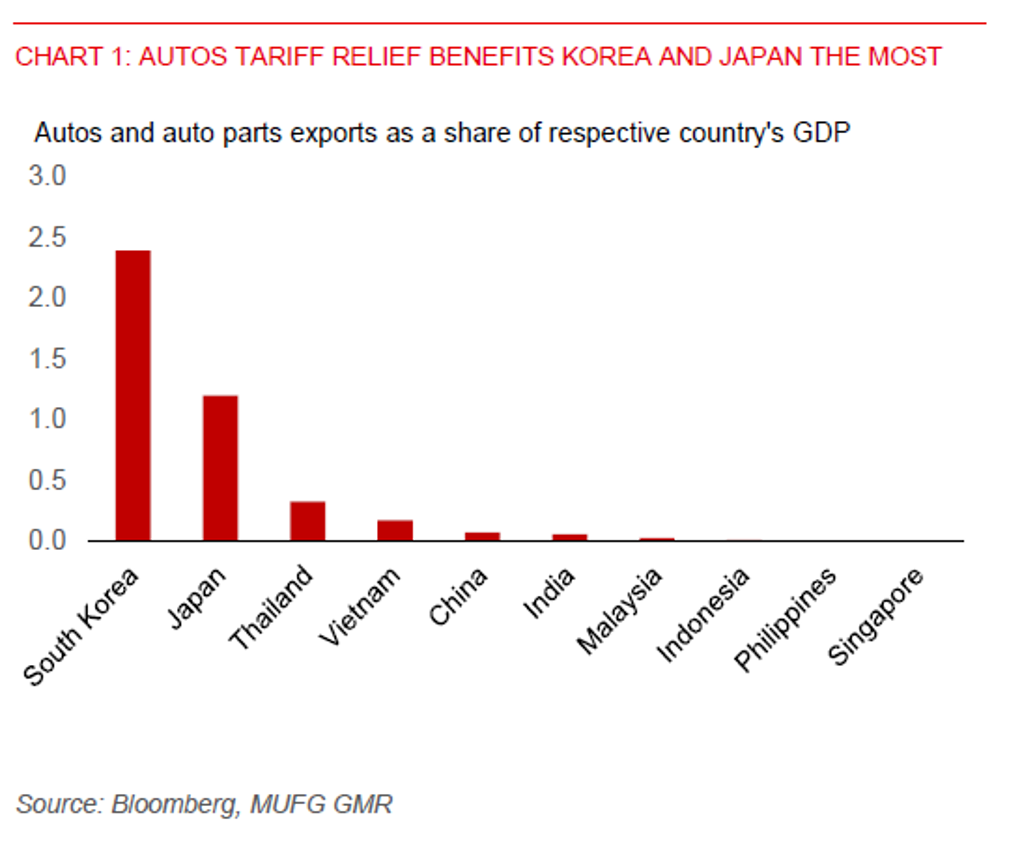

Market sentiment in the Asia region has improved, as US President Trump prepares to ease tariffs on auto parts and give imported vehicles a reprieve from separate levies on steel and aluminium. This will provide the biggest relief for South Korea and Japan in the Asia region, given their larger exposure to the US of auto exports. This latest tariff easing move has added to signs that Trump could look to pare back some of his import tariffs.

Meanwhile, bilateral trade negotiations between several Asian countries and the US have appeared to make some progress, including that for Singapore, Malaysia, South Korea, and India. Asian countries, except China, have chosen to negotiate with the US, rather than retaliating. The latest news from US Commerce Secretary Howard Lutnick is that the US is close to concluding a tariff deal. Trump has also commented that “India’s coming along great”.

Tariffs are starting to have some negative impact on the US economy. Ahead of the nonfarm payrolls data later this week, the US has released the number of jobs openings in March. Job openings fell to 7.19mn, the lowest since September 2024. This reflects slowing labour demand, as firms have likely slowed hiring amid global trade uncertainties. The Conference Board consumer sentiment index fell to 86 in March from 93.9 in February, while the Dallas Fed services index also declined to -19.4 from -11.3 in March. We will have a first look of US Q1 GDP data later today. Bloomberg consensus expects flat quarter-on-quarter growth, slowing from 2.4%qoq growth in Q4 2024. The pricing for the April 2026 FOMC meeting one year from now is at 3.04%, which is about 126bps below current pricing. This implies 5 US rate cuts from the current 4.25%-4.50% range.

Regional FX

MYR (+0.8%), THB (+0.8%), and TWD (0.7%) have led gains against the US dollar in the Asia region. The KRW - a key beneficiary of auto tariff relief – has also strengthened, though by only 0.2% vs. the US dollar. A weaker US dollar, along with the market becoming more dovish on the US rates outlook, could provide some support for several Asian currencies.

The key highlight ahead is the Bank of Thailand policy rate decision. The earthquake in March is likely to pose an additional hit to Thailand’s economy via lower tourism inflows in the coming months. We look for the Bank of Thailand to shift to a dovish stance, lowering the policy rate by another 25bps to 1.75% at the policy meeting later to provide support for growth. Moreover, Thailand’s headline and core inflation has been lackluster.