Ahead Today

G3: US ADP Employment Change

Asia: Hong Kong Retail Sales

Market Highlights

Global markets including in Asia continued to be affected by the key themes of deficits and deals, with the focus on the progress Trump’s tax bill and also the upcoming 9 July Reciprocal tariff deadline. On the tax bill, the Senate version passed with Vice President JD Vance casting the tie-breaking vote, but it now heads to the House of Representatives where there is opposition from the key moderate and ultra-conservative Republican lawmakers on the Senate version of the bill. Several of these concerns are somewhat conflicting as well, for instance on the cuts to Medicaid and the size of the deficit. Beyond the minute, the big picture is that deficits are likely to remain elevated, and as such tariffs are likely needed as a revenue source implying higher tariffs are likely here to stay. On the tariff front, President Trump said he is not considering delaying his 9 July deadline for higher tariffs to resume, and also renewed his threat to impose new tariffs on Japan after criticizing Japan’s stand on rice and autos. Meanwhile, Trump sounded more optimistic on reaching a trade deal with India, with India’s External Affairs Jaishankar saying that a deal will require “give and take” and finding a “meeting ground” ahead of the 9 July deadline.

Regional FX

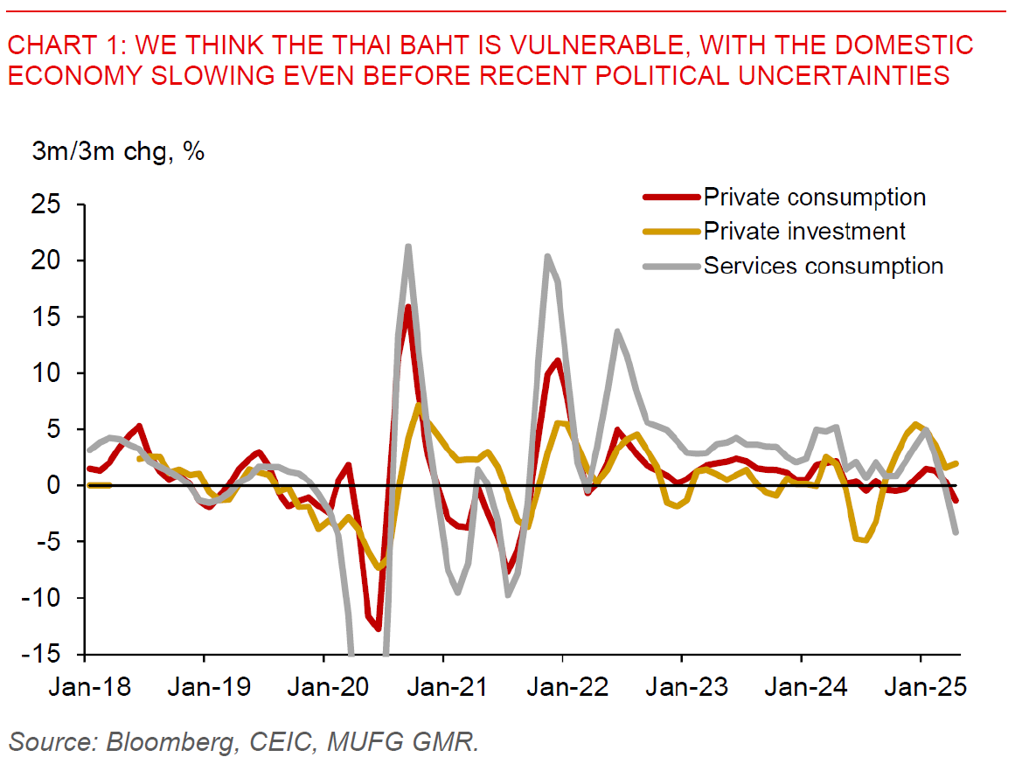

Across Asia, Asian currencies generally followed the weaker Dollar trend, with the Taiwan Dollar remaining very volatile this week. According to a variety of news reports, there could have been reported central bank FX intervention to buy Dollars to prevent Taiwan Dollar strength around the 29.00 levels, with USD/TWD rising to slightly below the 30.00 levels, before strengthening sharply by more than 2% to 29.170 levels as we speak. Meanwhile, Thailand’s Constitutional Court suspended Prime Minister Paetongtarn Shinawatra from office temporarily, until it rules on a petition seeking her permanent removal over alleged ethical misconduct. While the court set no deadline to adjudicate the petition, it gave Paetongtarn 15 days to respond to the allegations, with the deputy prime minister will be the acting leader in the interim. The key transmission mechanism from an economy perspective will come from a delay in passage of the budget, which could lead to lower fiscal support and hence slow growth moving forward, and also coming at the time of significant uncertainty around possible tariffs from the US. A left tail risk would be a fall of the current Thai government and dissolution of parliament leading to fresh elections, perhaps also catalysed by more meaningful protests. While this is not our base case, we continue to think Thai Baht will underperform moving forward (see Thai baht vulnerable as growth slows and multiple risks loom).