Ahead Today

G3: US Personal Income, US Personal Spending

Asia: Philippines Trade deficit, China industrial profits

Market Highlights

The big market development was the sharp US Dollar weakness and Asia currency strength, which started from Asia time yesterday and continued into the London session, before paring back somewhat during the US session. One key driver was a Wall Street Journal article highlighting that President Trump may select and announce Powell’s replacement by September or October 2025, much earlier Fed Chair Powell’s end of term in May 2026, and as such raising market concerns around the possible impact to Fed independence and also the prospects for future Fed rate cuts. More generally even putting aside the issue of the change in Fed chair, there have been growing signs of disagreement in the FOMC on the likelihood of a July rate cut which started from Governor Christopher Waller, followed by a change in tone from Governor Michelle Bowman. While other Fed speakers overnight such as Mary Daly and Susan Collins still struck a cautious tone on near-term rate cuts in July, Mary Daly said a rate cut may be likely in the fall if tariffs do not lead to a large or sustained inflation surge.

Regional FX

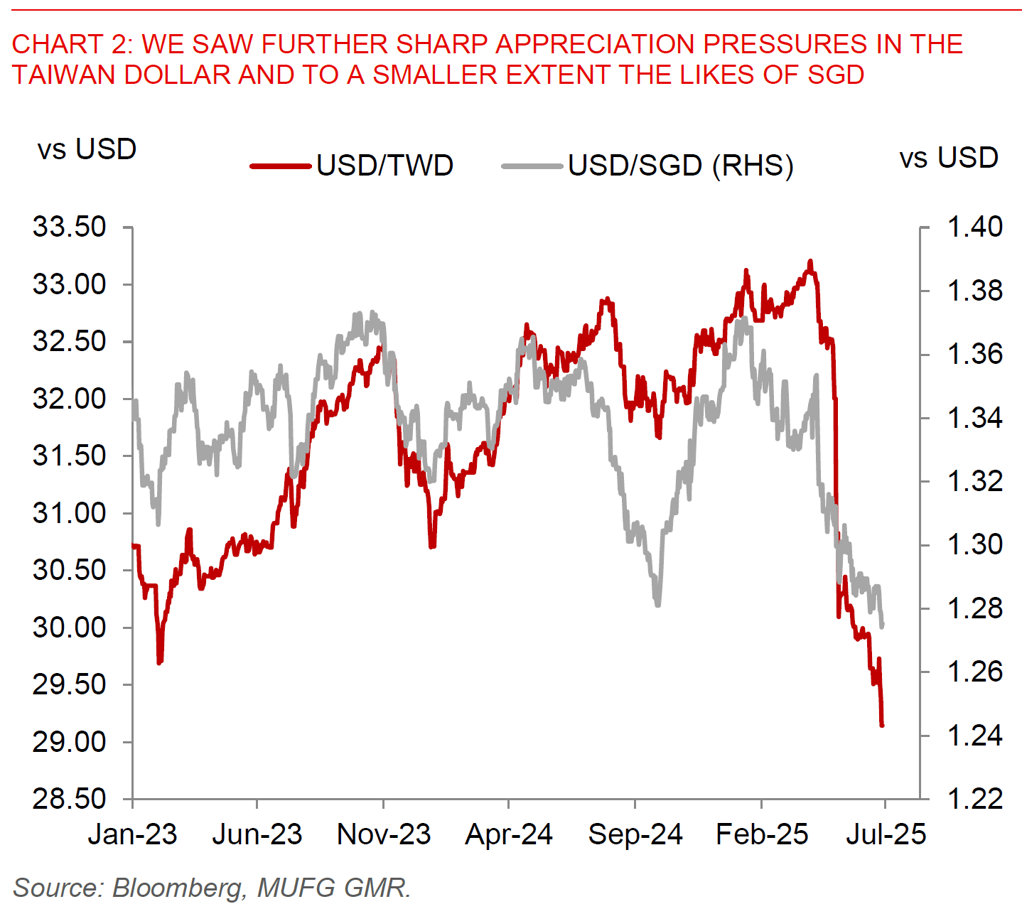

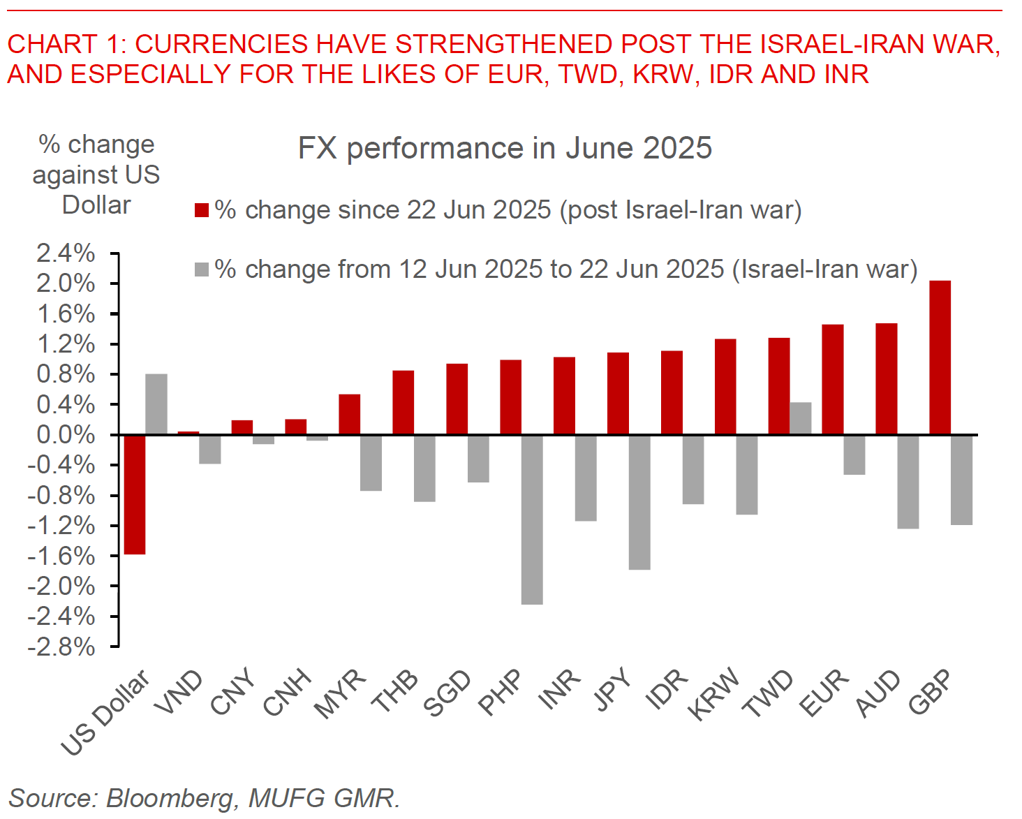

Across Asia, the bigger FX movers and outperformers not just on the back of these developments but also more generally since the Israel-Iran war include the likes of TWD and EUR, together with some partial catch-up in FX performance for the likes of oil-sensitive currencies such as INR, PHP, THB and KRW. For TWD in particular, these FX moves also come on the back of news that Taiwan life insurers’ foreign exchange losses more than doubled to US$9.1bn from January through May, from less than US$4bn from January through April. While the Taiwanese regulator has been providing life insurers more flexibility in using their reserves to reduce the impact of sudden swings in the currency, with the central bank also trying to manage the pace of FX appreciation by more closely scrutinising FX inflows and conversion, further sharp appreciation moves in the Taiwan dollar could raise some further concerns in this life insurance sector even as we do not think it is a solvency issue. The bigger macro picture in Taiwan from our perspective is that while exports are incredibly strong today due to the AI boom, moving forward the combination of semiconductor tariffs coupled with the fading of front-loading of exports should directionally imply a weaker TWD.

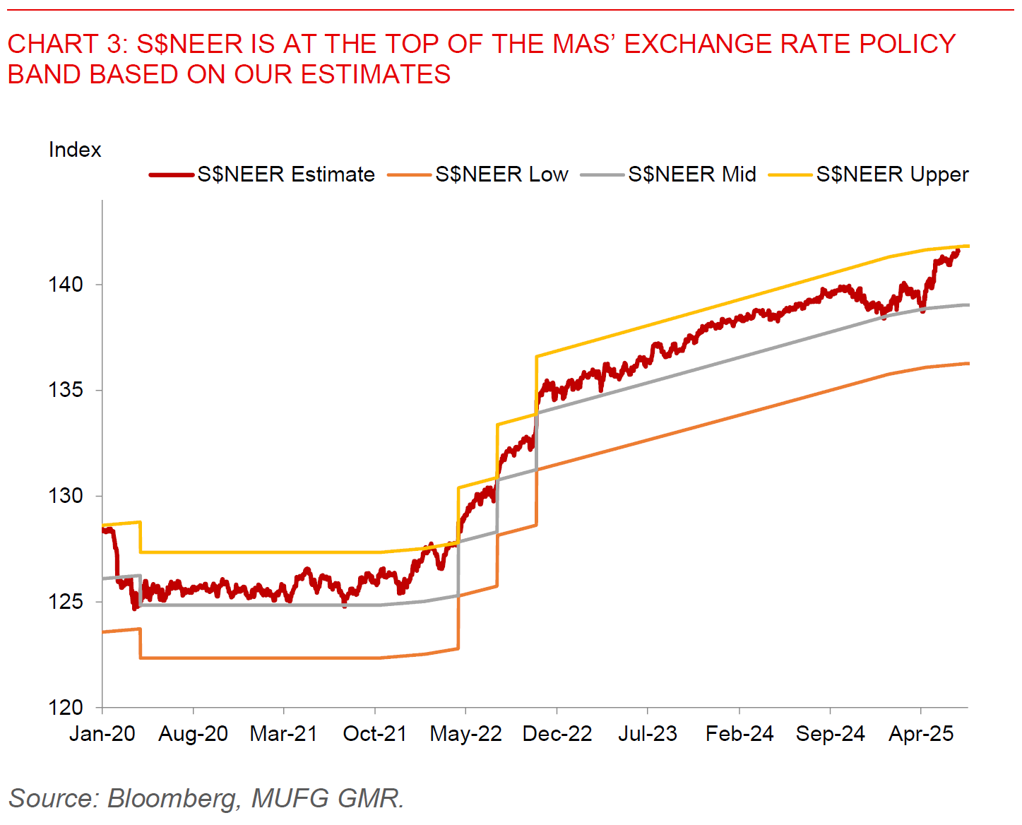

For USD/SGD, we estimate that the MAS S$NEER is very close to the top of the MAS exchange rate policy band, and as such, moving forward the pace of SGD appreciation against the basket may be more constrained absent a exchange policy move by the MAS. From our perspective, and from a fundamental perspective, Singapore’s inflation is low and manageable, while growth is expected to soften moving forward due to the lagged impact of tariffs. As such, SGD may look somewhat too strong within the context of the FX policy band.