Market Highlights

Brent oil prices rose above $90/bbl as both Saudi Arabia and Russia extended their supply cuts to year-end. Saudi Arabia will continue its 1 million barrels/day cuts for the next 3 months, above consensus expectations for a one-month cutback. Meanwhile, Russia’s export reduction of 300,000 barrels/day was also extended for 3 months. All this comes as increased oil supply from sanctioned countries such as Iran and Venezuela have been offset by strong oil demand and declining oil inventories, renewing concerns about the implications for inflation globally.

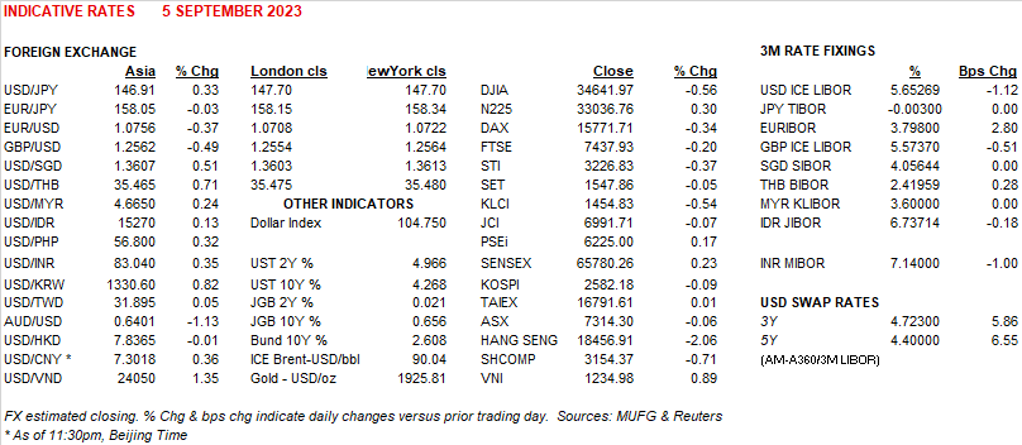

The Dollar strengthened meaningfully by 0.5% amidst the pickup in oil prices. The move was less so about the Fed, but more so about weak Chinese and European growth. Europe’s Services PMI numbers were revised down further into contractionary territory to 47.9, while China’s Caixin Services PMI disappointed consensus at 51.8. Meanwhile, Fed Governor Christopher Waller, a very well-respected hawk signalled support for a near-term pause in the September meeting. AUD was the key underperformer, with RBA pausing and also signaling concerns over Chinese growth.

The most crucial datapoint today will be the US ISM Services PMI together with the Prices Paid component, which has a good leading relationship with inflation. This also comes on the back of recent ISM Manufacturing data which showed a slight uptick in price pressures.

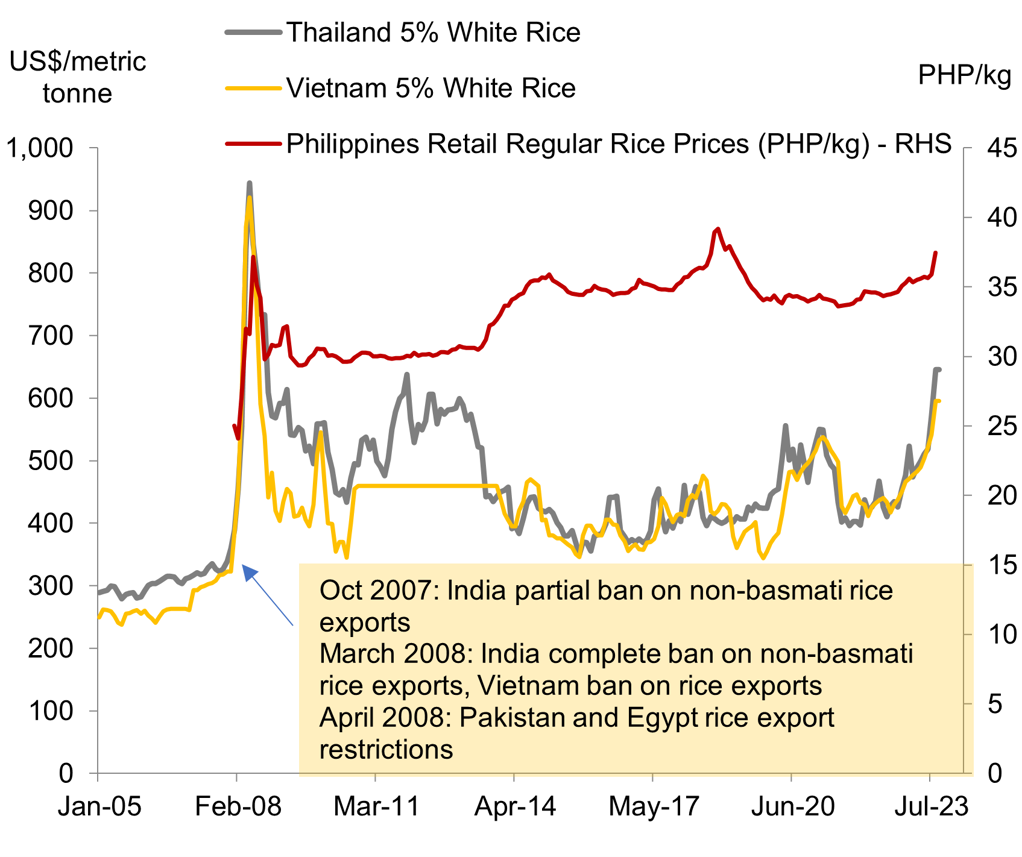

RICE PRICES HAVE SURGED GLOBALLY AND IN THE PHILIPPINES

Regional FX

The confluence of higher oil prices, disappointing Chinese growth, and a stronger Dollar all conspired to push USDAsia higher yesterday. Most Asian economies are net oil and gas importers, with the exception of Malaysia, and this has added to worries both from a inflation and current account perspectives. KRW fell by 1%, while current account deficit countries such as INR and PHP also declined by 0.4%. The Philippines CPI out yesterday was emblematic of some of the risks surrounding Asian inflation moving forward. Philippines headline inflation surprised meaningfully to the upside at 5.3%yoy (vs consensus for 4.7%yoy rise). The bulk of this was driven by a 4% surge in domestic rice prices, coupled with increases in oil prices. While core inflation pressure was quite contained, the rice export restrictions by India have raised upside risks for global rice and food prices.