Ahead Today

G3: Eurozone Services PMI, US JOLTS Job Openings, US Durable Goods

Asia: HSBC India PMI, RatingDog China PMI Services

Market Highlights

Global markets started the post summer break lull with a combination of a stronger Dollar, weaker Japanese Yen, a resumption of a rise in long-dated bond yields, and to top that up a surge in gold prices as markets turned more risk-off and sought alternative safe havens.

There were several key catalysts for these moves. On the Japan side, a non-committal message from Bank of Japan Deputy Governor Ryozo Himino on the timing of the next rate hikes led to a renewed bout of JPY selling, with Himino saying that BOJ must avoid being too early or falling behind in rate hikes as there are both upside and downside risks for the economy and inflation. Meanwhile, political risks in Japan and the potential for an early election also contributed to these moves, with LDP Secretary-General Hiroshi Moriyama saying he will quit if Prime Minister Ishiba approves, with local media reporting several other key LDP members plan to resign.

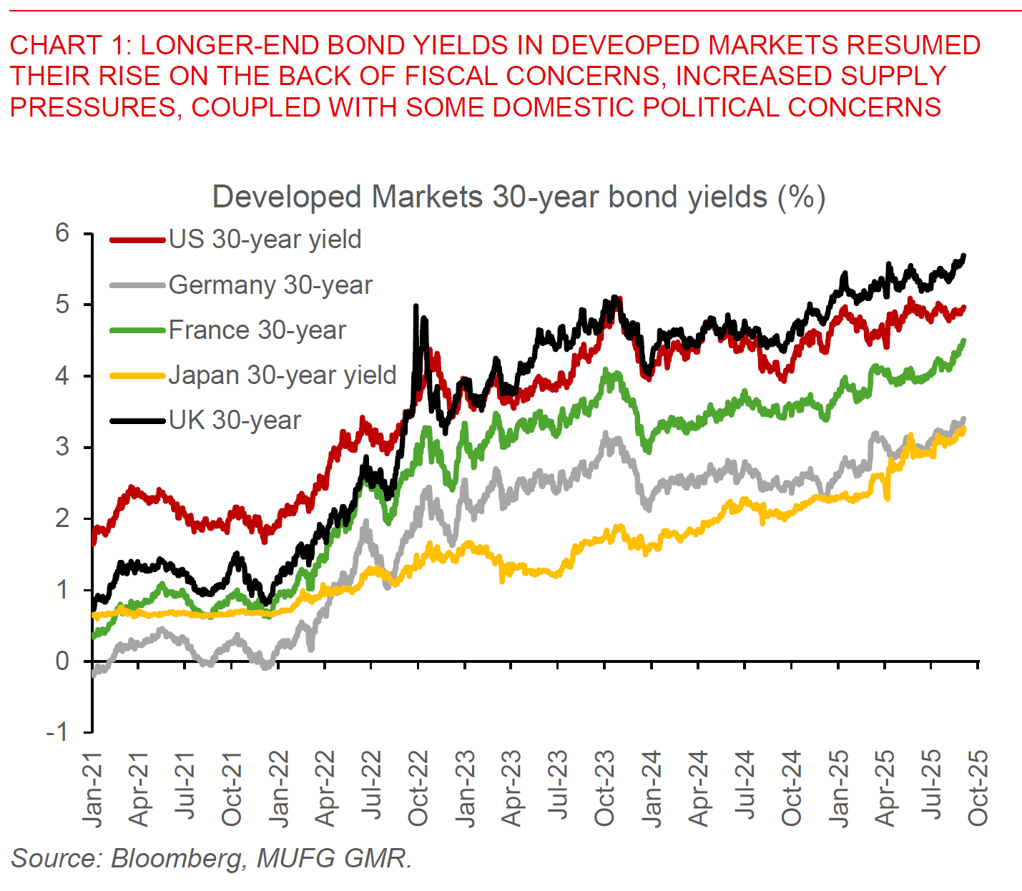

Outside of Japan, the key development was the resumption in longer-end bond yield sell-off globally, including in the US Treasury yield curve. This was perhaps in part catalysed in the near-term by rising supply pressures, with at least 28 issuers in Europe seeking to raise at least US$58bn, but offset on the demand side by seemingly strong bids, with the UK also raising US$18bn from a 10-year Gilt syndication - its biggest on record - coupled with quite a good auction in Japan as well. The broader picture is one of continued fiscal concerns for key developed markets, a shift in demand away from ultra-long dated paper including by insurers and lifers, coupled with some political risk at the margin in the likes of France.

All these also had some impact from an FX perspective, with the Dollar strengthening as we started the week with some risk-off moves, but interestingly gold has continued to do very well, rising above its previous record levels now above US$3500/ounce as investors sought alternative safe havens. It’s important to also view FX a relative asset class – not just money relative to each other (for instance the dollar versus CNY, and with that the price of money in part through interest rates differentials), but also money relative to other assets including real assets such as gold, bitcoin and real estate. On that front the big macro drivers of central bank reserve diversification, concerns over Fed independence, and reduction in overweights in US assets, global rise in debt, and the tipping point and acceleration in the changing global world order among others should continue to argue for better performance moving forward in alternative safe havens and real assets such as gold.