Ahead Today

G3: Eurozone CPI

Asia: Malaysia GDP, Malaysia Trade

Market Highlights

US Treasury yields fell while the Dollar weakened, as emerging concerns of asset quality in the US credit market led to a sharp sell-off in some regional banks in the US, resulting in slightly softer risk sentiment overall. Of course, these credit issues are by no means systemic or correlated, but the emergence of several cases, including what we saw overnight in regional lenders with some US$60mn of funds financing purchase of distressed commercial mortgage loans, coupled with the blowup of subprime auto lender Tricolor Holdings and auto-parts supplier First Brands Group have certainly raised some eyebrows with credit spreads tight by historical standards. Fed Governor Waller also spoke yesterday, saying that the Fed could continue lowering interest rates by 25bps increments to support a softer labour market, but also cautioned that policymakers should do so carefully to avoid making a policy mistake given the current divergence between strong measured GDP growth and weaker labour market.

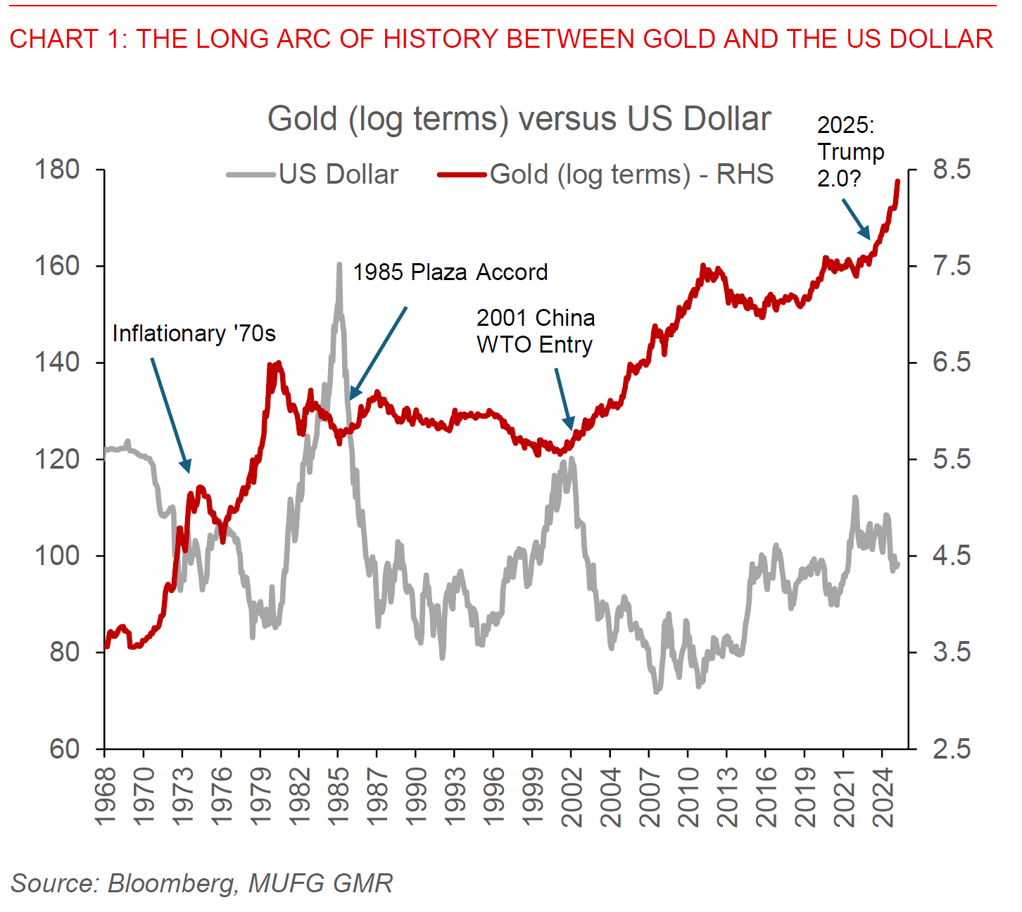

The bigger macro picture is also the sharp rise in gold prices, which doesn’t seem to have anything stopping its phenomenal increase for now. While it is unclear who exactly is buying gold and propping up prices, and importantly also why they are doing so, it is clear to our minds that we are certainly living in a potential period of momentous changes and tipping points. Throughout history, the last time gold prices started a meaningful bull run was in 2001 post the dot-com bust and also China’s WTO entry, and before that the inflationary 1970s and to a smaller extent post the 1985 Plaza Accord.

On that note, we continue to think that markets are underpricing the risk of an escalation in US-China trade tensions (at least a meaningful tactical one before longer-term de-escalation), which markets seem to be taking in their stride at the moment. Yesterday, China’s Commerce Minister Wang Wentao blamed the recent escalation in trade tensions with the US on restrictive measures against China after the Madrid talks, including the 50% affiliate rule by the BIS, with Minister Wang saying that the US measures “seriously harmed China’s interest and undermined the atmosphere of the bilateral economic and trade talks”. These comments come after US Treasury Secretary Scott Bessent mis-pronounced the name of China’s Vice Minister for Commerce and trade negotiator Li Chenggang in a media interview, called him “disrespectful” and “unhinged”, and said that he “may have gone rogue”, just to name a few. We think that the gulf in expectations between the US and China remains wide at the moment. In particular we see the export licensing control measures n rare earths and critical minerals by China as not subject to negotiation at all, given that the export controls are the means through which China can exert control and leverage especially on the US (see Spare the rod and spoil the child, Trump threatens 100% tariffs after China’s export controls and China significantly expands export controls on critical minerals).