Ahead Today

G3: US PPI, initial jobless claims

Asia: India exports

Market Highlights

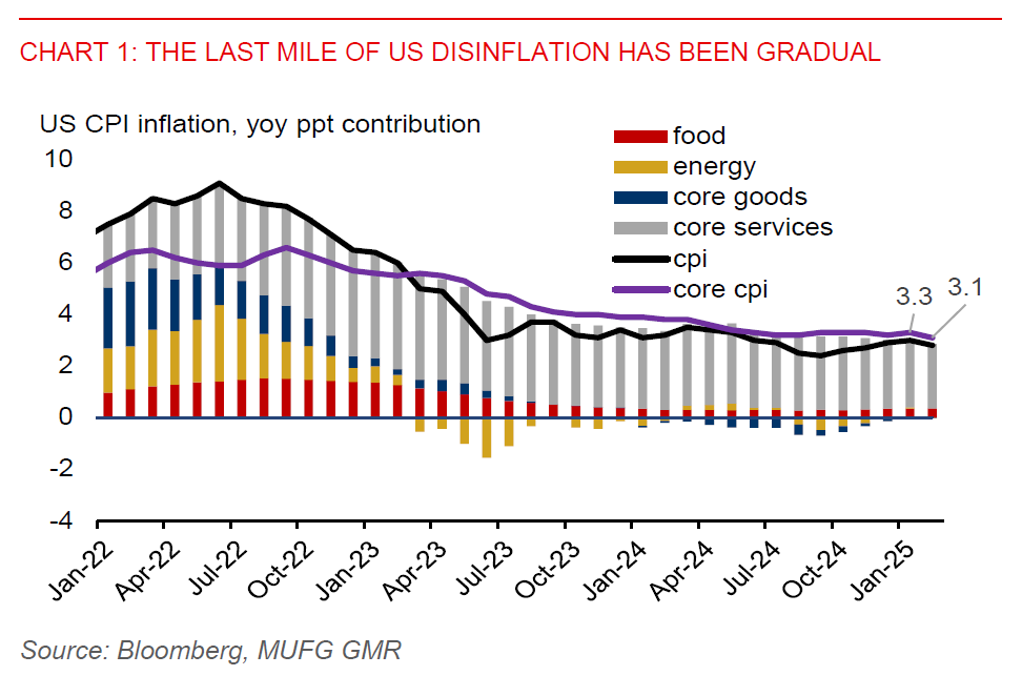

US disinflation has continued but at a gradual pace, while there is a risk that inflation could still pick up over the coming months due to tariff hikes. US headline CPI inflation slowed to 0.2%mom in February, from 0.5%mom in January, smaller than Bloomberg consensus of a 0.3% rise. Core inflation also slowed to 0.2%mom, from 0.4%mom in January. Notably, core services inflation was 0.3%mom, slowing from 0.5%mom in January, contributing just 0.15ppt to the month-on-month headline inflation rate. Contributions from core goods, food, and energy had also eased slightly. From a year ago, headline inflation was 2.8%yoy, down from 3%yoy in January, while core inflation was 3.1%yoy, down from 3.3%yoy in January.

The path to bringing down inflation to the 2% Fed target will likely be bumpy, as tariffs could drive up prices for a variety of goods. The Fed could remain patient with rate cuts while it seeks more clarity from Trump’s trade and fiscal policies. According to a recent speech by Fed Chair Powell, he thinks the costs of being cautious about policy rate cuts are very low. Markets have pared back some of their rate cut expectations, the 2-year and 10-year Treasury yields inched higher by about 3bps, while the broad US dollar index (DXY) has held steady in Wednesday’s session.

Regional FX

Asian currencies have broadly weakened against the US dollar in Wednesday’s session, with IDR, MYR, TWD, and PHP falling 0.2%-0.3%.

Notably, the rupiah has underperformed regional peers, down 0.9% against the US dollar so far this week. Domestic policy uncertainty has likely contributed to the rupiah weakness, stemming from the risk of further government debt monetization and lawmakers mulling to expand Bank Indonesia’s mandate. We maintain our outlook for the IDR to weaken towards the Covid peak of 16,625 level in Q2.

Meanwhile, India’s CPI inflation slowed to 3.6%yoy in February from 4.3%yoy in January, below the midpoint of the RBI’s 4% target. This provides room for the RBI to cut the policy rate further. In addition to that, India’s industrial production rose 5%yoy in January, from 3.2% increase in December.