Ahead Today

G3: US mortgage applications, empire manufacturing, Japan industrial production

Asia: China CPI and PPI, Philippines remittance

Market Highlights

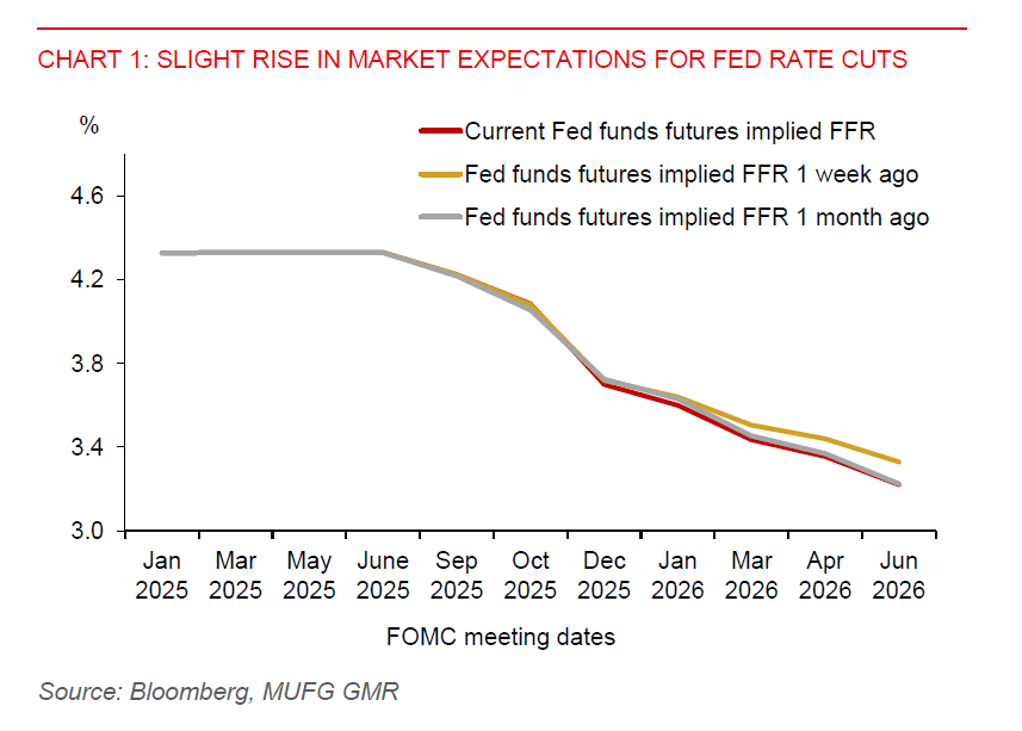

While the US government shutdown has disrupted the release of several key macro indicators, Fed Chair Jerome Powell noted that alternative data sources suggest little change to the Fed’s outlook since the September FOMC meeting. However, he flagged downside risks to the labour market, citing slower hiring, weaker nonfarm payroll gains, and softening job creation. Powell also highlighted that monetary policy may now face longer lags in influencing employment and inflation, warning that delayed action could result in “painful” job losses. This reinforces expectations for further rate cuts, potentially two more this year, with Powell indicating that the policy stance could shift to neutral as risks become more balanced.

Powell also signalled that the Fed may end its balance sheet runoff in the coming months, which will help support liquidity amid signs of tightening in money markets. He acknowledged the upside surprise in US macro data, though it contrasts with deteriorating labour market indicators. The Fed also stays cautious about the potential inflationary impact of tariff. But. for now, the Fed appears focused on cushioning employment risks. Powell’s dovish tone has somewhat weighed on US dollar upside momentum, while US equities recovered earlier losses.

Regional FX

Asian currencies have broadly weakened against the US dollar this week, as renewed US-China trade tensions dampen risk appetite. Notably, the Taiwanese dollar (TWD) and South Korean won (KRW) led regional declines, depreciating by 0.7% and 0.5%, respectively. The Singapore dollar (SGD) has also edged toward the 1.3000 level, after finding firm support around 1.2700, while the Malaysian ringgit (MYR) remains range-bound above the 4.2000 level.

Trade tensions have extended beyond tariffs, injecting fresh uncertainty into the global trade landscape. And while inflation has been quite subdued across the Asia region, it is subject to upside risk from supply shocks stemming from geopolitical developments, which could lift imported costs and shipping costs abruptly. China has reportedly sanctioned the US units of Korean-made ships, in addition to imposing special port fees on one another’s vessels. Beijing has also significantly tightened its export control of rare earth, a critical mineral that can produce a wide array of products including smartphones and computer chips. Notably, China holds dominant leverage over seven key rare earth metals (Samarium, Gadolinium, Terbium, Dysprosium, Lutetium, Yttrium, and Scandium), with limited near-term alternatives. In a further escalation, President Trump has hinted that the US may halt purchases of cooking oil from China in retaliation for Beijing’s boycott of US soybeans.