Ahead Today

G3: US PPI, retail sales, and initial jobless claims

Asia: China aggregate financing, India exports

Market Highlights

US retail sales will likely rebound in February following a weather-induced decline of 0.8%mom in January. But this would mask emerging signs of softening in consumer spending. The Fed’s latest beige book reveals that consumers are becoming cautious about discretionary spending. Latest US banking lending data also shows consumption loan growth is losing momentum.

Eurozone industrial production (IP) fell 3.2%mom in January, from a 2.6%mom increase in December. This was worse than the market consensus for a 1.8% decline. And from a year ago, eurozone IP declined by 6.7%.

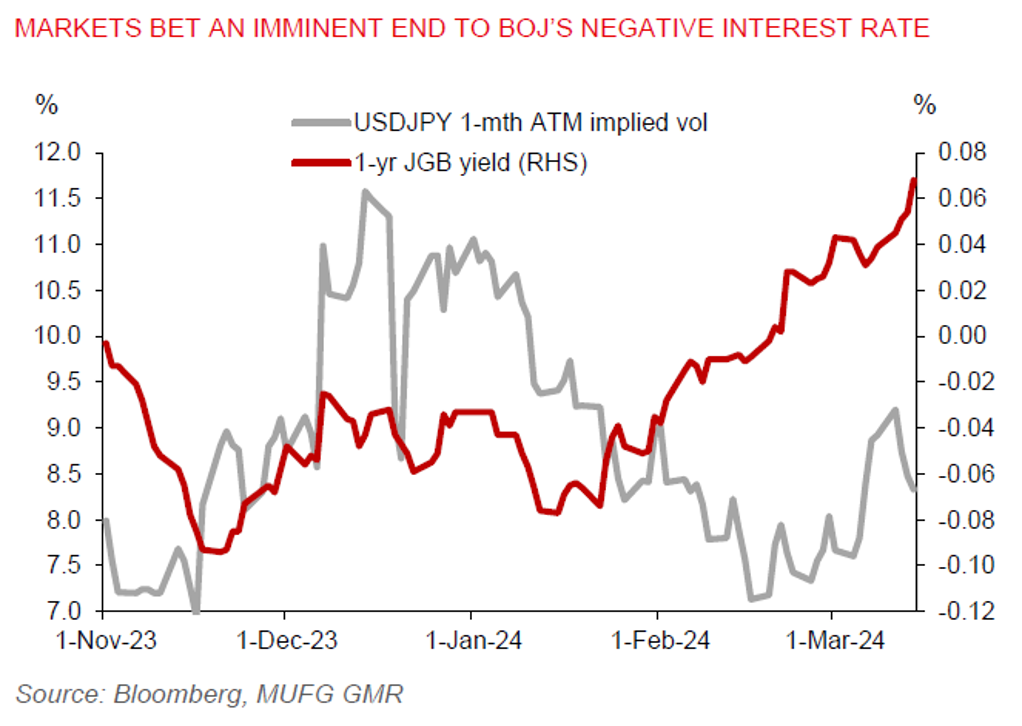

Toyota Motors has agreed to its labour unions’ demand in full for wage hikes and bonuses, adding that those increases would be at the fastest pace. This strengthens our view for the BOJ to exit its negative interest rate policy in the March meeting on Mar 19. Prime Minister Fumio Kishida said wage growth this year is set to be faster than in 2023. JPY continues to consolidate its recent strength versus the US dollar at around 147.80 level.

Regional FX

Asian currencies gave back some of their recent gains against the dollar yesterday. But USDCNH still trades below the 7.20 level for the third straight day. China’s upcoming aggregate financing data will shed light on the effectiveness of monetary stimulus on economic growth.

THB underperformed regional peers, with Prime Minister Srettha set to relinquish his role as finance minister. Pichai, a capital markets veteran and who’s appointed as Chairman of the Stock Exchange of Thailand just last month, is the frontrunner to become finance minister. Foreign investors have so far sold a net US$1.5bn worth of Thai equities and bonds this year.

Meanwhile, the SGD has held on to last week’s gains versus the US dollar. The MAS has released its latest quarterly survey of professional forecasters - a survey that we have also contributed to. The median forecast for 2024 GDP growth was raised to 2.4% from 2.3% in Dec 2023. This was in line with our 2.4% outlook. Meanwhile, the survey shows the inflation outlook was lowered to 3.1% from 3.4% previously, core inflation estimates stay at 3%, while 95% respondents (including us) see no change to the S$NEER policy setting in the April policy meeting.