Ahead Today

G3: US FOMC Fed Announcement

Asia: Philippines Trade, Singapore Unemployment

Market Highlights

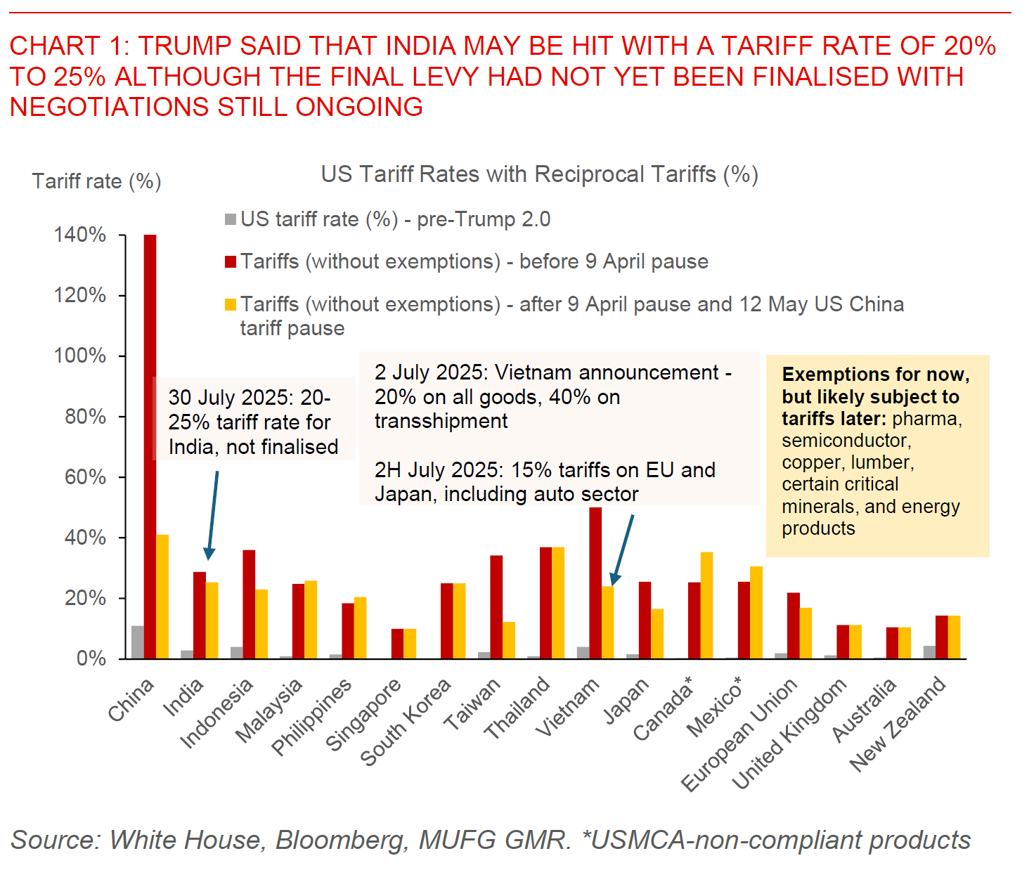

There were key developments on the tariffs and trade deal front for Asian countries, including for China and India. For India, President Trump said that India may be hit with a tariff rate of 20% to 25%, but cautioned that the final levy had not yet been finalised as the two countries are still negotiating. This comments also come of the back of an earlier Reuters report saying that India is preparing to face higher tariffs – likely between 20 and 25% - on some of its exports as a temporary measure, as it holds off on fresh trade concessions ahead of the 1 August deadline. Instead, India plans to resume broader trade negotiations when a US delegation visits in mid-August, with the goal of finalising a comprehensive bilateral agreement by September or October, according to the Reuters report. Key sticking points remains on agriculture including genetically modified crops and also India being unwilling to fully open its automobile sector, while India has expressed willingness to offer zero tariffs on some goods such as auto components and pharmaceuticals.

Both US and China agree to continue talks over extending a tariff pause before it expires in two weeks. This came after some confusion where China’s delegation earlier indicated a 90-day extension was agreed. US Treasury secretary Scott Bessent said that there are a few technical details to work out, and that he will provide President Trump with the facts for Trump to decide.

Regional Currencies

Across Asia, we also saw some key developments across the likes of South Korea and Singapore. South Korean officials including the Finance Minister, industry minister and Trade Minister met with US Commerce Secretary Howard Lutnick, with the Wall Street Journal reporting that Lutnick urged Korean officials to “bring it all” when making their final trade offer. Key to the proposal from the South Korean side seems to be a proposal focused on long-term economic cooperation including shipbuilding as an area of potential alignment. The Korea Economic daily reported that the US asked for appreciation of the South Korea won in recent currency talks as well.

Singapore’s central bank maintained the slope, width, and center of its currency band unchanged in its July meeting. MAS mentioned that inflation pressures should remain contained with inflation forecasts unchanged, while it continues to see growth moderating in 2H with the level of output falling “slightly” below potential. These moves were in line with our view that MAS will keep on hold in the July meeting with the focus likely to shift to the outlook to determine the likelihood of a October easing (Singapore MAS preview – Temporary July pause).

Meanwhile, Singapore’s Deputy Prime Minister Gan Kim Yong said he did not have the chance to speak with Howard Lutnick during his recent trip to the US and so sectoral tariffs on pharmaceuticals were not discussed. According to him, baseline reciprocal tariffs of 10% does not seem negotiable, but Singapore has registered its interest to be in the discussions if and when such an opportunity to negotiate comes up down the line. Meanwhile, one of US' concerns on pharmaceuticals is having secure lines of supply chains, and so a key element is how Singapore can be a reliable partner for the US, even as the US works to onshore some pharma production. According to DPM Gan, many key details of trade deals have not been worked out, importantly on how to define and apply rules of origin