Please download PDF using the link above for the full report

Asian economies showed mixed but generally resilient performance in the third quarter of 2025, amid various headwinds including diverging monetary policies, trade tensions and tariffs, and political events. Asia’s overall growth decelerated in Q3 from a strong Q2. Asian currency overall, measured by the Asia dollar index, weakened by 1.2% against the dollar this Q3, with KRW (-3.7%), INR (-3.5%) and PHP (-3.3%) being the laggard, and CNY (+0.6%) and HKD (+0.9%) being the out-performing ones. There was a certain level of disconnect between currency performances and individual country’s economic fundamentals in recent months. Delayed impact of tariffs, asset revaluation, and political events and etc can help to explain such gaps.

Looking forward, several main themes which likely affect Asian economic and FX performances in Q4, namely, “Impact of US tariffs on Asia economies in near term”, “Beyond Tariffs – US’s tighter controls on unauthorised immigration, H-1B policy changes, and HIRE Act”, “A Shift from a Unipolar to a Multipolar Supply Chain”, “Asia FDI to recover on tariff clarity and shift to a multipolar supply chain”, “China’s anti-involution campaign”, “Risks of Asian FX volatility amid a weaker US dollar”, “Political risks”. About China’s anti-involution campaign, price improvement of raw materials and better profit growth of upper-stream sectors indicate the signs of positive impact of the campaign. But given a more deep-rooted deflation in Chinese economy, more wide-spread over-capacity issues even in “new industries”, and high degree of indebtedness of local governments, it will talk longer time for China to climb out of deflation and government unlikely delivers stimulus big enough for a quick turn-around of domestic demand like what happened in 2015’s supply-side reform. Consequently, we expect Chinese economy to decelerate and hit the bottom in Q4, before a mild re-acceleration in 2026.

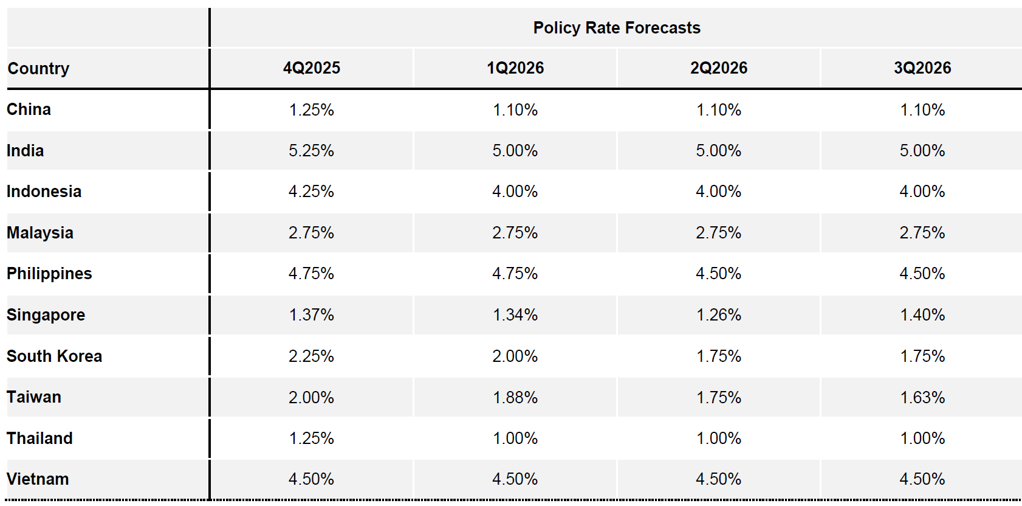

This Q4, tariffs likely generate more visible pressure on Asia’s exports, and individual country’s economic fundamentals and own policies likely generate bigger influence on its currency movement. Capital market performances, the cross-boarder FDI and portfolio flows remain relevant factors too. If US economy decelerates but not enters a recession, Fed’s continued rate cut likely foster both FDI and portfolios back into Asia, especially into country with cheap valuation, clear pro-growth agendas, aligned with multipolar supply chain themes.

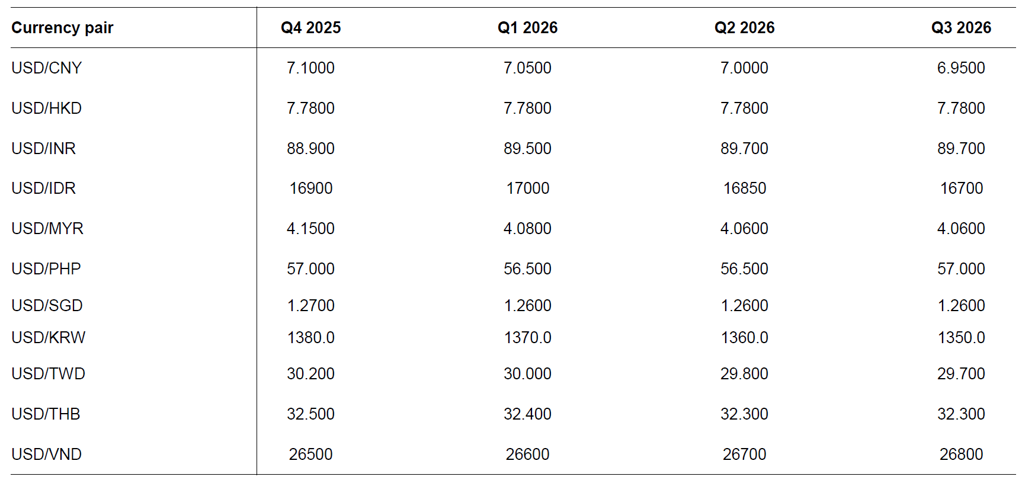

We are most positive on the currencies of economies with smaller exposure to US and China demand, smaller US tariffs, and domestic monetary and fiscal support. PHP and KRW likely are outperformer in Q4, the former is due to decent macro backdrop and an expected inclusion of the Philippines in the JPM GBI-EM index, while KRW’s strength would come from a bottoming out economy in Q4. We are most negative on IDR for Q4 due to Indonesia’s political and fiscal uncertainties. VND and INR likely depreciate too, Vietnamese economy has the high openness and largest exposure to US and China demand, while INR is imposed the highest 50% tariffs and is most negatively affected by US’s new H-1Bvisa policy and etc. we expect USD/CNY to reach 7.1. While exports growth may decline and economic activity decelerate, market’s focus likely remain on expectation of further policy easing and China’s asset revaluation, this would help an appreciation bias for CNY against the dollar.

Asia GMR