Please download PDF using the link above for the full report

Recently, various headlines dominated market participants’ attention, including Trump’s tax bill, Israel-Iran war, and the concerns on de-dollarization and etc. Now, as the expiration date of the 90-day pause approaches, a shift of market focus back towards tariffs is happening. About tariffs, Vietnam’s tariff deal with the US (while details are scant) implies that the possibility of a decline of US tariffs on China from current 41% level is low, and other Asian economies especially those with large trade surplus with the US are likely to receive higher tariffs compared with current blanket 10% rate. Although the larger Trump’s tariffs gaps between China and Vietnam and other Asian economies likely trigger further supply chains to shift out from China to the rest of Asia including Vietnam over the medium-term, in 2H, higher tariffs would weigh on Asia’s exports and overall economic performance, especially for those small open economies with larger exposure to US demand, as well as the spillover effect of high tariffs on China. These economies may decelerate more in H2 than China.

We expect China’s growth to decelerate from Q1’s 5.4% to about 4.3% in Q4, an overall 4.6% growth for 2025, due to a moderating positive fiscal impulse and the lingering weakness in the property sector. China’s weaker growth in H2 will drag on individual Asian economy by varying degrees.

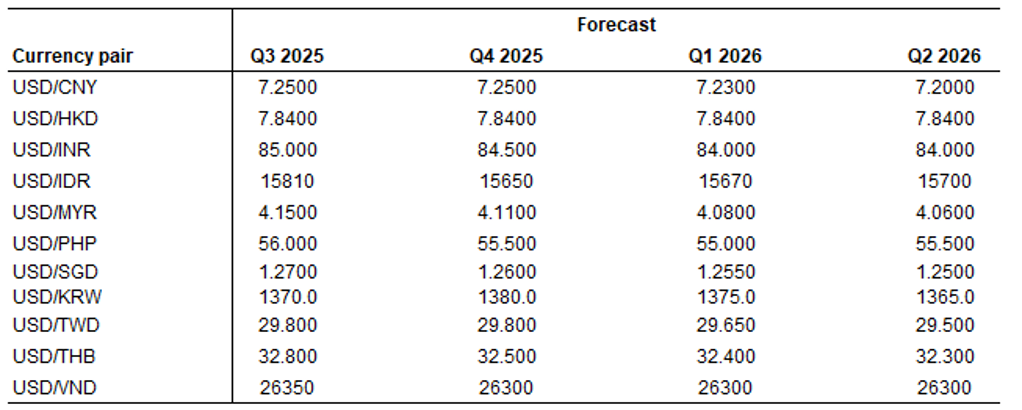

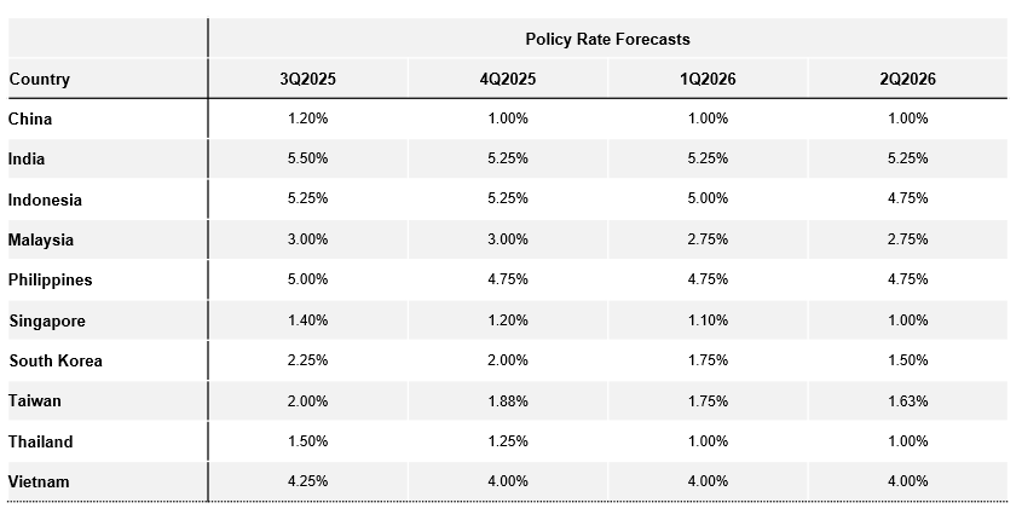

Having said it, for 2H, we expect much less Asian currency movement compared with a CNY’s 11% depreciation during the Trump’s 1.0 trade war. In fact, across Asia, we now expect some currencies to strengthen against the US Dollar. This reflects not just what has happened so far with faster Dollar weakness than we earlier assumed, but more importantly our global team’s expectation for further Dollar weakness and more Fed rate cuts than priced. In addition, there are also Asia-specific factors such as monetary and fiscal policy support for several, coupled with prospect of structural reform changes.

Moving forward, we are most positive on the currencies of domestic-oriented economies such as India, Philippines and Indonesia, either because we expect growth-inflation balance to improve attracting capital inflows, the likelihood of trade deals with the US for all 3, or also because we think in Indonesia’s case there has already been too much domestic negativity priced in and the central bank is unlikely to push back against currency strength. We are also positive on the likes of Asian currencies with structural stories such as Malaysia where long-term prospects for data centers and electronics sector continue to attract FDI commitments and inflows, coupled with some reform momentum.

We are negative on currencies such as CNY and VND due to higher US tariffs relative to other Asian countries, currencies which will likely suffer more from sectoral tariffs on electronics and semiconductors such as KRW, and also currency where the central bank could push back harder against currency appreciation such as the likes of TWD and SGD. We think THB will underperform due to domestic factors such as political uncertainty and also continued lack of structural reform momentum.