Key Points

-

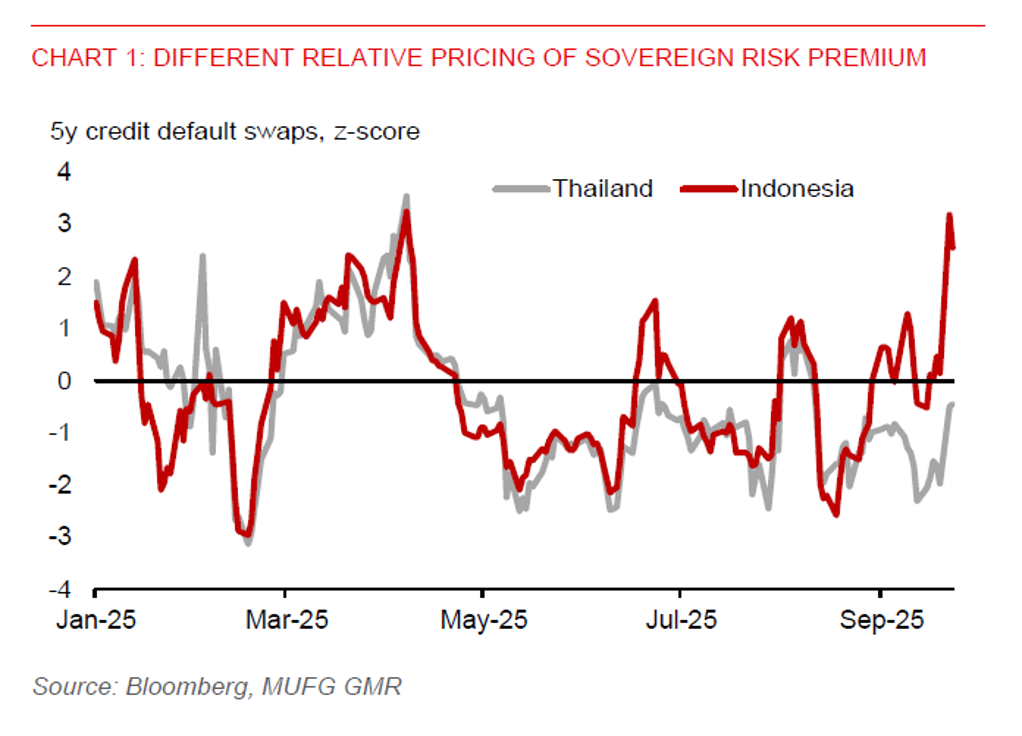

The rupiah has weakened over 3% year-to-date against the US dollar, while the Thai baht has appreciated by 7.2%, reflecting differing market perceptions of macro and political risks.

- Indonesia’s recent street protests, the removal of long-serving Finance Minister Sri Mulyani, and the government’s intention to review the State Finance Law have heightened concerns over fiscal credibility. These developments have contributed to a rise in the sovereign credit risk premium, reflecting growing investor unease about potential fiscal slippage and macro policy uncertainty.

-

In contrast, Thailand’s swift leadership transition to Prime Minister Anutin, coupled with the timely approval of the 2026 budget, has helped reassure markets and maintain investor confidence despite ongoing political volatility.

-

External buffers also favour THB Over IDR. Thailand’s balance of payments surplus widened to 3.4% of GDP in Q2, supported by tourism, exports, and gold trade. Indonesia’s BOP deficit, now at 1.9% of GDP, was dragged down by a wider current account gap and net foreign portfolio outflows. This divergence in external buffers has supported the baht’s resilience and undermined the rupiah.

-

With USDIDR breaching 16,500-level and market sentiment remaining fragile, the pair could consolidate above our initial year-end forecast of 16,400 in Q4, unless there is a meaningful shift in policy clarity. Importers are presented with a tactical opportunity to hedge USD liabilities, as the cost of protecting against rupiah weakness remains relatively low by historical standards.

-

In contrast, Thai authorities have expressed discomfort with the baht’s recent strength, particularly its correlation with gold prices, and may consider measures to dampen this influence. Nonetheless, Thailand’s robust external buffers, including sizable international reserves (including gold reserves) and a balance of payments surplus, combined with a broadly weaker US dollar, are likely to help anchor the baht within the 32.00–32.50 range against the US dollar in Q4.