ING: INTNED 3.875% Low Reset USD AT1 appealing sub 96 cash price

Attractive relval opportunity in a high quality bank in a AAA country

1) Highest YTC of any short call high quality European USD AT1

2) Minor downside if the instrument doesn't call, versus appealing upside if it does

3) ING AT1 is rated BBB flat with Fitch and Ba1 Stable with Moody’s

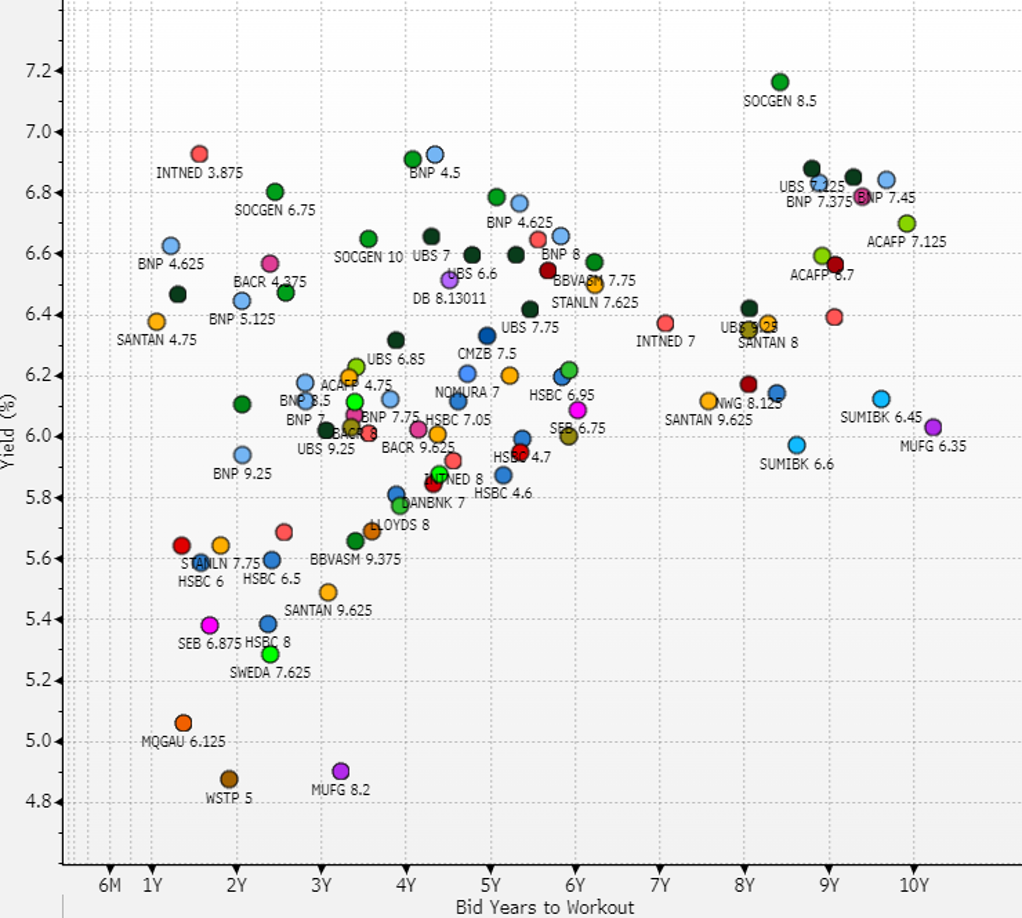

INTNED 3.875’S YIELD STANDS OUT AMONGST SHORT CALL USD AT1S

Source: Bloomberg, MUFG on 23/10/2025

- The INTNED 3.875 (call window May 27) is the highest yielding USD AT1 out of a high quality short call European bank at around 6.7% YTC (compare to BBVA 6.125 call Nov 27 with YTC of 5.96%).

The higher yield is due to these INTNEDs low back end of 284bp which puts some doubt around the call on the first call date/window. (It then becomes callable every 6 months after the first call date/window on May 16th 2027).

- What happens if the instrument doesn't get called in the 2027 first window? Well not all that much.

This INTNED 3.875 was issued in Sep 2021 when the USD 5Y swaps were at circa 0.75%. Now this is 3.23%. It is very unlikely that the US Treasury 5Y constant maturity. To which the coupon resets (currently at 3.56%) will be below 1% in November 2027. Hence the coupon is likely to reset higher than 3.875, which limits the downside risk significantly.

At the current cash price of 95.8 the INTNEDs have very limited downside from an extension event. The yield to worst drops to around 6.0% at the current price of 95.8. Bringing that yield to worst back to 6.7% the cash price drops by a modest 1.2 point to 94.6.

This 1.2 point price drop compares with a 4.2 point cash price upside if the INTNEDs do get called on the first call date.

- Finally, for further context, the next best USD AT1 out of European bank 27 call is the UBS 4.875 call Feb 27 at 6.25% YTC.

The latter has a back end of 340bp, which is 54bp better than the INTNED 3.875 (back end 284bp), but UBS is also still facing various headwinds from legacy CS AT1 write-downs which may impact the current capital buffers over the coming quarters or years.

ING doesn't have such pending legacy or legal issues of similar significance.