To read the full report, please download the PDF above.

Qatar doubles down on LNG capacity expansion which elongates the upcoming bearish price cycle

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

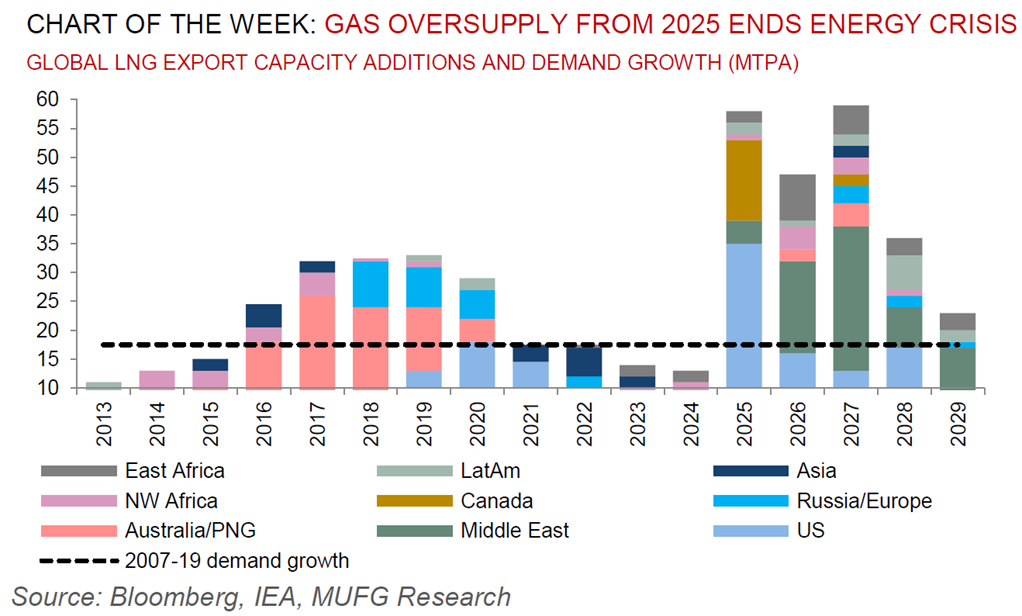

On 25 February, Qatar announced plans for further liquified natural gas (LNG) export capacity expansion by two 8mtpa trains “before the end of 2030”, that comes on top of it’s 48mpta capacity expansion currently under construction. The ramped-up target takes the country’s total LNG export capacity from 77mpta currently to now 142mtpa by 2030. When factoring in LNG export capacity currently under construction in the US (and other regions), we anticipate ~200mpta of additive global LNG supply capacity before the end of this decade, which constitutes ~50% of the 409mpta global LNG supply currently. To put the sheer velocity of this additional supply into context, global LNG demand printed at 401mpta in 2023. The resulting LNG oversupply, that will begin to take shape from 2025, leads to risks that global gas prices may decline to around supply cash costs (~EUR15-20/MWh), which in-turn could lead to the cancellation of US LNG exports (akin to 2020). At face value, although the Qatari announcement may seem counterintuitive given the approaching oversupply, we view that Qatar can leverage its pedigree as the world’s lowest cost LNG producer to take advantage of increased market share in light of the recently announced halts in US LNG export project approvals.

Energy

Oil bulls are quietly winning the narrative as prices are working their way higher, with a breakout of the USD10 range that it Brent crude has been confined to so far in 2024, now imminent. Granted, the steady climb is not remarkable, but economic exceptionalism, tightening fundamentals and prompt oil timespreads in backwardation (signalling supply tightness) is reinforcing the constructive narrative.

Base metals

A brief bounce in the LME aluminium price over the past week was tied to the potential for fresh US sanctions on Russia – announced on 23 February – to include some direct metal impact. Nonetheless, the actual sanctions announcement did not contain any explicit new focus on Russian aluminium and pricing has subsequently faded back to pre-episode levels.

Precious metals

Gold is trading in a narrow trading band, ahead of fresh US inflation data (core PCE) today (29 February) that may offer signs on when the Fed will pivot to commence its easing cycle. Swaps traders are still pricing little prospects of the Fed lowering borrowing costs before June, after recent data reaffirmed US exceptionalism (higher rates are historically negative for non-interest bearing bullion).

Bulk commodities

Iron ore prices continue to oscillate as investors remain undecided about the strength of China’s demand for steel ahead of the country’s normal peak construction season. Mills could take to replenishing iron ore inventories if profit margins improve, though the pace of replenishment still hinges upon steel demand.

Agriculture

Corn is extending its rebound from the lowest level in more than three years, as options volatility hovers near a five month high as traders take advantage of low prices to place bets ahead of the Brazilian planting season. The last time volatility reached this level, a flash drought was impacting US crops that raising questions about the scale of the harvest.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.