Natural gas price spike is more congestion risk, not winter apprehensions

Global commodities

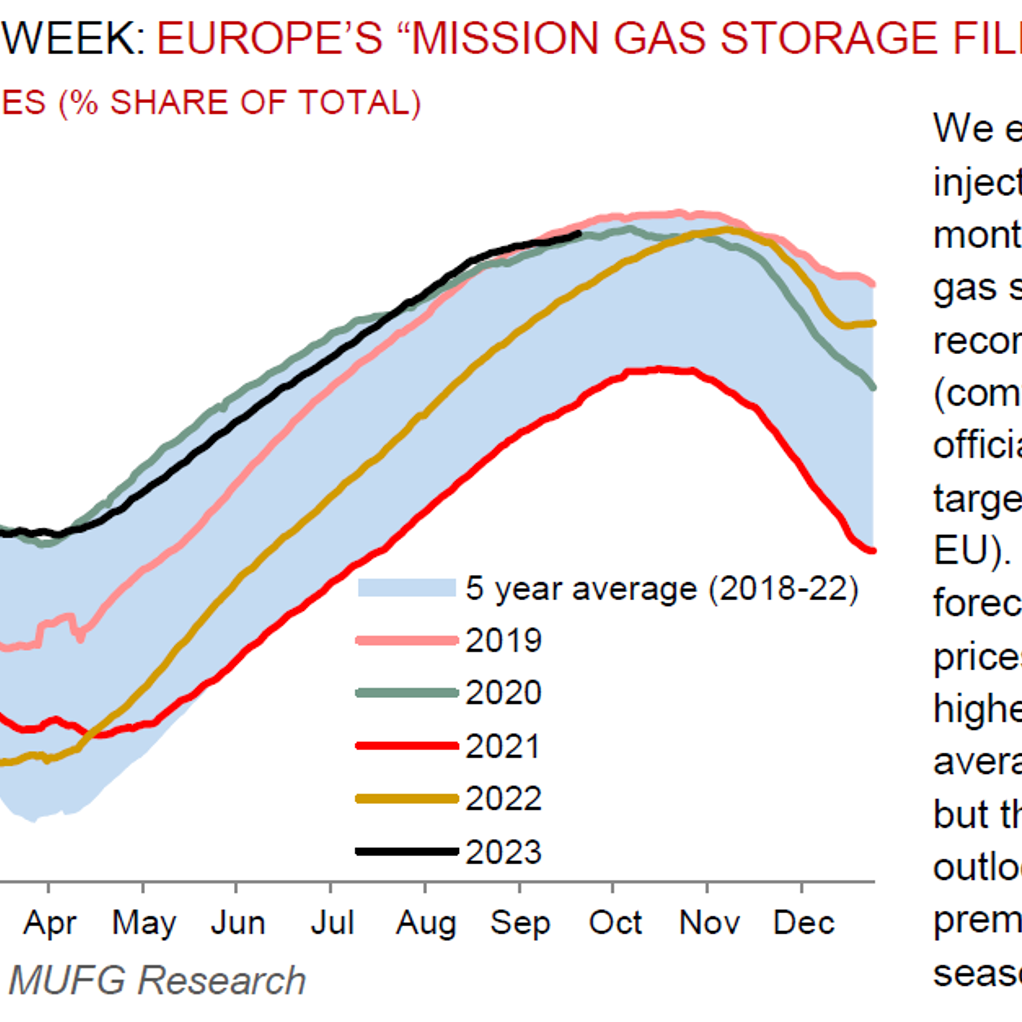

Last week’s resolution of the Australian LNG strike dispute was accompanied by a counter-intuitive rally in European natural gas (TTF) prices to levels last witnessed in April this year. To be clear, the end of strikes in Australia are unambiguously price bearish. Rather, we believe the spike in TTF prices has been predominantly driven by a decline in European storage congestion risk given extended Norwegian production outages. While the October 2023 contract is up ~15% so far in September, futures for the upcoming winter heating months ahead are becoming less costly relative to spot prices. This makes “floating storage” – a practice wherein traders hoard LNG vessels to be sold in subsequent months when prices are higher – less profitable, as the shrinking spread between months suggests this strategy is not lucrative. With this, the move to sell LNG cargoes into European import terminals could weigh on TTF prices, especially if early weather forecasts for a mild winter ahead prove accurate. On net, with European “mission storage fill” complete (gas inventories are currently 95% full), we reiterate our base case that TTF can balance the market this winter pricing just above hard coal, at EUR49/MWh and EUR58/MWh, in Q4 2023 and Q1 2024, respectively, close to forwards at EUR50/MWh.

Energy

Notwithstanding the higher for longer Fed narrative, oil is resisting the broader risk-off move seen in global markets. The relative resilience speaks loudly to crude’s tight fundamentals given deep deficits that reflects significantly lower OPEC+ supply and record high global demand. What’s more, crude inventories continue being depleted that’s revived discussions in the US of “tank bottoms” (minimum operating levels at Oklahoma’s storage hub have sunk below the 25m barrels threshold that is deemed critically low), and separately Russia’s ban of diesel and gasoline exports, reinforces the supply scarcity miring today’s oil and product complex.

Base metals

The base metals narrative is turning less bearish, albeit cautious on the upside. The more constructive stance has been evidence of a trough in China industrial activity amid a continued easing bias in the People’s Bank of China (PBoC) policy. However, appetite to deploy risk in the space is still constrained by the lack of improvement in early-cycle property trends.

Precious metals

Gold is holding up relatively well in the face of rising bond yields and US dollar strength. Though should Treasury yields remain elevated through October, that may overwhelm gold bulls – as a non-yielding asset, gold is having to compete for a place in portfolios (less of an issue when bond yields are low, but more challenging as yields rise).

Bulk commodities

Iron ore has rebounded from the lowest close in more than two weeks as a sharp rise in Chinese industrial profits suggested that the economy was stabilising. Though, the outlook for the steelmaking commodity is set for weakness in the final quarter of 2023. On the demand side, China’s property sector crisis is set to linger on, with officials set to order steel-output cuts to curb emissions. On the supply side, flows from Australia’s Port Hedland has set a record level of exports for the month of August, exacerbating the surplus in the market.

Agriculture

Wheat prices are edging higher as traders weigh heightened tensions in the Black Sea against plentiful supplies, particularly from Russia. A series of attacks by Ukraine and Russia, including a drone strike on Ukrainian port infrastructure close to the Romanian border is offsetting bumper harvest in parts of the Northern Hemisphere.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.