To read the full report, please download the PDF above.

Copper’s structural bull run is only in the early innings – the sleeping giant is awakening

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

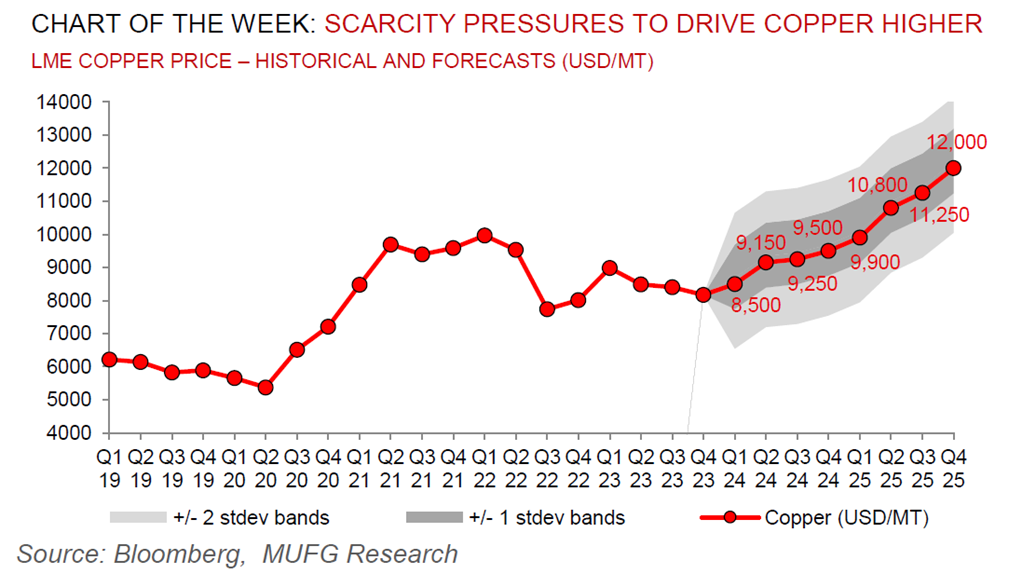

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

Copper prices are up ~5% year-to-date, recently breaking north of USD9,000/MT for the first time since 11 months. Akin to gold, the leg higher in copper seems to be driven by a rush into financial inflows following a meeting of Chinese smelters to discuss the intensifying market tightness owing to a combination of progressive supply shocks, a more robust demand environment and already tight stock buffers. What’s more, after a prolonged downturn, incremental evidence now points to a bottoming out in the industrial cycle, with the global manufacturing PMI in expansion for the first time in 18 months. Putting aside tight micro fundamentals and a supportive macro backdrop, looming Fed cuts will add a further upside catalyst to copper. Indeed, our examination finds that in non-recessionary Fed cutting cycles driven by policy normalisation and not a growth scare – such as today – copper on average rises ~13% over the 75 days post the first Fed cut. With our US rates strategist call for the first cut in June, then tight micro fundamentals and supportive macro aside, there is strong conviction for investors to scale long positions into the event. All in, despite the move higher year-to-date, we see copper as increasingly mispriced. Structural supply underinvestment – best reflected in peak mine supply we expect next year – implies that demand destruction will need to be the persistent solver on scarcity, an effect requiring substantively higher pricing than current spot levels. In this context, going forward we see the copper price surging, with our revised 2025 average price target of USD12,000/MT from USD9,500/MT by end-2024, as scarcity pressures intensify. Over the long term, copper is our most structurally long commodity conviction call given no other commodity is better positioned for the decarbonisation boom, as no element on earth is a better conductor of electricity – which is central to the energy transition.

Energy

Whilst fundamentals have not changed considerably since the start of the year, the quiet rally in crude and product prices – reflecting another sharp reversal in the IEA’s bearish 2024 market surplus to a bullish deficit, alongside supportive geopolitical risk premia from Russian refinery disruptions after drone attacks (with ~10% of the country’s refining capacity now offline) – is getting attention. Whilst we recognise that ample OPEC+ spare capacity continues to limit significant upside price risk (we model a USD100/b OPEC+ ceiling), we do believe the gravitational tilt remains upwards with lingering Fed rate cuts being the next key bullish catalyst.

Base metals

A busy macro environment thus far in 2024 has failed to drive price action for aluminium, as demand uncertainty has weighed on prices. We hold conviction that the base metal with the most supportive micro dynamics remains aluminium and the increasing pull of primary aluminium into China at a point of stabilising developed markets demand, supports our view of a marked global deficit this year in aluminium.

Precious metals

Gold has leaped above USD2,200/oz for the first time after the Fed maintained its outlook for three cuts this year, suggesting its not alarmed by a recent uptick in inflation. We reiterate our 2024 commodities views that gold is our most bullish call this year (year-end forecast of USD2,350/oz), on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

The rally in iron ore – the most China centric industrial commodity – from below USD100/MT, has stalled following investor’s laser focus on the challenges in China’s real estate sector that is hampering demand. The continued build in iron ore port stocks ultimately reflects the depressed mill margin environment restraining the typical seasonal uptrend in hot metal production, in turn a result of weakness in property related demand so far this year.

Agriculture

Wheat prices are gaining ground, supported by short covering and apprehensions of escalating tensions in the Black Sea. The gains have come despite expectations of wetter (more favourable) weather in Texas and Oklahoma this week, according to forecaster Maxar Technologies.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.