Balancing bullish geopolitical risks with bearish higher-for-longer rates across commodity markets

Global commodities

Our thoughts continue to be with those affected from the conflict in Israel and Gaza. Whilst, on balance, we are in a less complex environment compared to the initial few days since the conflict broke out on 7 October, this does not mean we are any closer to a diplomatic conclusion. Israel is still likely to launch a ground invasion of Gaza targeting Hamas, but there are now more questions from the international community on (i) what this incursion will look like, (ii) what will be the scale of the humanitarian crisis that will emerge; and (iii) what comes next. Commodity markets remain laser focused on the threats to first order (near-term) energy supply risks and second order (medium-term) energy/metals demand headwinds from a potential acceleration in the global slowdown that a prolonged (and potentially expanded), conflict may entail. What is clear is that commodities are facing steep volatility price swings as investors hedge heightened geopolitical risk premia, against a backdrop of higher-for-longer rates (combined with a supportive US dollar) and its chilling reverberations on commodity demand.

Energy

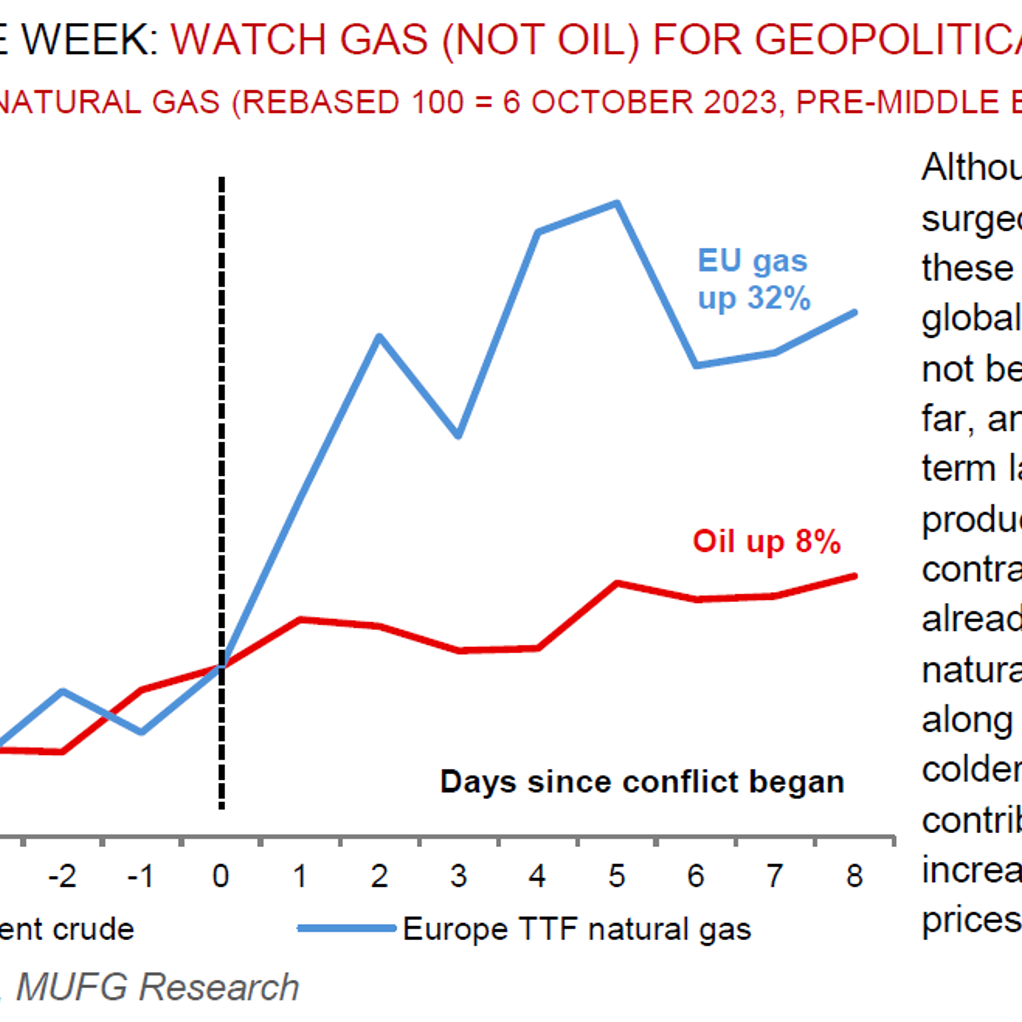

The key consideration for oil markets today is how the US can skilfully navigate pressure to tighten the enforceability of its sanctions on Iranian barrels without (i) antagonising (politically) China’s growing appetite for discounted Iranian crude, and (ii) exacerbating (economically) upside pressure on US gasoline prices that lower Iranian crude exports may cause. Meanwhile, in natural gas markets, high frequency LNG loading data suggests that the ongoing 10Bcm per year disruption to Israel’s Tamar gas field is not impacting LNG supplies as of yet – causing European (TTF) gas prices to come off ~5-6% thus far this week.

Base metals

China’s better-than-expected Q3 2023 GDP figures released this week is proving to be a tonic for the base metals complex. Having said that, short of a material step change higher in China’s base metals imports, or increasing supply binds, our conviction remains that the near-term base metals pulse is constrained by the higher-for-longer rates environment, leaving it vulnerable to left-tail price risks.

Precious metals

Gold has jumped to the highest level in four weeks as the intensifying conflict in the Middle East bolsters safe haven demand, with prospects for a near-term diplomatic resolution deteriorating. We still believe that the conflict is not likely to cause a sustained gold rally, with bullion comprising a poor track record as a hedge against heightened geopolitical risk that often proves short-lived, with the exception being when oil supply is threatened.

Bulk commodities

The near-30% rally in European (TTF) gas prices over the past ten days has moved European gas prices above coal, which implies a potential reversal of the coal-to-gas (C2G) fuel substitution. This is likely to in turn pull coal prices higher, even as there have been no disruptions to the global coal trade market.

Agriculture

Notwithstanding higher-for-longer rates and extreme weather conditions, government policies can independently drive commodity surges, as exemplified by India’s sugar export restrictions due to drought, where prices have room for further upside. Indeed, India’s plan to limit sugar exports this season due to drought is causing angst over possible price spikes.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.