To read the full report, please download the PDF above.

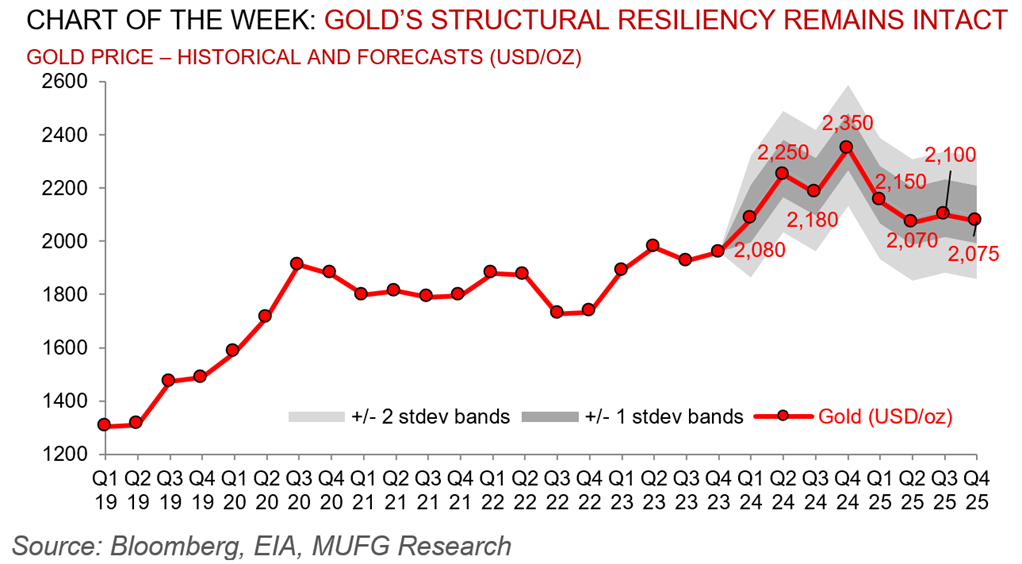

Gold's resiliency intact despite hot US inflation dampening Fed rate cut expectations

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

Gold prices have remained in consolidation form as hotter-than-expected US inflation has dampened hopes for a rate cut in the first half of 2024. Beyond the sticky inflation reading, elevated yields have found further support following the recent FOMC meeting, which removed the tightening bias with Fed Chair Powell signalling that a March cut “is probably not the most likely case”. Whilst higher for longer rates is bearish for non-interest bearing bullion, we hold conviction that the other two channels that are central to our bullish 2024 gold view remain intact, namely, robust EM central bank purchases on reserve diversification and bullions role as the geopolitical hedge of last resort (see here). On net, with spot gold prices now flirting below the USD2,000/oz handle, we acknowledge downside risks to our constructive USD2,350/oz year-end forecasts. However, we continue recommend leaning long gold and view any sell-off as a buying opportunity in an environment with elevated risk dimensions (geopolitics, recession repricing) which play into gold’s favourable hedging qualities.

Energy

Whilst crude oil is struggling to break out of a USD10 range that it’s been confined to thus far this year, it remains resolutely on track to log an impressive quarterly advance. US economic exceptionalism, tightening fundamentals and prompt oil timespreads in backwardation (signalling supply tightness) is reinforcing the constructive narrative. Meanwhile, a glut of US natural gas is pushing prices (Henry Hub) to test COVID lows, reinforcing our 2024 bearish call (see here).

Base metals

Base metals have been in largely sombre form into the Chinese Lunar New Year and our conviction that risks currently are skewed to the downside. The LMEX index – which tracks the performance of the six major base metals – is down ~4% year-to-date, as a still challenging China and higher for longer rates keeps traders on the sidelines.

Precious metals

Silver and PGMs (platinum and palladium) have hammered lower in line with gold’s fall (following the higher-than-expected US CPI reading), but still stand to bounce on barging hunting.

Bulk commodities

One of Australia’s largest power plants will be restored to full operation this week following severe storms that damaged grid infrastructure and cut power to more than 500,000 customers. Two units of the Loy Yang A coal-fired power station in Victoria have returned to service and the remaining two are now being restored, utility AGL Energy stated.

Agriculture

Russia’s local wheat prices are at the lowest since November 2023 as traders rush to export large volumes of the grain after a series of bumper harvests. The world’s top wheat exporter is on track for a third consecutive large crop, which is set to support Russia keep its dominant position in the 2024-25 period.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.