Commodity markets reactions are often more ephemeral than geopolitical events

Global commodities

The movements of global markets are of trivial importance compared with the value of human life and our thoughts are with those affected from the conflict in Israel and Gaza. The events in the Middle East are unequivocally top of mind and have impacted commodity markets to a reasonable degree. At moments like this, there is a temptation to believe that the market might offer important insights into what is going on and what might happen next. We view that this temptation ought to be resisted. Granted, buying crude is the “go-to” response whenever geopolitical supply risks rise in the Middle East, and unsurprisingly oil is witnessing a leg-up with Brent crude up USD3/b thus far this week. Yet, in the context of last week’s USD11/b collapse on global macro skittishness, this week’s USD3/b uplift may look like a standard rebound (in the absence of the conflict). As a basic principle, commodity market reactions tend to be much more ephemeral than real-life geopolitical events. Thus, it is practical to postulate that the geopolitical price risk premium now playing out in financial markets may begin to slowly ebb, especially should the conflict not escalate into a wider regional conflagration – which is our base case. Overall, global markets, under ordinary circumstances, is the best mechanism for the allocation of physical commodity resources and a good estimator of asset values – but we caution its merits about gauging geopolitical risks.

Energy

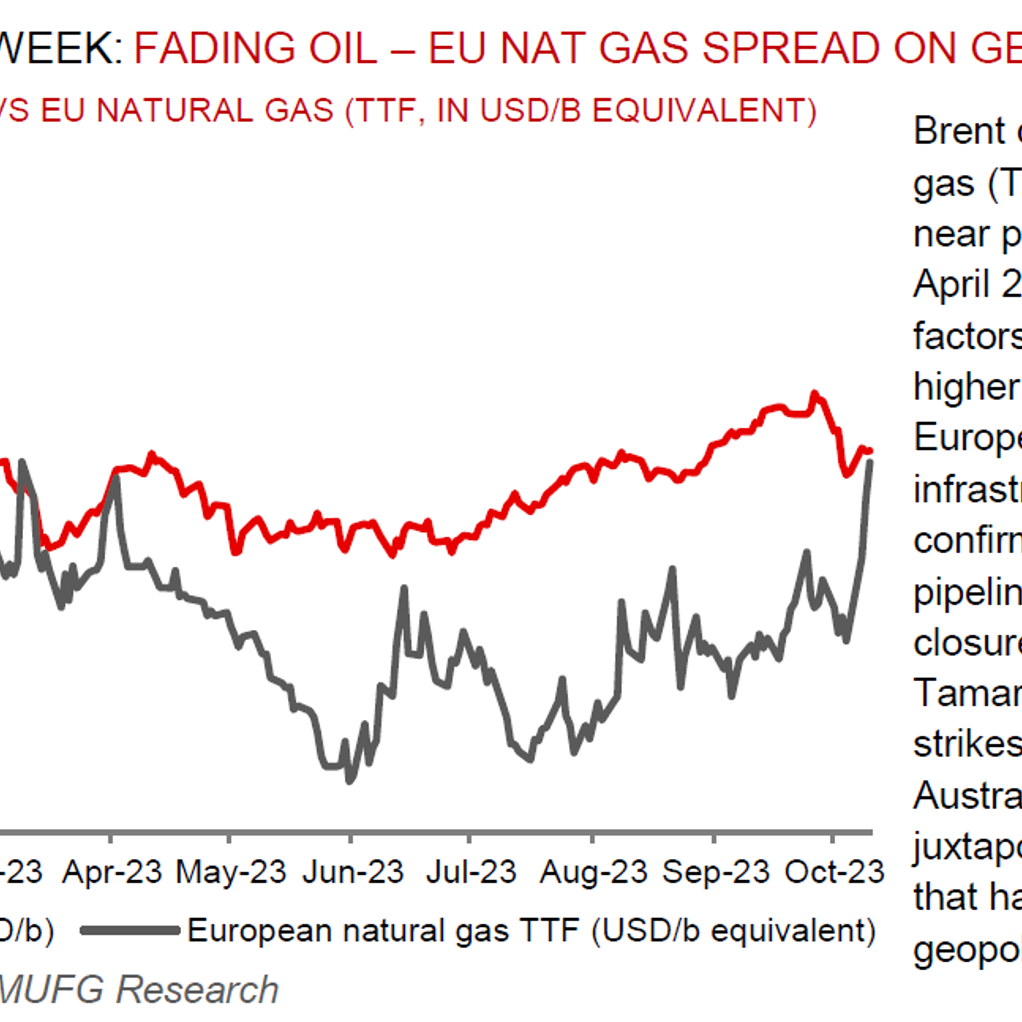

Whilst there has been no impact on current global oil production from the conflict in the Middle East, we recognise two medium-term reverberations on global oil supplies – (i) a reduced likelihood of imminent Saudi-Israeli normalisation and with it an accompanying increase in Saudi oil output; and (ii) downside risks to Iranian oil production should sanctions enforcement strengthen. Meanwhile, European natural gas markets have witnessed significant strength this week, with TTF prices surging more than 30% to ~EUR50/MWh – highest since April 2023. The catalyst has been two-fold – (i) the Finnish government announcing that it is treating a leak detected along the Balticconnector gas pipeline (between Finland and Estonia with 2.6Bcm annual capacity) over the weekend as a deliberate act of sabotage; and (ii) Israel asking Chevron to halt operations at the ~10Bcm per year Tamar field for safety reasons.

Base metals

Base metals have been under pressure this week amid renewed fears over China’s property market after Country Garden (China’s largest private developer) warned that it might not be able to meet repayments on offshore debt. This bearishness comes despite reports of fresh stimulus with Chinese policymakers reportedly weighing the issuance of at least CNY1trn of extra sovereign debt for spending on infrastructure.

Precious metals

Gold prices, which witnessed initial safe haven buying on this week’s Monday open following last weekend’s events in Israel, is now levelling off. On net, we see the conflict has not likely causing a gold rally, with bullion comprising a poor track record as a hedge against heightened geopolitical risk that often proves short-lived, with the exception being when oil supply is threatened.

Bulk commodities

Iron ore have plunged to their lowest in seven weeks as turmoil in China’s property sector continues to plague steel markets. More broadly, there are indications that steel mills’ are grappling with their profitability, a negative for iron ore pricing.

Agriculture

El Nino has started to cause some concerns in Asia, and it’s a strained rice market that’s facing the first test from the weather phenomenon. Major importer Indonesia has flagged a marginal hit to output, while Vietnam has told farmers to plant their next crop earlier than usual to avoid water shortages. The Philippine is also giving aid to growers to cope with the weather as rice inflation surges.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.