To read the full report, please download the PDF above.

Examining commodity inflationary risks due to Red Sea shipping disruptions

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

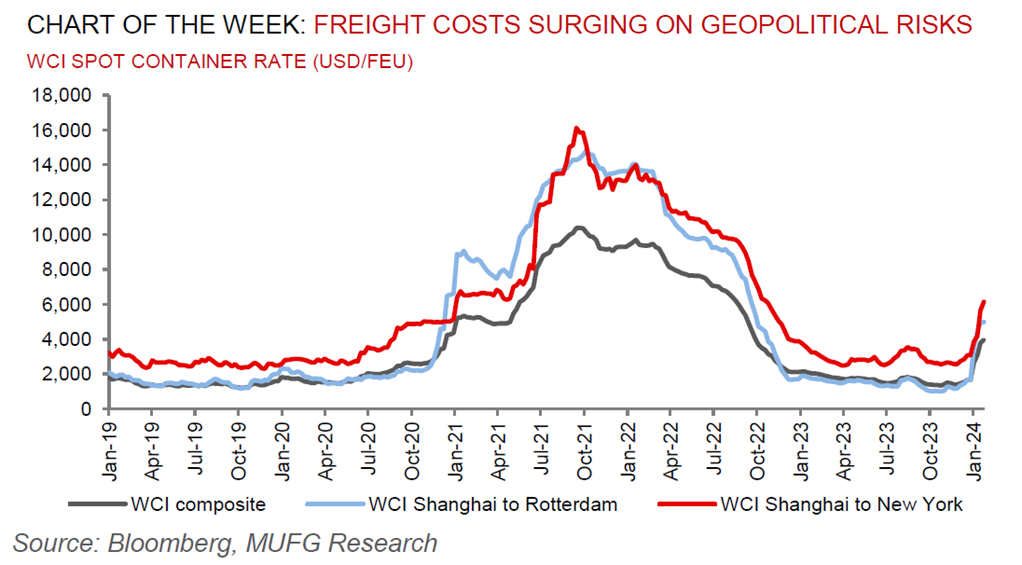

With escalating geopolitical tensions disrupting shipping via the Suez Canal and pushing up freight costs, there might be a sense of déjà vu in the air. After all, supply chain pressures had only just started to abate last year following pandemic-related disruption. We ask to what extent might supply chain strains persist this time around? Notwithstanding a confluence of factors at play, it is likely that we are only just starting to see the impact of the Red Sea crisis filter through into production. Companies that rely on a just-in-time manufacturing model and maintain relatively low inventories of critical components are particularly susceptible to any trade delays – especially ahead of China factory closures during the Lunar New Year. The data readings are concerning, with sea freight costs acutely rising due to the disruptions in the Red Sea, with shipping costs from Asia to Europe rising by 350% and by 100% from Asia to the US. Such increasing shipping costs have reignited apprehensions around inflation and whether ongoing disruptions may temper hopes for aggressive policy cuts by central banks in 2024. We are less concerned that higher costs will raise global inflationary pressures for two reasons. First, sea freight transport costs account for a minor share of the price of final consumption goods (~1.5%). Second, whilst the transmission channels of higher shipping costs tend to quickly filter through to producer prices (PPI), the impact on consumer prices (CPI) can lag and peak only after 12 months. On net, while it is difficult to hold conviction when normal transit will resume in the Red Sea, we estimate today’s higher shipping costs raises global inflation by ~0.2ppts in 2024, with somewhat large ramifications in Europe and smaller effects in the US.

Energy

Saudi Aramco has been asked by the Saudi Ministry of Energy to maintain its maximum sustainable capacity (MSC) at 12m b/d, and not to continue plans to increase it to 13m b/d. This is a long-run positive for oil prices, and comes at the same time that the market is waiting to see how the US responds to military fatalities in Jordan blamed on an Iranian-linked militia faction. Meanwhile, natural gas prices in both the EU (TTF) and US (Henry Hub) are rising (albeit from low levels) on geopolitical tensions and colder weather forecasts in the weeks ahead.

Base metals

Conditions may be forming for nickel to bounce back following a long period of retracement that has been so severe that producers have been cutting back. The key bottleneck driving nickel’s surplus to date has been an expansion of production capacity in Indonesia. Should prices rise, that will help to resort the market’s positive dynamics as the battery-demand narrative – and nickel’s central role within it – remains intact.

Precious metals

Total gold demand hit a record in 2023 and is expected to rise again in 2024 as the Fed moves towards easing rates alongside geopolitical tensions that remain elevated. We reiterate our 2024 commodities views that gold is our most bullish call this year, and agree with the WGC that bullion is set to hit record levels on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

Iron ore prices have declined in recent trading sessions as China’s factory activity contracted for a fourth consecutive month, signalling continuing economic woes alongside the crisis in the property sector. The official PMI reached 49.2 this month – below the 50 mark that separates expansion from contraction. That adds to concerns over demand in the commodities-intensive manufacturing sector just as real estate grapples with a prolonged slump.

Agriculture

China is increasingly turning to Russia for its grains demand, as the country diversifies imports to reduce its reliance on traditional suppliers, notably the US. Russian exports of cereals to China rose ~4x in 2023 to ~1.2m tons, while shipments of some edible oils have ballooned to over half of China’s imports, according to Chinese customs data.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.