To read the full report, please download the PDF above.

Lowering our oil price call despite the “Trump put”

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

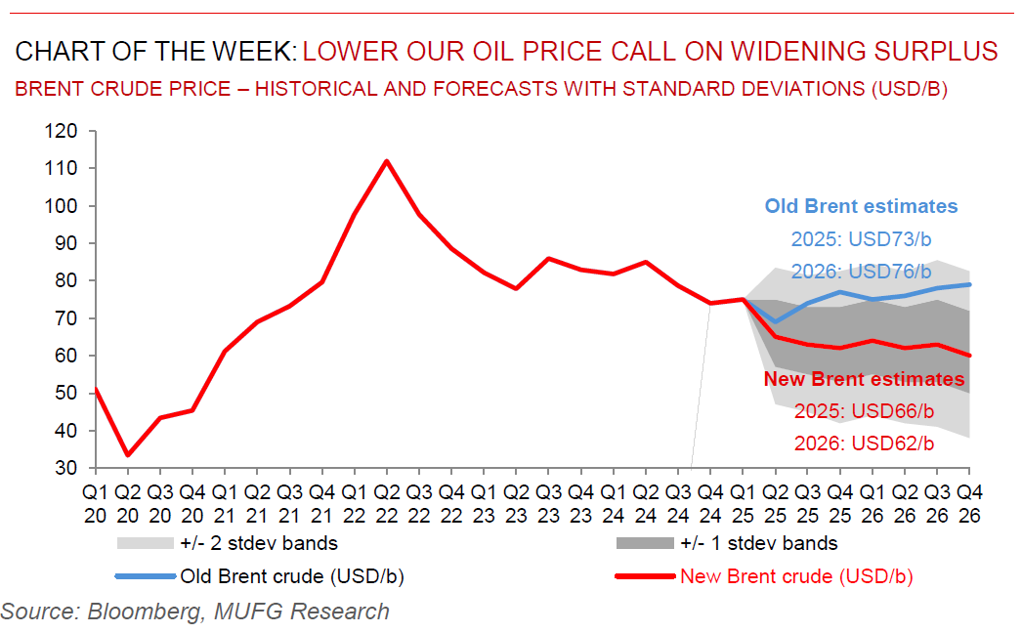

Global markets have been in turmoil post the 2 April “Liberation Day” announcements with stock markets shedding trillions of dollars, credit spreads widening, oil prices tumbling and currencies gyrating wildly. A pivot in trade policy was the most obvious route for a recovery. We have witnessed a version of that, starting with the 90 day pause on reciprocal tariffs, product-specific tariff exemptions, and seeming US openness in negotiating with China. Whilst these modest shifts have reduced the probability of the bear case, the “Trump put” does not extend to energy, as the US administration remains resolute in prioritising lower oil prices. We have been cautious in revising our December 2024 call for Brent crude to average USD73/b and USD76/b in 2025 and 2026, respectively, post “Liberation Day” given the fluidity in global macro developments. With the dust settling somewhat, we now hold conviction that we are past the peak of new tariff “shocks”, and possibly past peak policy uncertainty. Critically, whilst the “de-escalation” trade may have room to run in some risk assets, this does not signal an all-clear for crude oil. Our new fundamentals estimates signal that tariff-induced softer global oil demand growth (0.5m b/d in 2025), alongside rampant (OPEC+ and non-OPEC+) supply growth (1.6m b/d in 2025), will drive a large oil surplus in 2025 (1.1m b/d) and 2026 (0.7m b/d). Such quantums of oversupply, coupled with heightened implied volatility, is prompting us to mark-to-market our Brent oil price levels lower to USD66/b and USD62/b in 2025 and 2026, respectively. Granted, the Fed put and Chinese stimulus may offer a floor in oil prices, but it’s tough being an oil bull today.

Energy

Oil prices witnessed their largest decline since November 2021 last month, on signs of tepid global oil demand, with Brent crude once again testing the USD60s/b handle (USD58/b marked the recent low on 9 April). The US administration’s volatile tariff policy strategy, especially those involving China, has made traders that were already skittish on the longstanding oversupply this year (that pre-dates President Trump’s second term), nervous about loosening fundamentals. Key economic data readings from the US (GDP and payrolls) look set to reinforce the narrative that US tariffs (and countermeasures), are sapping growth and fuelling uncertainty about the scale of weakness on the demand-side of the oil equation. Meanwhile, European natural gas (TTF) prices continues its plummet, now flirting close to the EUR30/MWh handle. The ongoing trade war continues is weighing on global gas demand, which is offering the space for more imported gas into the European continent – supporting Europe’s stockpiling that is currently underway to fill adequately ahead of the winter heating season.

Base metals

The rebound in across the base metals complex continues with the latest catalyst stemming from US signals of a more conciliatory tone towards China in its trade war. While hopes of accelerated Chinese stimulus and still firm demand (and micro fundamentals) in China can potentially keep prices treading water near-term, we view the emerging and increasingly apparent loss in global demand momentum in the coming months will eventually pressure the base metals space, in our view. We thus remain guarded, especially for copper given its historical sensitivity to global growth uncertainty.

Precious metals

Investors on edge by the growing global trade war, flocked to gold-backed ETFs in the Q1 2025, with inflows propelling bullion’s 19% rally in the three month period, according to the World Gold Council. Despite persistently notching fresh peaks, our conviction remains resolute that we are a distance away from overextended or bubble territory, and maintain our above consensus forecasts for gold to catapult even higher and hit USD3,850/oz by year-end and breach north of the USD4,000/oz threshold by Q2 2026.

Bulk commodities

ArcelorMittal has warned US tariffs and European support for local steelmakers are boosting prices, though potential disruptions from global trade uncertainty is high. It forecasts lower steel demand than previously expected, revising its estimate of 2.5-3.5% growth in global ex. China consumption in 2025.

Agriculture

Grain prices have declined in recent sessions as better weather in the world’s largest producers is strengthening the outlook for supply. Drier weather is expected to improve planting conditions across the US Midwest in the week ahead, while limited near-term rain in Argentina and Brazil will be favourable for harvesting, according to forecaster Vaisala.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.