FX Daily Snapshot

- Mar 28, 2024

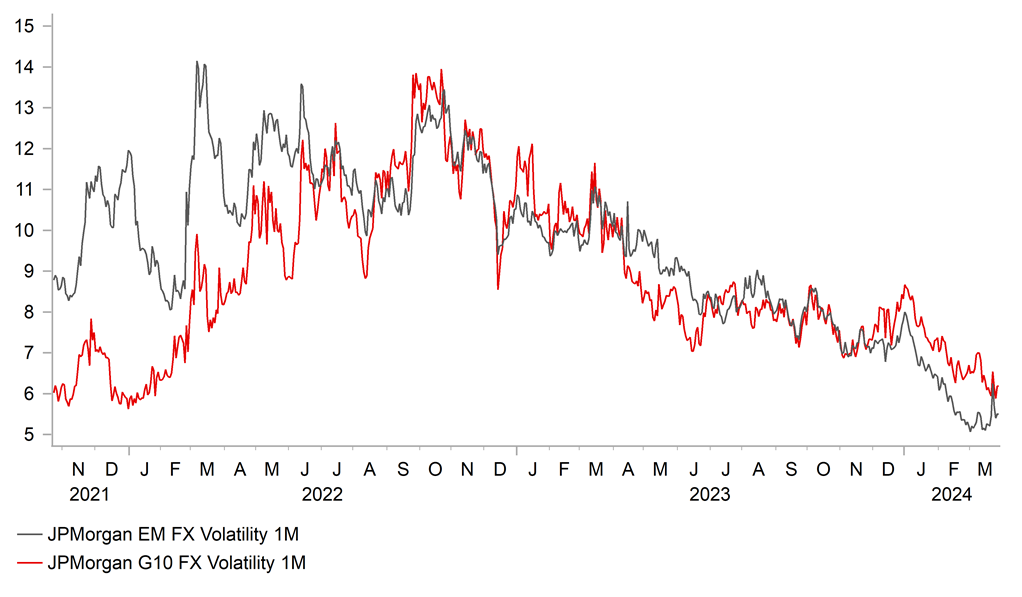

Japan steps up intervention threat helping to dampen FX volatility

USD/JPY: Fed rate cut outlook & intervention risk in focus

The major foreign exchange rates have continued to remain stable during the Asian trading session. Over the last five trading days the dollar index has traded within a narrow range between 103.90 and 104.50. The lack of volatility for major foreign exchange rates continues to reflect in part market expectations for a synchronized start to easing cycles for major central banks. The US, euro-zone and UK rate markets have all moved to price in the first rate cuts from the Fed, ECB and BoE in June although it is judged as a closer call for the BoE. Market participants remain comfortable pricing in the first rate cut from the Fed in June and a total of three 25bps cuts by the end of this year even after the relatively hawkish comments from Fed Governor Waller before the Economic Club of New York overnight. He stated that in his view, “it is appropriate to reduce the overall number of rate cuts or push them further into the future in response to recent economic data”. He described the recent stronger inflation figures as “disappointing”. He also noted that he sees “economic output and the labour market showing continued strength”. In light of the recent stronger inflation figures he wants to see “at least a couple months of better inflation data” before cutting. While the comments still appear consistent with the Fed delivering the first rate cut in June, they do highlight the risk that Fed could delay rate cuts into the second half of this year if inflation continues to prove stronger than expected in the coming months. It is one potential catalyst that could disrupt the current period of low volatility for major foreign exchange rates and encourage an even stronger US dollar.

Another dampener for FX volatility this week has been the pushback from Japanese officials against recent yen weakness which is helping to at least temporarily keep USD/JPY below the 152.00-level. Market participants are wary of the heightened risk of intervention heading into the less liquid Easter holiday period which is making it more risky to hold on to yen shorts. Japan’s Chief Cabinet Secretary Hayashi reiterated overnight that they are watching FX moves with a high sense of urgency, and won’t rule out any options against excessive moves. The threat of intervention to support the yen was dialled up another notch yesterday after the MoF, BoJ and FSA held a joint meeting yesterday to discuss recent developments in global financial markets. After the meeting, Vice Finance Minister for International Affairs Kanda sent a clear warning that “the recent weakening of the yen cannot be said to be in line with fundamentals, and it is clear that speculative moves are driving the weaker yen. He added that the recent 4% weakening of the yen is not a moderate move, and they can’t tolerate speculative moves in FX. It was the strongest warning yet from Japanese officials that they are prepared to intervene to support the yen if recent price action continues.

LOW & FALLING FX VOLATILITY FAVOURS FX CARRY TRADES

Source: Bloomberg, Macrobond & MUFG GMR

GBP/SEK: Weighing up who will be next European central bank to cut rates

The pound has traded on a firmer footing at the start of this week after suffering a sell-off following the latest MPC meeting on 21st March. It has resulted in EUR/GBP falling back towards 0.8550 after briefly rising above the 0.8600-level on 22nd March. Even after Governor Bailey stated that rate cuts are “in play” at future meetings, market participants remain somewhat reluctant to price in earlier rate cuts from the BoE. The probability of a rate cut as early as in June is still judged as finely balanced at around 50:50 probability, and an even earlier rate cut in May is judged at around 1 in 5 probability. There is still a strong belief that the BoE will need to see more evidence in the coming quarter showing core inflation and wage pressures continue to slow to give the BoE enough confidence to begin cutting rates. At the last MPC meeting, the voting pattern amongst members shifted in a more dovish direction when Jonathan Haskel and Catherine Mann both dropped their previous votes for hikes. However, recent comments since the last MPC meeting indicated that they are unlikely to vote for a rate cut anytime soon. MPC member Haskel told the FT that the BoE should not rush to cut rates with wage growth still too high. He also favours a slower pace of cuts when the easing cycle gets underway. Given he is one of the most hawkish members on the MPC, the comments are unlikely to have much impact on UK rates and the pound.

The next G10 central bank to follow the SNB and begin to cuts rates looks like it could be the Riksbank after they delivered a dovish update to their policy guidance yesterday. The Riskbank has brought forward plans to begin cutting rates and signalled clearly that they will begin to lower rates in either May or June if inflation prospects remain favourable. We had thought that the Riksbank may have been reluctant to signal that they could cut rates ahead of the ECB who are on course to start cutting rates in June. The May guidance from the Riksbank has increased downside risks for the krona in the near-term although they did add that the krona continuing to weaken is one risk that could cause inflationary pressures to rise again. It suggests that a sharper sell-off for the krona could encourage the Riksbank to wait until June to begin cutting rates. The updated forecasts for the policy rate also revealed that Riksbank plans to lower the policy rate back towards 3.00-3.25% in the year ahead. Overall, the developments support our long EUR/SEK trade recommendation (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Mar |

10K |

11K |

!! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Feb |

0.3% |

0.1% |

! |

|

US |

12:30 |

Continuing Jobless Claims |

-- |

-- |

1,807K |

!! |

|

US |

12:30 |

GDP (QoQ) |

Q4 |

3.2% |

4.9% |

!!! |

|

US |

12:30 |

Initial Jobless Claims |

-- |

212K |

210K |

!!! |

|

CA |

12:30 |

GDP (MoM) |

Jan |

0.4% |

0.0% |

!! |

|

US |

14:00 |

Pending Home Sales (MoM) |

Feb |

1.4% |

-4.9% |

!! |

Source: Bloomberg