FX Daily Snapshot

- Mar 27, 2024

USD tests highs with Japan intervention in sight

JPY: Broader dollar strength takes USD/JPY to new high

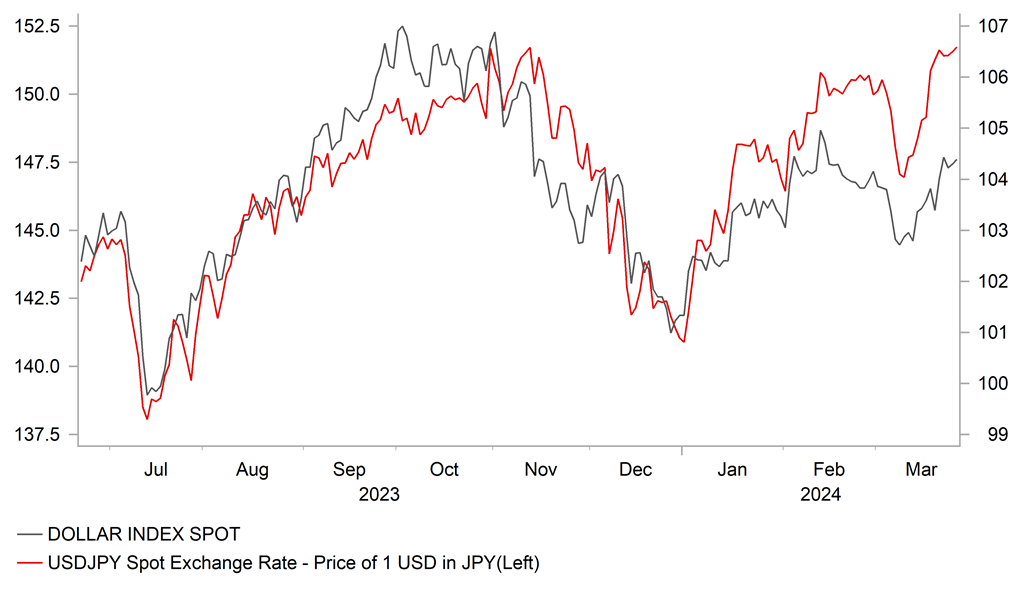

The US dollar is back at the highs (DXY basis) from Monday with short-term yields broadly stable as US economic data continues to fall short of indicating any compelling evidence of slower growth that would justify the current extent of monetary easing priced and guided by the FOMC through the median dot profile. The resilience of the dollar has resulted in USD/JPY breaking above the 2022 high of 151.95 – but only just – with the current high today at 151.97. We have had further rhetoric from the MoF with Finance Minister Suzuki again warning that the government would take “bold action” in the FX markets if unwarranted yen depreciation continues. The rate hike from the BoJ certainly appears to have fuelled renewed vigour in selling the yen, which since the day of the BoJ rate hike is the second worst performing G10 currency. Only CHF has performed worse fuelled obviously by the SNB rate cut. The co-movement of yield spreads with the US and USD/JPY and DXY and USD/JPY indicate an overshoot of spot which will undoubtedly encourage MoF action on the basis that the move since the BoJ rate hike is more driven by speculation. Option-related barrier could be helping contain a move higher at the moment but if we do break through and we see sharper moves above it remains highly likely that the MoF and BoJ will act.

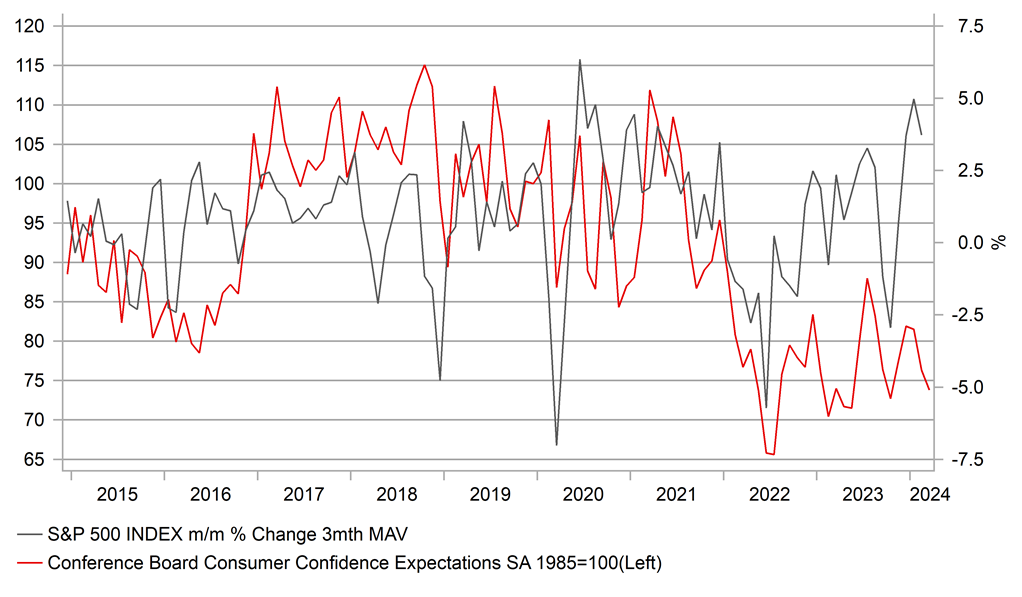

Recall in 2023, the MoF did not have to intervene and from the high of 151.91, USD/JPY fell back sharply driven lower by the weaker US inflation and the plunge in yields. With US yields lower than back in Oct/Nov and with inflation lower and stickier at these lower levels a sharp move lower in yields looks a lot less likely. Nonetheless, the data flow in our view continues to point to a greater risk of a slowdown unfolding. The US consumer confidence data yesterday revealed another drop in the expectations component which is a better indicator of possible consumption patterns going forward. The index fell for the third consecutive month despite the continued strong performance of US equity markets. Expectations about job prospects and incomes both declined.

The high level of rates is clearly starting to impact. Credit card delinquency rates have hit the highest level since the GFC on credit card interest rate charges of over 20% - a record level. It certainly suggests that the cushion of covid-related savings that helped support the consumer is no longer a factor. The FT today is also highlighting the growing divergence between large-cap and small-cap stocks – the divergence in performance is at a 20-year high as small firms suffer more from the high level of interest rates. At some point soon we will have to start seeing more obvious evidence of economic slowdown in order to validate market pricing and Fed guidance. If it doesn’t come over the coming month of data, June rate cut expectations will be wound down. That’s the risk to our view of a modestly weaker US dollar through Q2.

USD/JPY RELATIVE TO DXY INDICATES SPECIFIC YEN SELLING

Source: Macrobond & Bloomberg

SEK: Riksbank guidance shift could prompt underperformance

The financial markets have been quiet this week after the heavy calendar of central bank meetings last week. The key central bank event for this week comes today with the Riksbank meeting – the announcement will be at 0830 GMT this morning. Given the grasping for any macro theme or trade that may open up some speculation on divergence there is certainly a chance that we could see an FX reaction to the Riksbank announcement. The forward rates market implies very little is priced for an actual rate cut today and a cut today certainly seems premature.

However, the guidance today from the Riksbank could certainly reinforce the speculation of a rate cut at the following meeting on 8th May. The forward market is priced for about 16bps of cuts at that meeting, so a strong message on inflation returning to target at today’s meeting could lift expectations of a cut in May and see SEK sell off further. We published a trade idea in last week’s FX Weekly (here) to sell SEK versus EUR on the prospect of a dovish message. The only issue here heading into the announcement is that price action indicates further anticipation of a dovish message from the Riksbank. Since Friday morning, EUR/SEK has advanced by nearly 1.0% and the options market overnight vol implies a potential big move post-meeting. If the market is positioned up for a dovish message and that message fails to meet expectations there could well be some initial SEK rebound.

That’s the obvious risk given the very recent price action. However, there is certainly good reason for the Riksbank’s tone today to be clearly dovish. The inflation backdrop has changed quite quickly and the outlook certainly justifies a notable shift in tone. One reason for caution would be the FX risk to inflation from a SEK sell-off. However, that risk now is a lot less given the shift in bias from the RBA, the dovish message from the Fed, the more sanguine message from the BoE and the surprise cut from the SNB. The growth backdrop in Sweden also argues for a more dovish message and the potential for an earlier rate cut. Real GDP contracted by 0.1% in Q4, the third consecutive quarter of contraction with growth this year according to the Bloomberg consensus set to be just 0.1%.The underlying CPIF ex-energy inflation gauge has fallen from 6.1% to 3.5% in just four months.

So we see plenty of justification for a Riksbank rate cut to be more clearly signalled. In February, the communication was clear that a rate cut in H1 2024 was feasible so given developments since then that view will hold and if with more conviction will help fuel expectations of a May rate cut.

US CONSUMER EXPECTATIONS FAILING TO RESPOND TO EQUITY GAINS

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SW |

08:30 |

Riksbank Policy Announcement |

4.00% |

4.00% |

!!! |

|

|

SZ |

09:00 |

ZEW Expectations |

Mar |

-- |

10.2 |

! |

|

EC |

10:00 |

Business and Consumer Survey |

Mar |

96.3 |

95.4 |

! |

|

EC |

10:00 |

Consumer Confidence |

Mar |

-15.5 |

-14.9 |

! |

|

EC |

10:00 |

Services Sentiment |

Mar |

7.8 |

6.0 |

! |

|

EC |

10:00 |

Industrial Sentiment |

Mar |

-9.0 |

-9.5 |

! |

|

UK |

10:30 |

BoE FPC Meeting Minutes |

-- |

-- |

-- |

! |

|

UK |

11:00 |

CBI Distributive Trades Survey |

-- |

-- |

-7 |

! |

|

US |

11:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-1.6% |

! |

|

FR |

11:00 |

France Jobseekers Total |

-- |

-- |

2,827.7K |

!! |

|

EC |

12:30 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

SZ |

14:00 |

SNB Quarterly Bulletin |

-- |

-- |

-- |

! |

|

US |

22:00 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg