FX Daily Snapshot

- Apr 19, 2024

USD appreciation concerns remain in focus as Israel retaliates

USD: Scale of strength curtailed

Yesterday saw more evidence of relatively positive US data with the Philly Fed manufacturing survey stronger than expected and reinforcing the expectations of the Fed being considerably behind other central banks in easing. The dollar remains well supported at higher levels and jumped further higher today after Israel launched retaliatory strikes in Iran. The initial news we are hearing suggests the attack has been relatively contained and specific to where Iran’s strikes were launched from. That should allow for a line to be drawn and should help contain the financial market fallout. Crude oil is where there is greatest impact, up 2%.

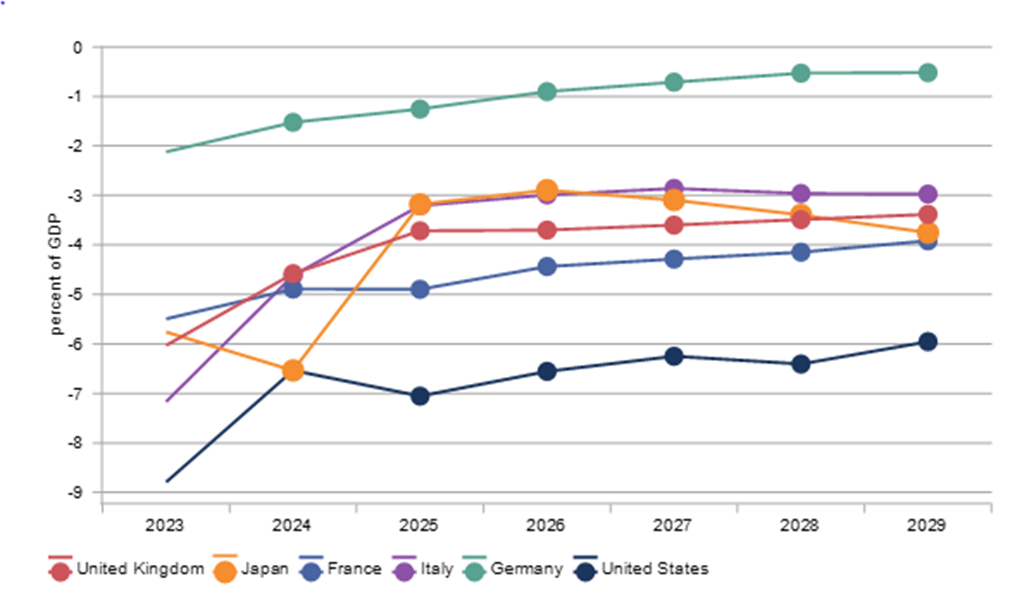

The US performance was becoming a bit more mixed prior to Israel’s retaliation with signs of positive momentum petering out. Concerns over the impact of dollar strength and hence the limits to the move may have played a part in this. The IMF has been clear this week on the dangers of divergence highlighting the huge US fiscal deficits (-7.1% in 2025 according to the IMF) in contrast to more contained deficits in other advanced economies (-2.0% on average) which will mean global yields are higher in general and the US dollar stronger.

As we have been stating here, there remains scope for the dollar to advance further from here and until we start to see some clearer evidence of economic slowdown or easing inflation pressures. The dollar is now weaker this week versus CHF, EUR, CAD and GBP possibly on the view that divergence has limits possibly given the current pricing in the rates market. The steady flow of data pushing yields higher now means the 2-year UST note yield is trading just 35bps below the fed funds effective rate. That certainly seems on the high side given the transmission of tighter policy at the peak rate is now running for nearly 9mths. In contrast, the 2-year bund yield in Germany is trading over 100bps below the ECB policy rate. Rates markets seems priced for perfection in the US and for very bad news in Europe.

Of course ECB President Lagarde stated last week that the ECB is not dependent on Fed actions but that is only true up to a point. If the pricing is accurate in US rates markets, it likely too pessimistic in pricing in euro-zone markets. ECB Governing Council member Robert Holzmann stated yesterday that if the Fed doesn’t cut rates, the ECB will find it difficult to cut three or four times.

FX moves if large enough will certainly act as an impediment to notable divergence. The ECB projections currently have 1.0800 as the EUR/USD assumption. A drop to parity coupled with further increase in energy prices would alter the inflation outlook enough to curtail cuts by more than currently priced (3 cuts). Crude oil and natural gas prices are now higher than the estimate in March for 2024 (USD 80 p/bl & 30 EUR/MWh). Further energy price increases now if there is further escalation after Israel’s response overnight could have monetary policy implications for both the Fed and the ECB but higher energy prices would certainly have more negative implications for growth in the euro-zone and hence would weigh on EUR/USD.

IMF LATEST FISCAL DEFICIT FORECASTS HIGHLIGHTS US DIVERGENCE

Source: Macrobond; IMF Estimates April 2024

JPY: Gains for yen and Swiss franc following Israel response

While the US dollar is broadly stronger today in response to Israel’s response overnight, the Swiss franc and the yen are outperforming the dollar while the Norwegian krone is the strongest G10 currency after the dollar. Hence, the initial FX moves today certainly seem driven by risk-off and higher oil prices. However, the yen and risk appetite dynamics are questionable so the performance likely also reflects the ongoing reluctance in the market to sell the yen at these weaker levels which are likely close to possible intervention levels.

But developments apart from the Israel strike point certainly more in favour of renewed yen selling. Firstly, nationwide CPI data today from Japan was weaker than expected with each CPI measure coming in 0.1ppt weaker than expected. The core-core CPI YoY rate fell from 3.2% to 2.9%, the weakest since November 2022. Still, disinflation in services is far more limited and suggests greater underlying pressures. Nationwide service CPI YoY slowed from 2.2% to 2.1%, but still close to the peak of 2.3%. Furthermore, as we have highlighted before, subsidise utility prices will end at the end of this month while higher energy prices now and renewed yen weakness all point to upside inflation pressures ahead. Higher energy prices will also be a negative for Japan’s trade balance.

There has also been little further complaint from Washington in regard to yen weakness. Both Finance Minister Suzuki and BoJ Governor Ueda spoke from Washington and confirmed that FX wasn’t discussed at the G-20 meeting while Finance Minister Suzuki repeated that Japan was in close dialogue with the US and South Korea on FX.

Given the drop in UST bond yields on the back of the Israel response is a key factor in the slight decline in USD/JPY we doubt this will persist. The Israel retaliation seems contained and hence there will be limited fallout in bond markets that points to continued upside risks for USD/JPY and with that the threat of intervention.

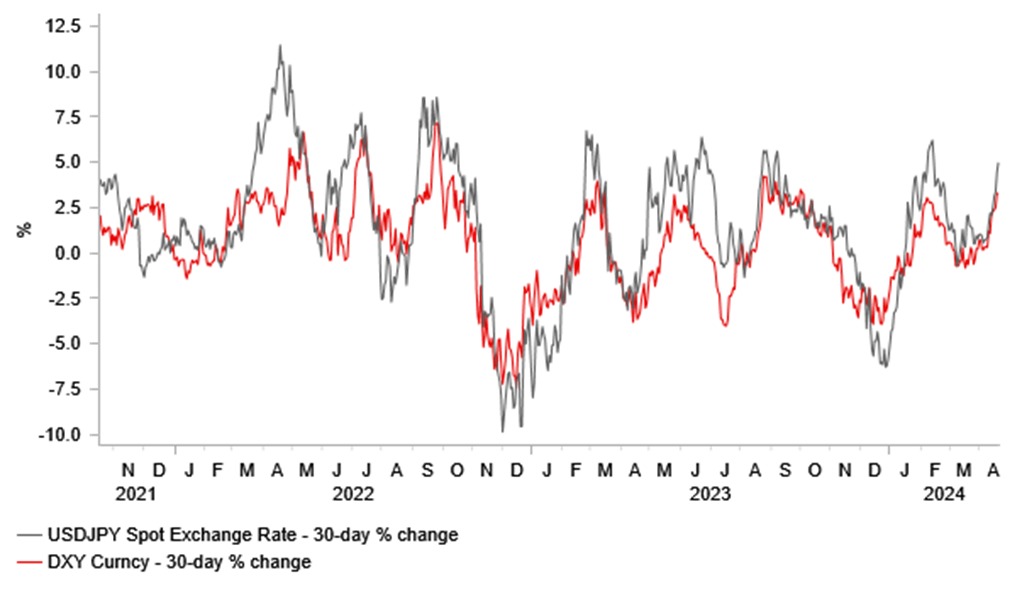

USD/JPY MODERATELY OUTPERFORMING BROADER USD IN 30-DAY PERIOD

Source: Bloomberg & Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

10:00 |

IMF Meetings |

-- |

-- |

-- |

! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

UK |

15:15 |

BoE Breeden Speaks |

-- |

-- |

-- |

!! |

|

UK |

15:15 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!!! |

|

US |

15:30 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

UK |

17:30 |

BoE MPC Member Mann |

-- |

-- |

-- |

!!! |

|

GE |

20:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg