Commodities Weekly

- Jan 11, 2024

To read the full report, please download the PDF above.

Ten questions for 2024

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

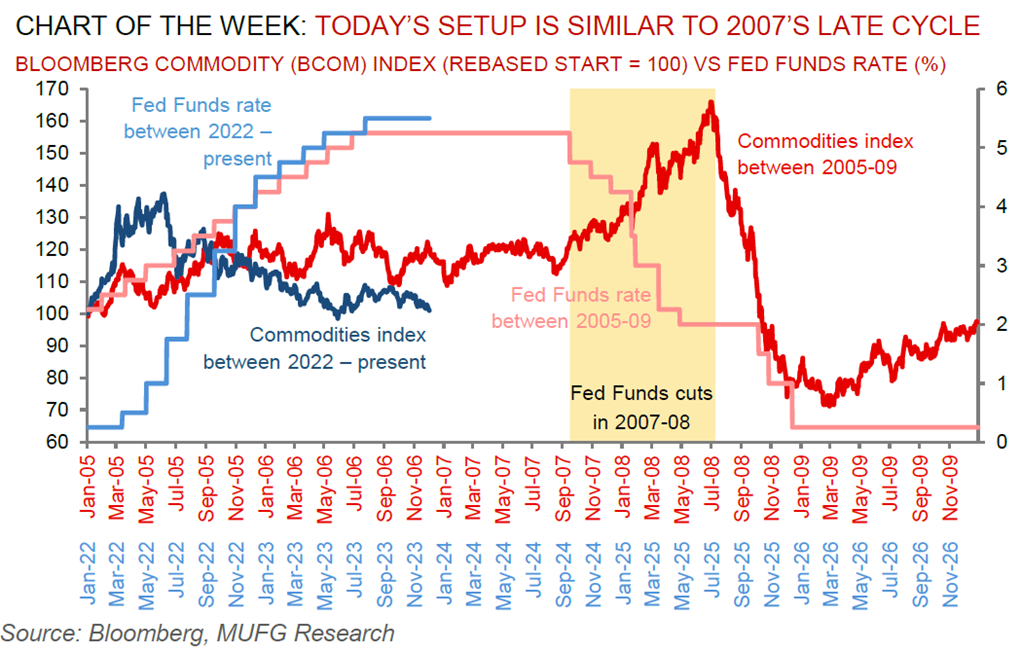

We wish all of our clients a happy, healthy and prosperous 2024. In the first Commodities Weekly of this year, we examine what we believe are the ten most important questions for 2024. Please see here for our Commodities 2024 outlook and here for our Energy 2024 outlook.

Energy

Its been a choppy start to the year for global oil markets with the push-and-pull between geopolitical angst, conflicting supply prospects and tepid demand, all weighing on crude prices. Meanwhile, US natural gas (Henry Hub) prices are surging in a major reversal as forecasts showed intense cold across the northern tier of the US into late January (we complex still remains mired in oversupply and US natural gas is one of our most bearish calls in 2024).

Base metals

Copper is struggling to edge higher as pricing patterns on the world’s preeminent metals market suggest there’s ample near-term supply. Cash metal is current more than USD105/MT cheaper than benchmark three month futures on the LME – the widest contango in data going back to 1994.

Precious metals

Gold’s bounce is stalling as the US dollar and yields remain steady. The Fed’s vice chair for supervision, Michael Barr, signalled the Fed’s Bank Term Funding Program had functioned as intended to ease stress in the financial system and was set to expire on 11 March. This may have been slightly negative for gold as it may imply the Fed is confident of the health of the regional banks.

Bulk commodities

Iron ore has extended its slide for five consecutive trading days, as supplies rise at a time when demand continues to disappoint and more Chinese steel mills look to suspend production.

Agriculture

The rice market is set to remain tight at the start of 2024 on India’s ongoing export restrictions and an expected boost from festival demand, providing incentives for elevated prices to climb even higher.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.